Discover European Undervalued Small Caps With Insider Buying In July 2025

As the pan-European STOXX Europe 600 Index remains roughly flat amid ongoing U.S. and European trade discussions, small-cap stocks in Europe are navigating a mixed landscape with varying economic indicators. While Italy's FTSE MIB and the UK's FTSE 100 have shown modest gains, Germany's DAX and France's CAC 40 remain relatively unchanged, reflecting a cautious market sentiment. In this environment, identifying promising small-cap stocks often involves looking for those with strong fundamentals that can capitalize on economic trends such as expanding industrial output or favorable currency movements.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Stelrad Group | 13.0x | 0.7x | 38.62% | ★★★★★☆ |

| Instabank | 10.2x | 2.9x | 23.94% | ★★★★★☆ |

| Yubico | 32.7x | 4.7x | 11.25% | ★★★★☆☆ |

| CVS Group | 44.6x | 1.3x | 39.67% | ★★★★☆☆ |

| Seeing Machines | NA | 2.9x | 44.26% | ★★★★☆☆ |

| Troax Group | 32.8x | 2.9x | 27.63% | ★★★☆☆☆ |

| A.G. BARR | 19.7x | 1.9x | 45.56% | ★★★☆☆☆ |

| NOTE | 21.1x | 1.4x | -8.42% | ★★★☆☆☆ |

| Lords Group Trading | NA | 0.2x | -3.83% | ★★★☆☆☆ |

| FastPartner | 17.3x | 4.4x | -37.81% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

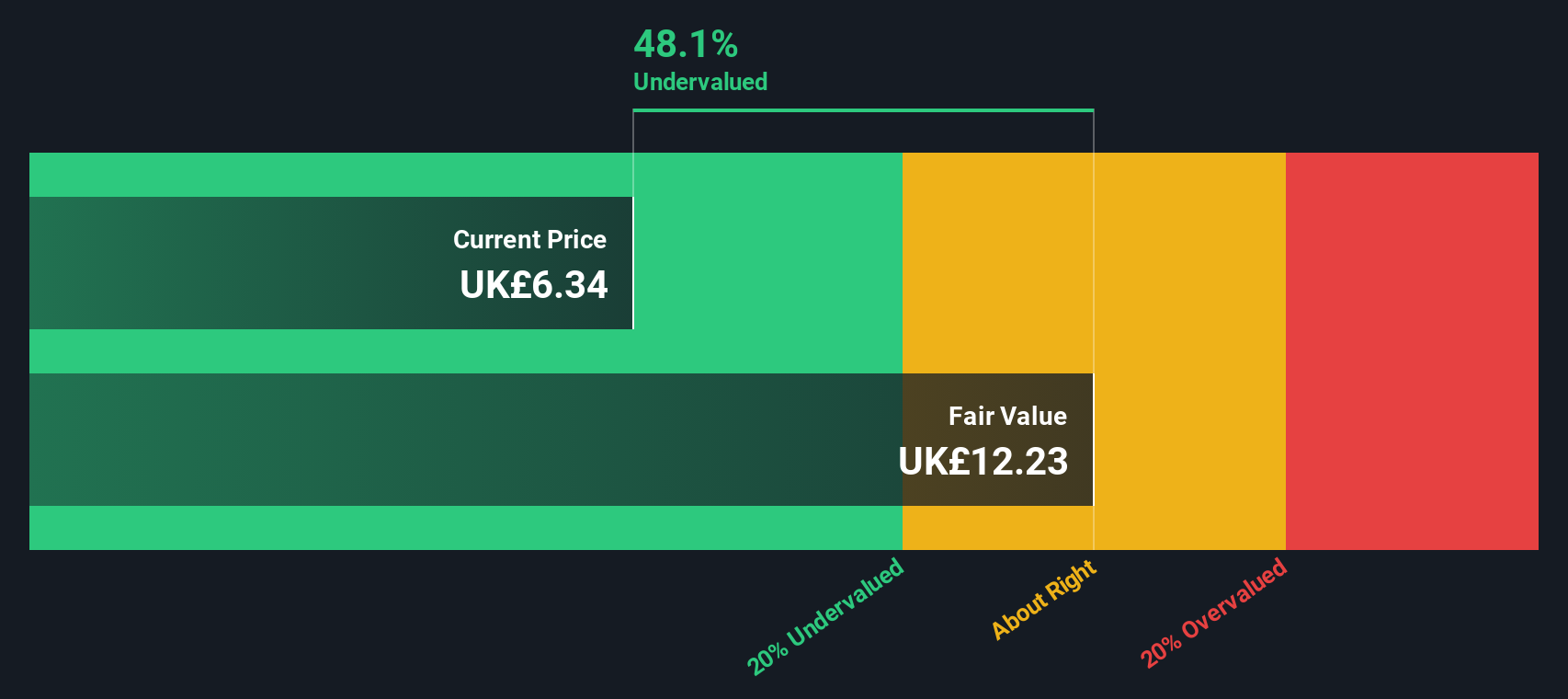

A.G. BARR (LSE:BAG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: A.G. BARR is a UK-based company primarily engaged in the production and distribution of soft drinks, cocktail solutions, and other beverages, with a market capitalization of approximately £0.58 billion.

Operations: The primary revenue stream comes from soft drinks, contributing significantly to the overall revenue of £420.4 million. The gross profit margin has shown a declining trend, reaching 39.08% in recent periods. Operating expenses have increased to £107.1 million, with sales and marketing accounting for a substantial portion at £51.1 million.

PE: 19.7x

A.G. BARR, known for Irn-Bru and Rubicon, is navigating a restructuring phase by seeking to sell Strathmore Mineral Water Company Ltd., aiming to boost profits. Despite relying on higher-risk external funding, they forecast a 10% annual earnings growth. Insider confidence is evident with recent share purchases in March 2025. The addition of Dr. Rohit Dhawan as Non-Executive Director promises strategic innovation through AI expertise from July 29, 2025, potentially enhancing their competitive edge in the consumer sector.

- Navigate through the intricacies of A.G. BARR with our comprehensive valuation report here.

Gain insights into A.G. BARR's historical performance by reviewing our past performance report.

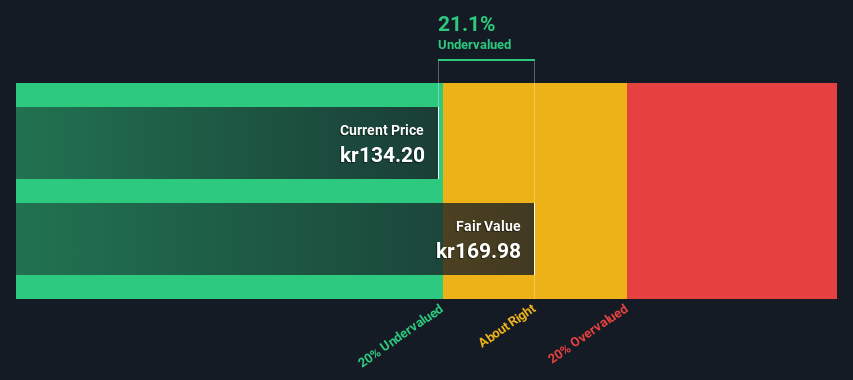

Troax Group (OM:TROAX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Troax Group specializes in manufacturing and supplying metal-based mesh panel solutions for industrial applications, with a market capitalization of approximately €2.02 billion.

Operations: Troax Group's revenue primarily comes from its operations, with a notable gross profit margin of 37.37% as of June 2025. The company incurs costs mainly through COGS and operating expenses, including significant allocations to sales and marketing as well as general and administrative expenses. Over the observed periods, net income margin varied, reaching 8.72% in June 2025.

PE: 32.8x

Troax Group, a European company, is navigating through a challenging period with sales and net income declining in the first half of 2025 compared to the previous year. Despite this, they are taking strategic steps by consolidating operations to enhance efficiency and reduce costs. The company's commitment to growth is evident as earnings are expected to increase by 29% annually. Insider confidence remains high with recent share purchases indicating belief in future prospects despite current financial pressures.

- Delve into the full analysis valuation report here for a deeper understanding of Troax Group.

Assess Troax Group's past performance with our detailed historical performance reports.

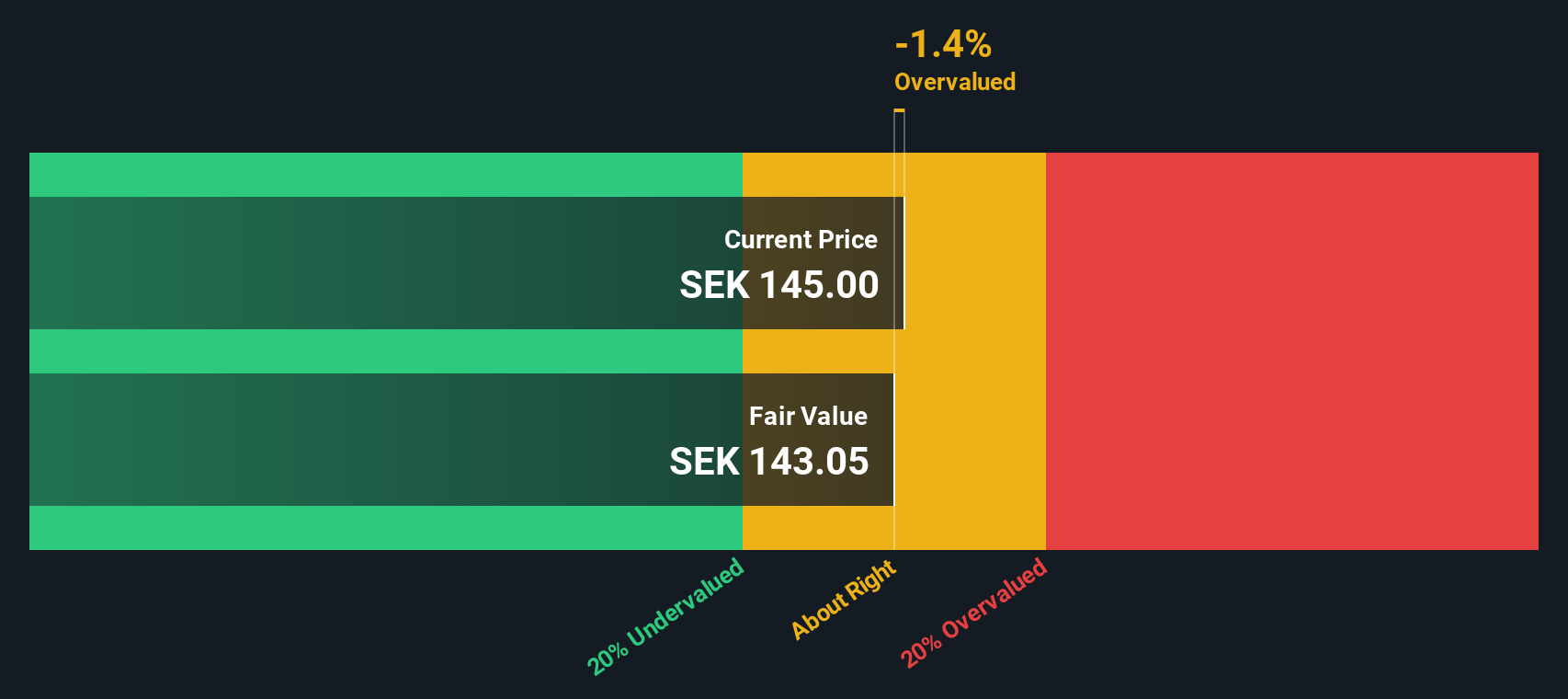

Yubico (OM:YUBICO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yubico is a company specializing in security software and services, with a market capitalization of SEK 10.25 billion.

Operations: The company's primary revenue stream is from Security Software & Services, with the latest reported revenue being SEK 2.45 billion. Over recent periods, there has been a notable increase in gross profit margin, reaching 81.57% by December 2024 and slightly adjusting to 80.96% by March 2025. The cost of goods sold (COGS) has remained relatively low compared to revenue, while operating expenses have seen an upward trend driven by sales & marketing and R&D expenses.

PE: 32.7x

Yubico, a company in the security technology industry, is expanding its YubiKey as a Service across the European Union, enhancing its presence in 199 locations globally. This expansion supports organizations' adoption of phishing-resistant multi-factor authentication. Despite a drop in net income from SEK 73.8 million to SEK 51.3 million year-over-year for Q1 2025, insider confidence is reflected by CEO Mattias Danielsson's purchase of 30,000 shares valued at approximately SEK 4.3 million in May 2025.

- Click to explore a detailed breakdown of our findings in Yubico's valuation report.

Explore historical data to track Yubico's performance over time in our Past section.

Next Steps

- Reveal the 53 hidden gems among our Undervalued European Small Caps With Insider Buying screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal