How Investors Are Reacting To Meta Platforms (META) $14 Billion AI Investment Following Earnings Release

- Meta Platforms recently announced an earnings release after the market close, with analysts and investors closely watching its major commitments to artificial intelligence initiatives and infrastructure investment.

- Market attention is heightened due to Meta’s significant hiring of AI specialists, high-profile product development, and expectations that AI-driven improvements will strengthen both ad monetization and user engagement across its platforms.

- We’ll examine how Meta’s increased AI investment, highlighted by its $14 billion commitment to Scale AI, shapes the current investment narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Meta Platforms Investment Narrative Recap

To be a shareholder in Meta Platforms today, you need to believe that its outsized bets on artificial intelligence and infrastructure will drive long-term engagement and monetization across its digital platforms. The latest earnings news reinforces AI as Meta's key short-term catalyst, but does little to change the fundamental risk of rising operating expenses, especially as further AI investment and hiring could pressure profitability in the near term.

Among the latest developments, Meta's commitment of US$14 billion to Scale AI stands out as the clearest signal of its AI-first approach. This is relevant for investors evaluating whether these ambitious infrastructure and talent investments can yield returns in advertising and business messaging, or ultimately challenge margins and free cash flow as capital costs climb.

By contrast, keep in mind that higher-than-expected costs tied to AI infrastructure and data centers could...

Read the full narrative on Meta Platforms (it's free!)

Meta Platforms’ narrative projects $247.4 billion in revenue and $85.6 billion in earnings by 2028. This requires 13.2% annual revenue growth and a $19 billion earnings increase from the current $66.6 billion.

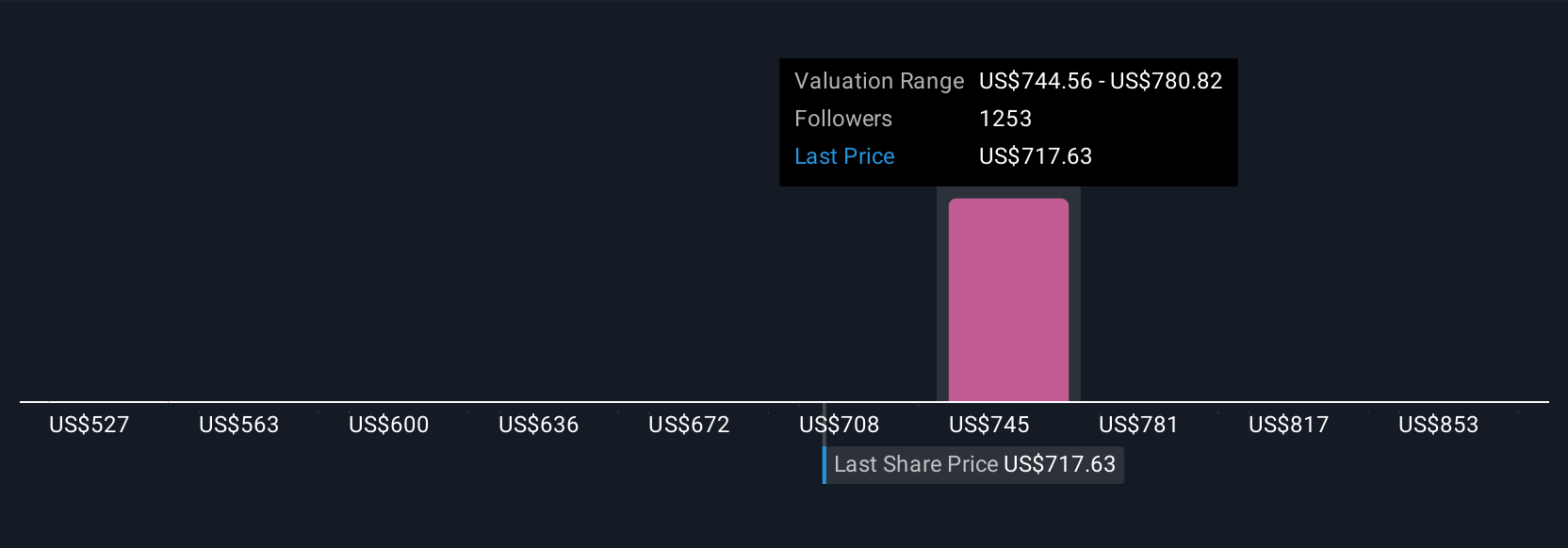

Uncover how Meta Platforms' forecasts yield a $747.06 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Seventy-six members of the Simply Wall St Community estimate Meta's fair value anywhere from US$527 to US$890 per share. While some expect significant upside from AI-fueled revenue expansion, many caution that greater investment spending could weigh on free cash flow and returns, reflecting just how much opinions can differ.

Explore 76 other fair value estimates on Meta Platforms - why the stock might be worth as much as 24% more than the current price!

Build Your Own Meta Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meta Platforms research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Meta Platforms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meta Platforms' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal