Top European Dividend Stocks To Watch In July 2025

As European markets remain mixed with the pan-European STOXX Europe 600 Index ending roughly flat, investors are keeping a close eye on trade talks and economic indicators across the region. In this environment, dividend stocks can offer a stable income stream, making them an attractive option for those looking to navigate uncertain market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.41% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.18% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.67% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.77% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.77% | ★★★★★★ |

| ERG (BIT:ERG) | 5.21% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.02% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.47% | ★★★★★★ |

Click here to see the full list of 226 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

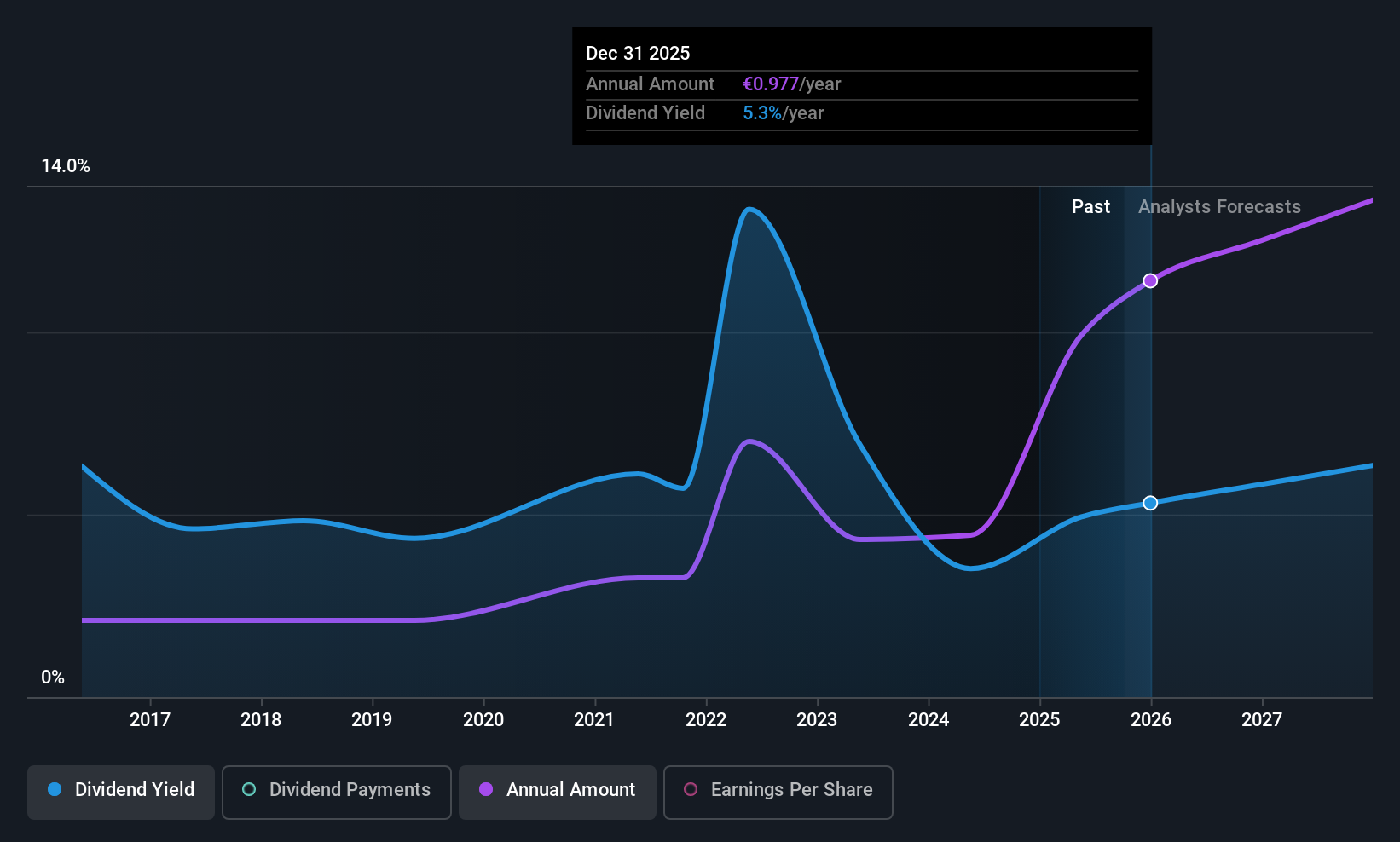

Unipol Assicurazioni (BIT:UNI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Unipol Assicurazioni S.p.A., along with its subsidiaries, offers insurance products and services mainly in Italy, with a market cap of €12.36 billion.

Operations: Unipol Assicurazioni S.p.A. generates revenue through its primary operations in providing a range of insurance products and services within Italy.

Dividend Yield: 4.9%

Unipol Assicurazioni's recent dividend announcement of €0.85 per share, alongside a Q1 net income increase to €272 million, highlights its commitment to shareholder returns. Despite a below-market average yield of 4.92%, the dividend is well-covered by earnings (58% payout ratio) and cash flow (38.2% cash payout ratio). However, its dividend history shows volatility, with past payments being unstable and unreliable over the last decade despite some growth in payouts.

- Take a closer look at Unipol Assicurazioni's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Unipol Assicurazioni is trading behind its estimated value.

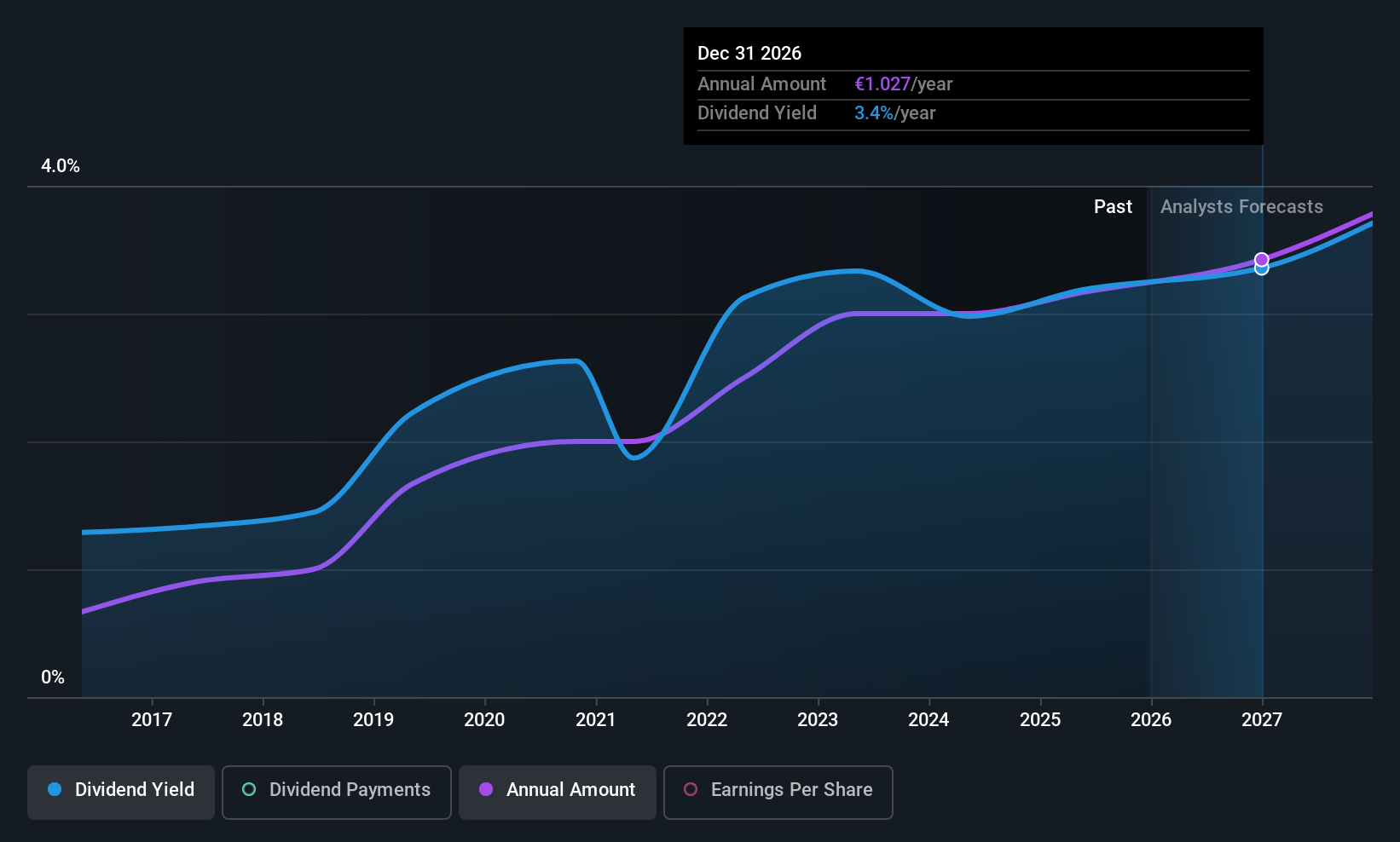

Wienerberger (WBAG:WIE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wienerberger AG is a company that produces and sells clay blocks, facing bricks, roof tiles, and pavers across Europe West, Europe East, and North America with a market cap of €3.31 billion.

Operations: Wienerberger AG generates its revenue from three main segments: €1.23 billion from Europe East, €2.69 billion from Europe West, and €805.43 million from North America.

Dividend Yield: 3.1%

Wienerberger's recent dividend increase to €0.95 per share, a 5.6% rise from the previous year, underscores its ongoing commitment to dividends despite challenges. The dividend yield of 3.1% is below Austria's top quartile but remains well-covered by cash flow with a low cash payout ratio of 36.8%. However, earnings coverage is strained due to a high payout ratio of 131.4%, and profit margins have declined to 2.6% from last year's 4.8%.

- Get an in-depth perspective on Wienerberger's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Wienerberger is trading beyond its estimated value.

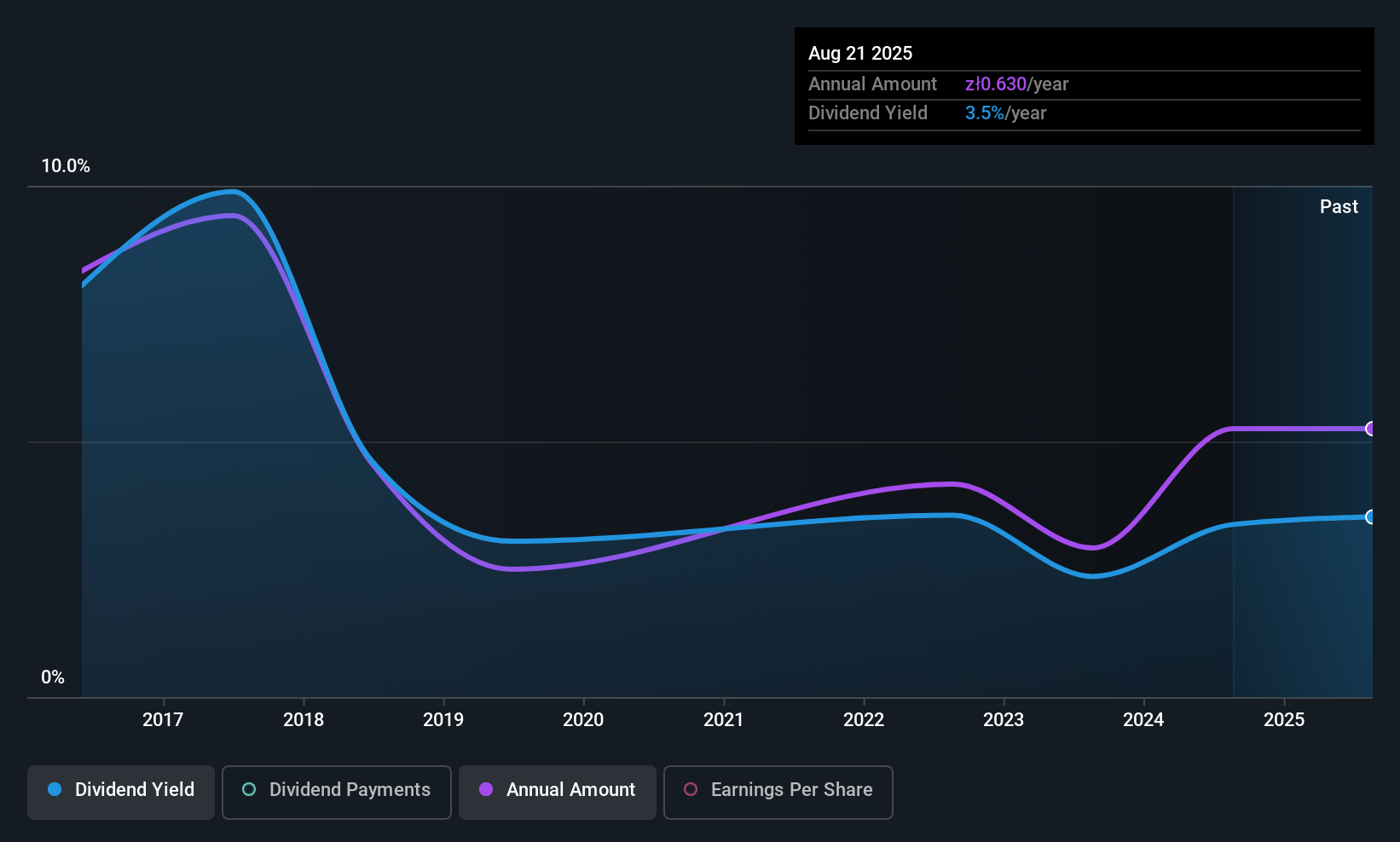

Kino Polska TV Spolka Akcyjna (WSE:KPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kino Polska TV Spolka Akcyjna is a media company operating in Poland and internationally, with a market cap of PLN364.71 million.

Operations: Kino Polska TV Spolka Akcyjna generates revenue from several segments, including Zoom TV (PLN31.72 million), Stopklatka TV (PLN60.29 million), Kino Polska Channels (PLN34.32 million), Sale of License Rights (PLN14.11 million), Production of TV Channels (PLN11.14 million), and Filmbox Movie Channels and Thematic Channels (PLN162.62 million).

Dividend Yield: 3.4%

Kino Polska TV Spolka Akcyjna's dividend of PLN 0.63 per share, payable in August 2025, reflects a cautious approach given its historical volatility and lack of consistent growth. The dividend yield is modest compared to top-tier Polish payers but is well-covered by earnings and cash flows with low payout ratios of 18.6% and 15%, respectively. Recent earnings growth supports sustainability; however, the stock trades significantly below its estimated fair value, suggesting potential undervaluation.

- Navigate through the intricacies of Kino Polska TV Spolka Akcyjna with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Kino Polska TV Spolka Akcyjna is priced lower than what may be justified by its financials.

Make It Happen

- Click here to access our complete index of 226 Top European Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal