Subdued Growth No Barrier To East Buy Holding Limited (HKG:1797) With Shares Advancing 35%

East Buy Holding Limited (HKG:1797) shareholders have had their patience rewarded with a 35% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 49% in the last year.

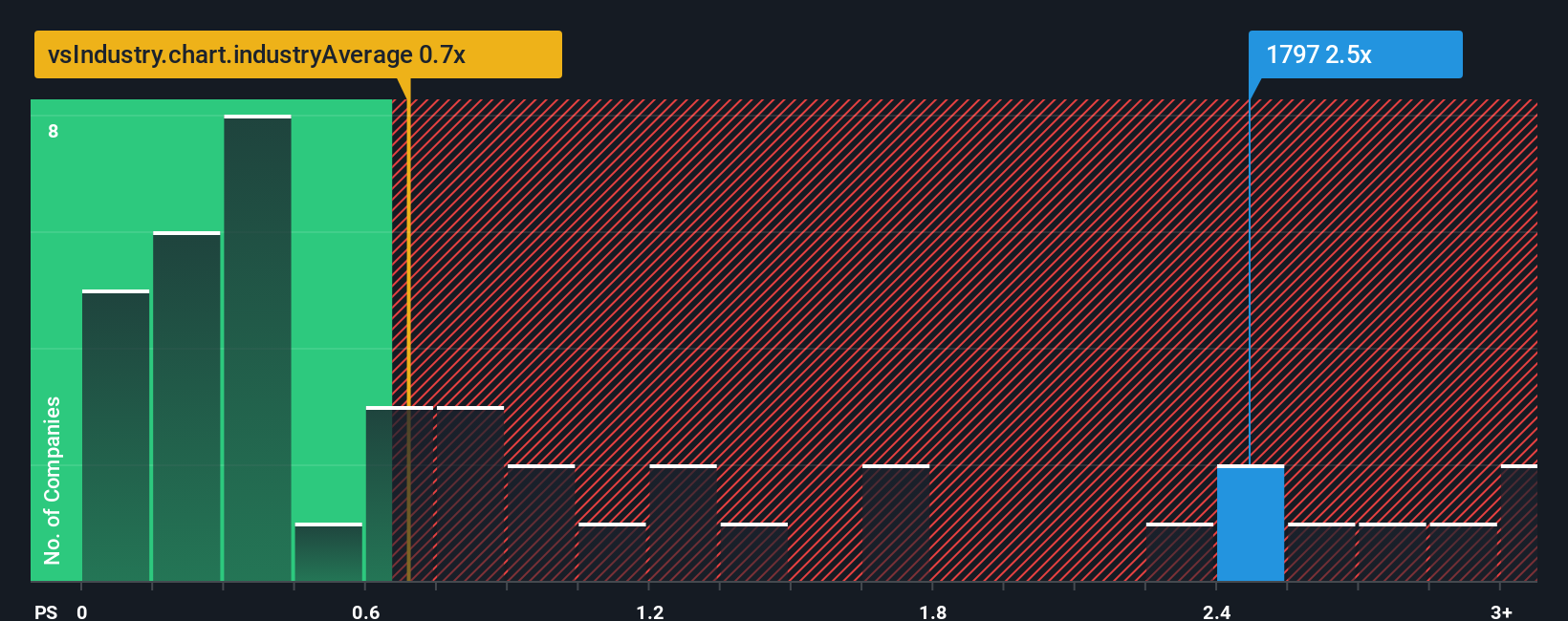

After such a large jump in price, given close to half the companies operating in Hong Kong's Consumer Retailing industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider East Buy Holding as a stock to potentially avoid with its 2.5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for East Buy Holding

What Does East Buy Holding's P/S Mean For Shareholders?

Recent times have been advantageous for East Buy Holding as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on East Buy Holding will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, East Buy Holding would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 50%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue growth is heading into negative territory, declining 28% over the next year. Meanwhile, the broader industry is forecast to expand by 9.7%, which paints a poor picture.

With this information, we find it concerning that East Buy Holding is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Final Word

East Buy Holding's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

For a company with revenues that are set to decline in the context of a growing industry, East Buy Holding's P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for East Buy Holding with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal