Will Arranging $91.45M Blue Rock Village Refinance Loan Change Walker & Dunlop's (WD) Narrative

- Walker & Dunlop recently arranged US$91.45 million in loan proceeds for the refinance of the 560-unit Blue Rock Village multifamily property in Vallejo, California, partnering with Prime Residential and securing a 10-year, full-term interest-only, fixed-rate Freddie Mac loan.

- This transaction underlines Walker & Dunlop's continuing strength in multifamily finance and its capacity to serve major clients with significant, long-term financing solutions.

- We'll explore how arranging a large refinance loan for a key multifamily asset could impact Walker & Dunlop’s broader investment outlook.

Walker & Dunlop Investment Narrative Recap

To be a shareholder in Walker & Dunlop, you need confidence in the company’s ability to capitalize on pent-up demand for multifamily financing as market conditions gradually recover. The recent Blue Rock Village refinancing highlights operational capability and supports the main short-term catalyst, transaction volume recovery, but does not materially reduce the immediate risks of subdued client activity or the impact of higher personnel and credit costs.

Among recent announcements, the arrangement of a US$87.2 million acquisition loan for Santa Fe Ranch Apartments in California stands out, reinforcing Walker & Dunlop’s focus on growing multifamily finance activity. In the context of catalysts, this deal underlines the company’s continued push to capture market share as owners seek financing solutions in an undersupplied multifamily market.

However, despite rising deal flow, investors should also be aware that growing loan loss provisions are becoming increasingly relevant and could influence...

Read the full narrative on Walker & Dunlop (it's free!)

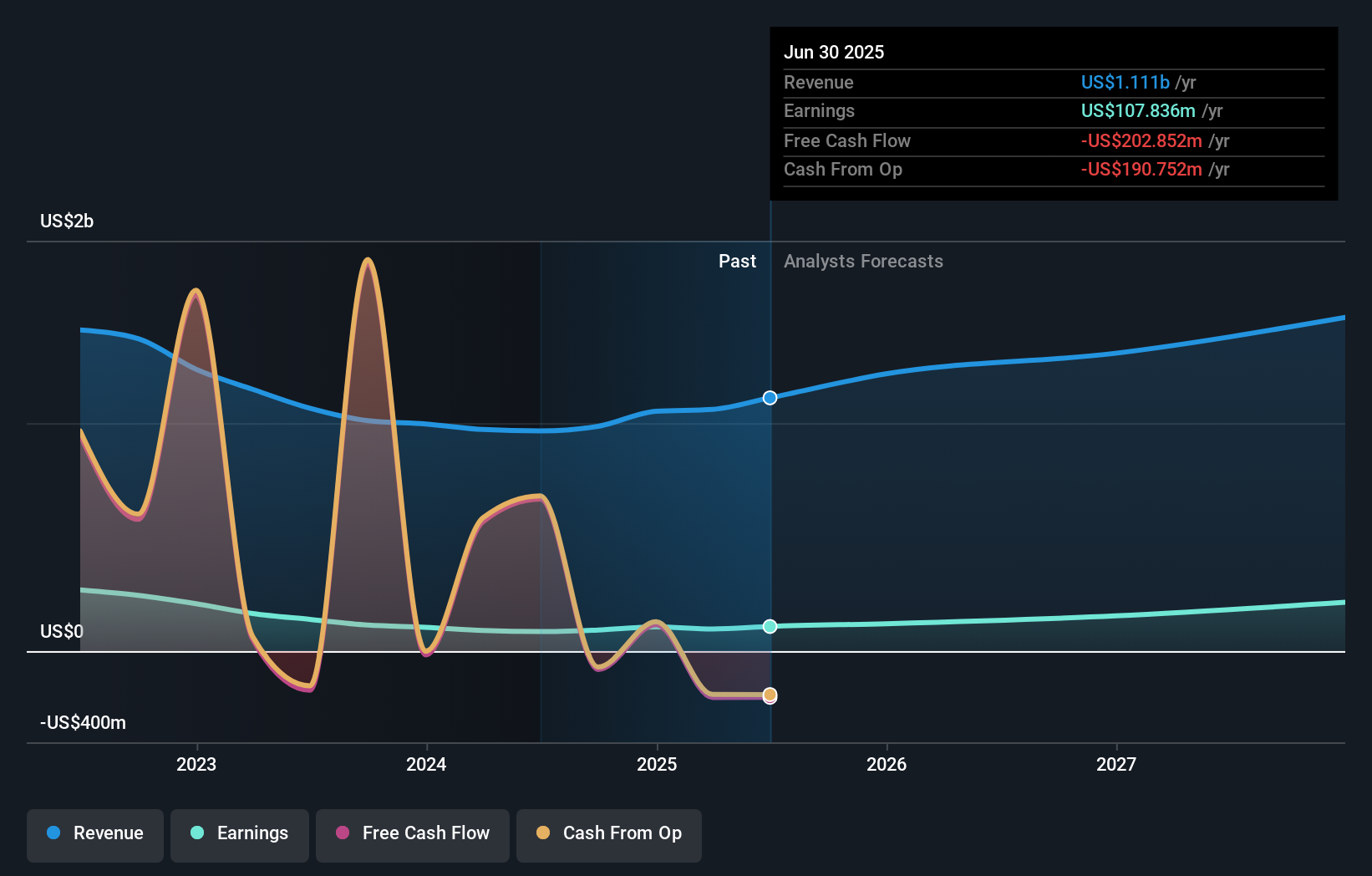

Walker & Dunlop's outlook anticipates $1.4 billion in revenue and $212.8 million in earnings by 2028. This trajectory relies on a 9.1% annual revenue growth rate and a $116.2 million increase in earnings from the current $96.6 million.

Exploring Other Perspectives

Simply Wall St Community contributors have set fair value estimates for Walker & Dunlop from US$41.01 to US$102.98 across three independent views. As market participants anticipate higher transaction volumes, shifts in revenue and credit risk could play a significant role in the company’s future performance, reviewing various perspectives can provide context for your own outlook.

Build Your Own Walker & Dunlop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walker & Dunlop research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Walker & Dunlop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walker & Dunlop's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal