The market is losing patience! Intel (INTC.US)'s latest earnings report urgently needs to hand over a profit roadmap

The Zhitong Finance App learned that in April of this year, Chen Liwu, the new CEO of Intel (INTC.US), told investors during his first earnings call that it would “take time” to reverse this troubled chipmaker. But after only three months, investors seemed to have run out of patience.

Admittedly, since the announcement of Chen Liwu's appointment as Intel's CEO in March, Intel's stock price has risen by about 19%, but it has overshadowed its rivals. For example, the stock price of Nvidia (NVDA.US) soared by nearly 50% during the same period, and the stock price of AMD (AMD.US) rose 64%. Therefore, when Intel announces earnings this Thursday, its CEO must convince the market with a clear profit and revenue growth roadmap to prove that future stock prices can grow significantly.

Rational Equity Armor Fund Manager Joe Tiga) said, “I hope this financial report will give us some answers.” “Intel still has great opportunities, but we've cut our holdings and moved to other chip stocks.”

Investors were once excited by the news that Chen Liwu succeeded his predecessor Pat Gelsinger (Pat Gelsinger) as Intel's CEO. As time went on, however, market sentiment gradually cooled down. Although Chen Liwu has begun to cut costs, he has yet to set a clear new strategic direction for the company, which is under double pressure in terms of market share and new plant construction.

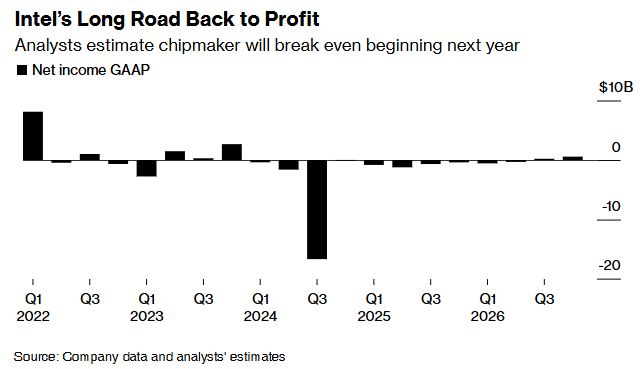

Wall Street expects Intel's second-quarter revenue to drop 7% year over year to US$11.9 billion, with a loss of $0.31 per share. The company, on the other hand, anticipates that it will not be possible to resume profits and achieve revenue growth until the middle of next year at the earliest.

Chen Liwu promised to cut operating expenses and reduce capital expenses by about 2 billion US dollars this year. But currently Intel has only told about 4,000 employees (4% of the total number of employees) that their jobs will be abolished. Wall Street's view of this is that it's far from enough.

Lynx Equity Strategy analyst KC Rajkumar wrote in a research report: “The most critical thing about the upcoming earnings report is whether Intel can provide a credible break-even path. It's not just a matter of cutting costs; revenue must also grow.”

For Intel, the most critical opportunity is whether it can benefit from the wave of artificial intelligence (AI) infrastructure building—which is probably the biggest business opportunity in the semiconductor industry's history. However, this market is currently dominated by Nvidia, and Intel will face huge challenges if it wants to break into it. Investors also want to see two signals: one is that large customers are signing up to use Intel's foundry services, and the other is that Intel's self-developed chips are regaining market share.

Currently, the market is still not optimistic about Intel's prospects. Of the 52 analysts tracked by Bloomberg, only 4 gave Intel shares a “buy” rating, 42 recommended holding, and 6 recommended selling. They gave an average 12-month price target of $21.93, which is nearly 7% lower than Intel's closing price of $23.49 on Wednesday.

Stacy Rasgon, an analyst at investment bank Bernstein, summarized the seriousness of the problems Intel is currently facing in 71 research reports. She said, “Does Intel's financial data still make sense now?” “Can new products reverse the decline in market share? Or is it all too late?”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal