European Penny Stocks With Market Caps Under €300M

The European market has been buoyed by optimism surrounding a potential EU-U.S. trade deal, with the pan-European STOXX Europe 600 Index seeing modest gains amid these developments. As investors navigate this landscape, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities for growth at lower price points. Despite their vintage name, these stocks can still provide significant value when supported by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €0.95 | €14.11M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.45 | €45.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.494 | RON16.71M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.93 | €61.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Libertas 7 (BME:LIB) | €2.30 | €49.01M | ✅ 4 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.255 | SEK3.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.26 | €10.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.145 | €296.15M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.97 | €32.71M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 335 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Renta Corporación Real Estate (BME:REN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Renta Corporación Real Estate, S.A. is a real estate company focused on acquiring, rehabilitating, and selling properties in Barcelona and Madrid, Spain, with a market cap of €24.80 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: €24.8M

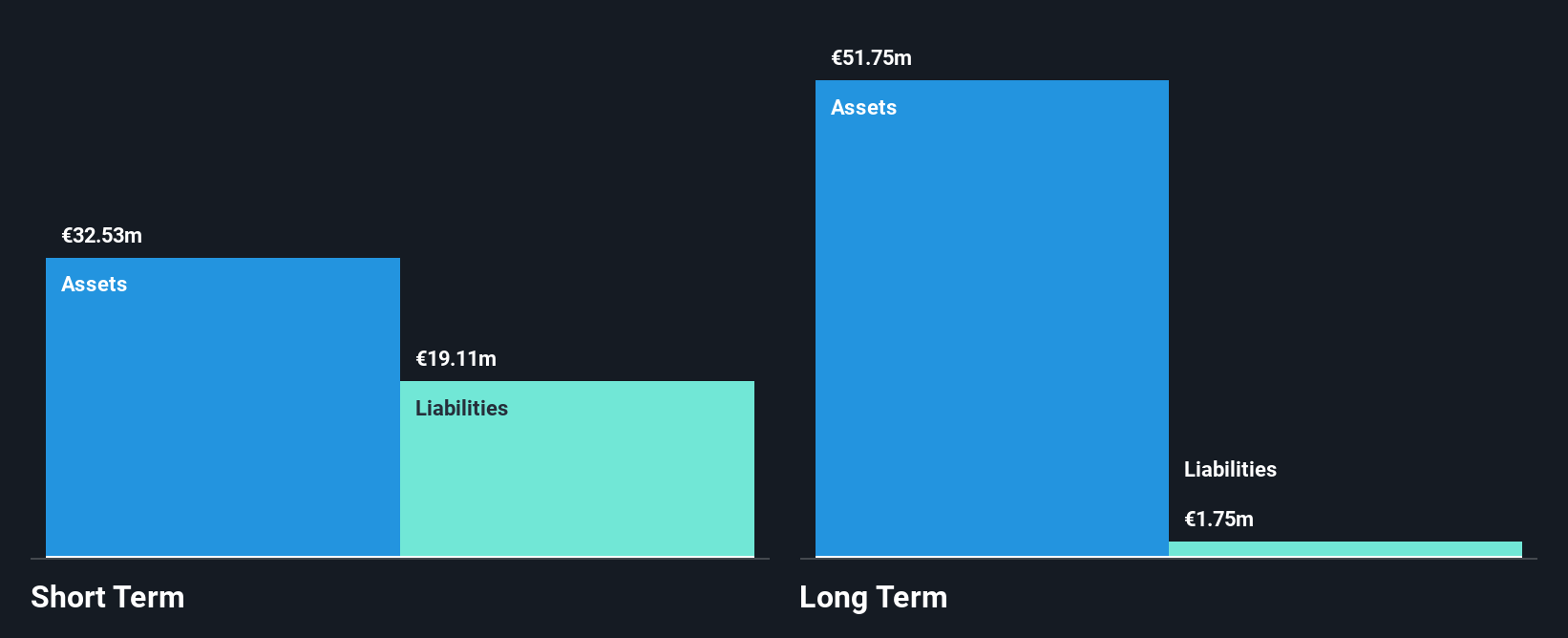

Renta Corporación Real Estate, S.A., with a market cap of €24.80 million, has shown resilience in its financial structure. The company's short-term assets exceed both its short and long-term liabilities, and its debt to equity ratio has improved significantly over the past five years from 112.9% to 25.9%. Although earnings have declined by an average of 15.7% annually over the past five years, recent results show a turnaround with net income rising to €2.36 million in H1 2025 despite reduced sales of €1.05 million compared to last year’s €6.07 million, indicating potential recovery prospects within the real estate sector in Spain's key markets.

- Dive into the specifics of Renta Corporación Real Estate here with our thorough balance sheet health report.

- Understand Renta Corporación Real Estate's track record by examining our performance history report.

Guillemot (ENXTPA:GUI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guillemot Corporation S.A. designs, manufactures, and sells interactive entertainment equipment and accessories across various countries including France, Germany, and the United States, with a market capitalization of €74.88 million.

Operations: The company generates revenue from two main segments: Thrustmaster, which contributes €113.10 million, and Hercules, accounting for €12.02 million.

Market Cap: €74.88M

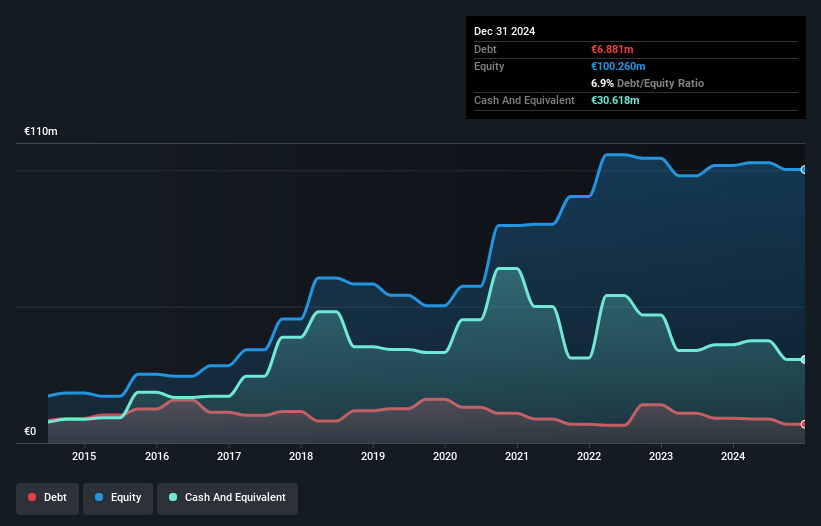

Guillemot Corporation S.A., with a market cap of €74.88 million, has a robust financial position, as its short-term assets (€110.9M) surpass both short and long-term liabilities. The company’s debt is well covered by operating cash flow (263%), and it holds more cash than total debt, reflecting prudent financial management. Recent governance changes saw Valentin Guillemot appointed CEO, potentially bringing fresh perspectives to the leadership team. Despite experiencing a large one-off loss of €4.4M in 2024, earnings are forecast to grow at 30.89% per year, suggesting optimism for future profitability improvements in its interactive entertainment segments.

- Click here to discover the nuances of Guillemot with our detailed analytical financial health report.

- Assess Guillemot's future earnings estimates with our detailed growth reports.

Heidelberg Pharma (XTRA:HPHA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Heidelberg Pharma AG is a biopharmaceutical company specializing in oncology and antibody targeted amanitin conjugates (ATAC) with operations in Germany, the United States, and internationally, and has a market cap of €208.32 million.

Operations: The company's revenue is derived from its ADC Technology and Customer Specific Research segment, generating €4.18 million.

Market Cap: €208.32M

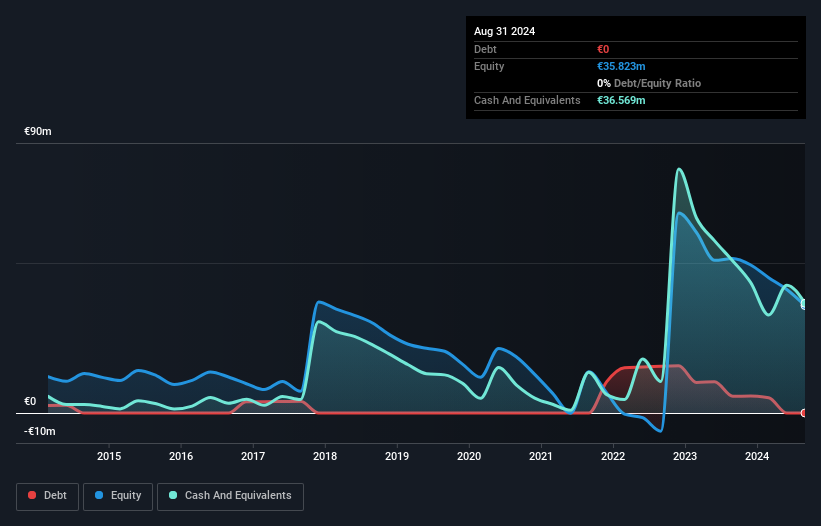

Heidelberg Pharma AG, with a market cap of €208.32 million, operates in the biopharmaceutical sector focusing on oncology. Despite being unprofitable and having limited revenue (€4.18 million), the company is debt-free and maintains a solid cash position, covering both short-term (€6.4M) and long-term liabilities (€37.6M). Recent developments include dosing the first patient in a Phase I clinical study for HDP-102 targeting non-Hodgkin lymphoma, demonstrating potential in its proprietary ATAC technology platform. However, earnings are forecast to decline by 11.4% annually over the next three years, highlighting ongoing financial challenges amidst promising R&D progress.

- Take a closer look at Heidelberg Pharma's potential here in our financial health report.

- Learn about Heidelberg Pharma's future growth trajectory here.

Summing It All Up

- Explore the 335 names from our European Penny Stocks screener here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal