Undiscovered Gems in Europe to Watch This July 2025

As European markets navigate a landscape of mixed stock index performances and economic indicators, investors are keenly observing developments such as the eurozone's expanding industrial output and Germany's rising investor sentiment. In this context, identifying promising stocks involves looking for companies that demonstrate resilience and potential growth amidst these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

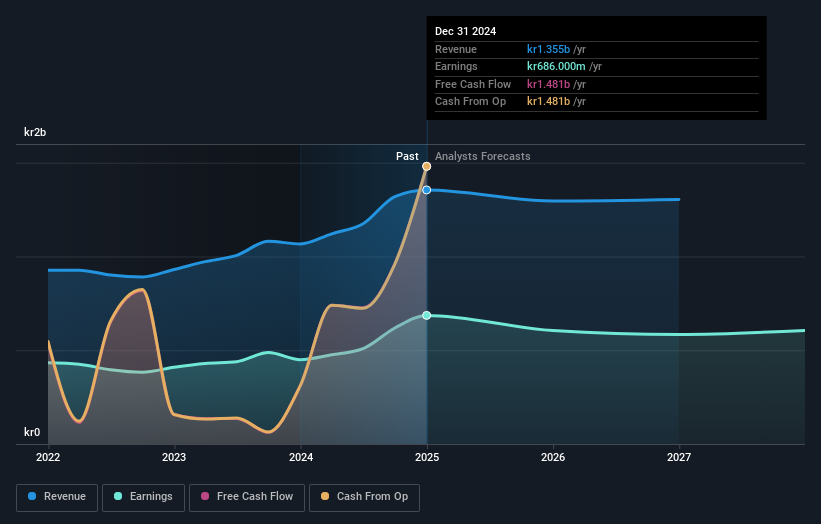

SpareBank 1 Ringerike Hadeland (OB:RING)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SpareBank 1 Ringerike Hadeland is a Norwegian financial institution offering a range of banking products and services to both private and corporate clients, with a market capitalization of NOK 5.95 billion.

Operations: Ringerike Hadeland generates revenue primarily from its Private Market (NOK 459 million) and Corporate Market (NOK 472 million) segments, supplemented by Real Estate Brokerage (NOK 59 million) and IT and Accounting Services (NOK 92 million). The company focuses on these core areas to drive its financial performance.

SpareBank 1 Ringerike Hadeland, with total assets of NOK31.7B and equity of NOK4.9B, shows a strong financial position in the banking sector. Its earnings growth over the past year hit 44.9%, outpacing the industry average of 7.8%, while trading at 33% below estimated fair value suggests potential undervaluation. The bank's liabilities are primarily backed by low-risk customer deposits, making up 80% of its funding sources, which is considered safer than external borrowing options. Despite an expected decline in earnings by an average of 5.3% annually over the next three years, it remains free cash flow positive and reported a net income increase to NOK148M for Q1 2025 from NOK145M a year earlier.

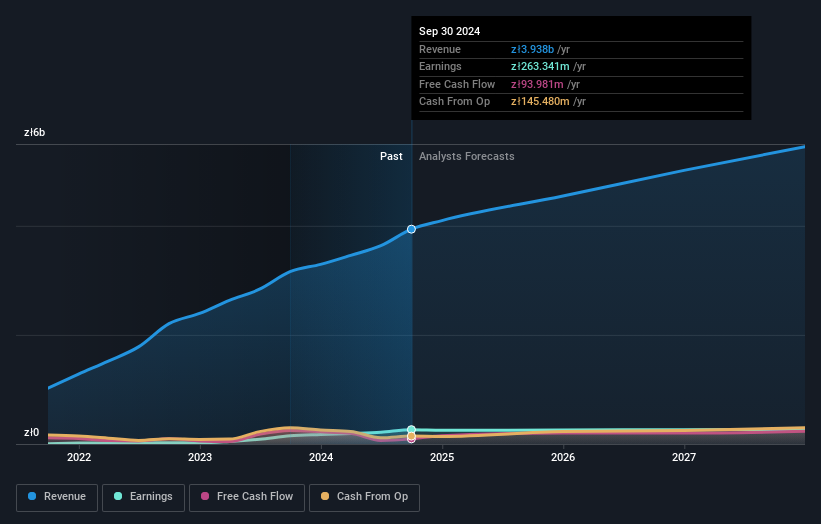

Rainbow Tours (WSE:RBW)

Simply Wall St Value Rating: ★★★★★★

Overview: Rainbow Tours S.A. is a tour operator providing travel services in Poland and several other countries, including the Czech Republic, Greece, Spain, Turkey, Slovakia, and Lithuania; it has a market capitalization of PLN 1.92 billion.

Operations: Rainbow Tours S.A. generates significant revenue primarily from its tour operator activities in Poland, amounting to PLN 4.14 billion, with additional contributions from foreign operations totaling PLN 161.84 million.

Rainbow Tours, a notable player in the travel sector, has been making waves with its impressive financial performance. Trading at 39.5% below its estimated fair value, the company seems attractive for potential investors. Earnings have surged by 57.5% over the past year, outpacing the Hospitality industry's growth of 8.2%. The debt to equity ratio has significantly improved from 101.6% to just 9.7% in five years, reflecting robust financial health and management's effective strategies. Recent earnings reports show sales hitting PLN 869 million and net income reaching PLN 59 million for Q1 2025, indicating strong operational momentum ahead of their upcoming AGM on June 17th.

- Click here to discover the nuances of Rainbow Tours with our detailed analytical health report.

Review our historical performance report to gain insights into Rainbow Tours''s past performance.

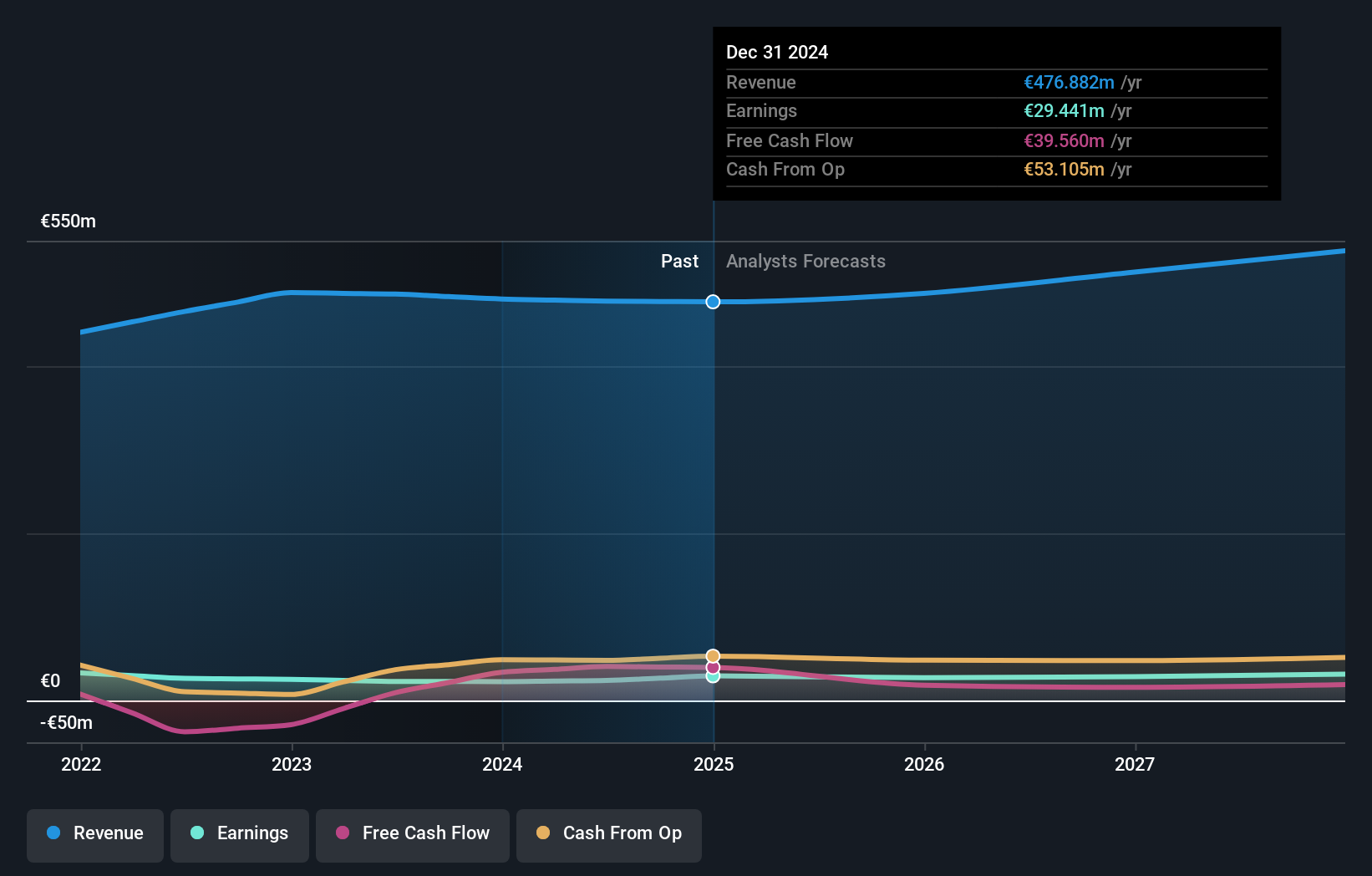

Uzin Utz (XTRA:UZU)

Simply Wall St Value Rating: ★★★★★★

Overview: Uzin Utz SE is a company that develops, manufactures, and sells construction chemical system products across Germany, the United States, Netherlands, and other international markets with a market capitalization of approximately €325.36 million.

Operations: Uzin Utz SE generates revenue primarily from its Germany - Laying Systems segment, contributing €206.90 million, followed by Western Europe at €78.49 million and Netherlands - Laying Systems at €84.16 million. The company's net profit margin is a key financial indicator to evaluate its profitability relative to total revenue across these regions.

Uzin Utz, a player in the European chemicals sector, has shown promising financial health with its debt to equity ratio improving from 42.7% to 24.8% over five years. The company boasts high-quality earnings and a net debt to equity ratio of 8.9%, which is deemed satisfactory. Its price-to-earnings ratio stands at 11.1x, making it a compelling value compared to the broader German market's 18.5x average. Notably, Uzin Utz's earnings surged by 30.4% last year, outpacing the industry growth rate of 16.2%, suggesting robust operational performance and potential for continued success in its niche market segment.

- Click to explore a detailed breakdown of our findings in Uzin Utz's health report.

Examine Uzin Utz's past performance report to understand how it has performed in the past.

Taking Advantage

- Click this link to deep-dive into the 321 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal