Does Alibaba’s (BABA) Debt Exchange Reflect Strategic Flexibility or Financial Pressure Amidst Earnings Revisions?

- Earlier this month, Alibaba Group Holding announced a fixed-income exchange offer for three tranches of callable, senior subordinated unsecured notes totaling US$2.65 billion in principal, with maturities ranging from 2030 to 2054.

- Although Alibaba recently launched its Quark AI Glasses for the Chinese market, persistent downward revisions of earnings estimates have amplified concerns about its near-term financial health.

- We'll explore how these ongoing negative earnings estimate revisions weigh on Alibaba's investment narrative despite new product initiatives.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Alibaba Group Holding's Investment Narrative?

To believe in Alibaba as a long-term investment, you need to have conviction in its ability to keep leveraging its large-scale e-commerce and cloud technology operations, while absorbing near-term challenges from changes in earnings expectations and general market uncertainty. The company’s recent fixed-income exchange offer, covering US$2.65 billion in callable senior subordinated notes, signals a tactical move to optimize its debt structure, but based on current price action and consensus, it does not appear to shift the main short-term catalysts. The priorities remain steady revenue growth, execution on new products like the Quark AI Glasses, and continued delivery of shareholder returns through dividends and buybacks. The significant risk lies in downward earnings estimate trends, which have weighed on sentiment recently, and suggest that ongoing concerns about profitability may continue to be front of mind, even after new financial restructuring measures like this debt initiative. Ultimately, unless these revisions reverse, the fixed-income exchange alone is unlikely to be a game changer for the balance of risk and opportunity in the near term.

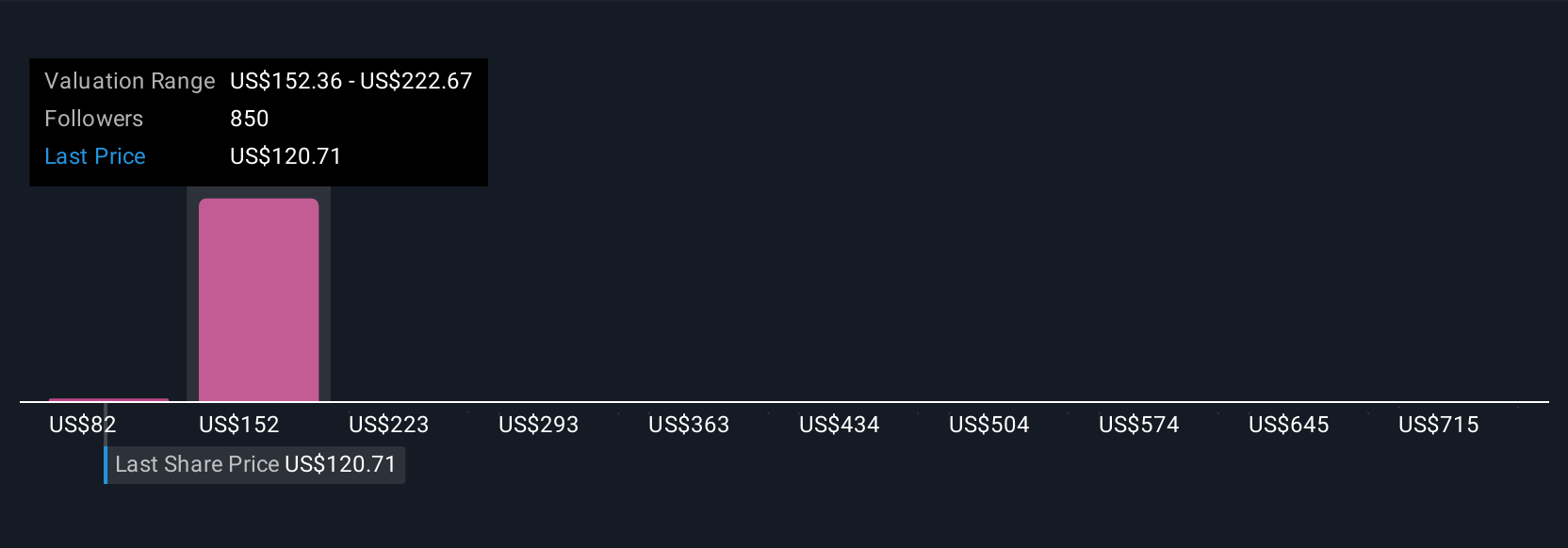

But, consensus earnings estimate cuts remain a key risk most may not expect at first glance. Alibaba Group Holding's shares have been on the rise but are still potentially undervalued by 21%. Find out what it's worth.Exploring Other Perspectives

Explore 79 other fair value estimates on Alibaba Group Holding - why the stock might be worth 33% less than the current price!

Build Your Own Alibaba Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alibaba Group Holding research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Alibaba Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alibaba Group Holding's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal