IPO Forward|Linglong Tire: Raising capital to increase the “7+5” layout and speed up the path of global tire giants

The trend of A-share listed companies sprinting south to Hong Kong stocks continues. Recently, another A-share company knocked on the Hong Kong Stock Exchange. Linglong Tire (601966.SH) submitted a prospectus to the Hong Kong Stock Exchange and plans to list on the main board of the Hong Kong Stock Exchange. CITIC Securities and CMB International are co-sponsors.

When A-share companies were listed in Hong Kong for the second time, the focus was on “internationalization.” Linglong tires are no exception. The company's plans to use the proceeds from the Hong Kong stock listing include: expanding production capacity, particularly the construction of overseas factories; improving R&D capabilities; and enhancing global marketing strategies.

According to the Zhitong Finance App, due to the impact of the continuous contraction in stock prices for 4 years, Linglong Tire's A-share market value is currently only about 22 billion yuan left.

According to the prospectus, Linglong Tire's product portfolio includes a wide range of passenger and light truck tires, truck tires and off-road tires, and has a variety of specifications to suit different application scenarios; in terms of the brand matrix, the company's brands include Linglong, Leo, Yufeng, Atlas, Lvxing and Ruijie.

Based on global sales in 2024, Linglong Tire is already the largest OE tire (automobile manufacturer's original tire) manufacturer in the Chinese market, and is also the third largest OE tire manufacturer in the world. Furthermore, if the scope is framed in the field of new energy vehicles, Linglong Tire has been the world's largest OE tire manufacturer for five consecutive years.

Steady growth in tire faucets

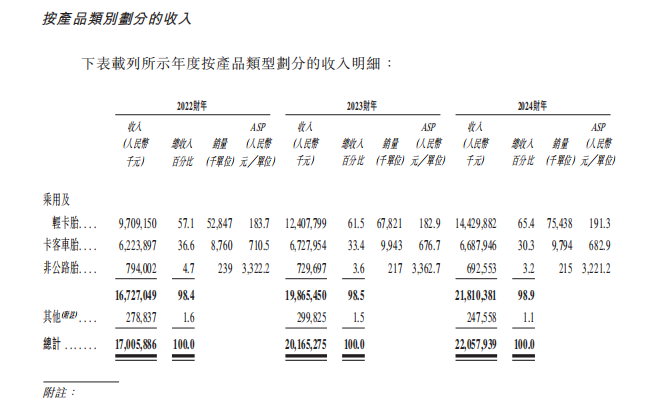

The outstanding market position has helped Linglong Tire achieve strong sales performance. In the last three full years, Linglong Tire's revenue continued to expand at a compound annual growth rate of 13.9%. According to the data, in 2022 to 2024, the company achieved revenue of 17.06 billion yuan, 20.065 billion yuan, and 22.058 billion yuan respectively.

Looking at the split structure, passenger and light truck tires have always been the company's largest source of revenue, and their share has continued to rise over the past few years. According to financial reports, the business's revenue increased from 9.709 billion yuan in '22 to 14.43 billion yuan in '24, accounting for an increase of 57.1% to 65.4%. Truck and bus tires are the second largest business of Linglong Tire. Revenue during the reporting period was 6.224 billion yuan, 6.728 billion yuan, and 6.688 billion yuan respectively, accounting for 36.6%, 33.4%, and 30.3% of corresponding revenue. In the same period, Linglong Tire also derived some of its revenue from off-road tires and other businesses, including material and waste sales, but they all accounted for a small share of revenue.

Looking at the overall picture, it's not hard to see that passenger and light truck tires, which account for the largest share of revenue, are also the business segments that have contributed the most to Linglong Tire's performance growth over the years. The reason why the scale of this business was able to grow in an orderly manner was due to a sharp rise in the volume and price of related products during the period. In terms of sales, there was an increase of 28.3% over the previous year in '23, and an increase of about 11.2% the following year; at the same time, the average sales price remained stable in '22 and '23, and there was a slight increase in '24.

While revenue has been steadily expanding, Linglong Tire's profitability has also improved significantly in recent years. Data show that in 22-24, Linglong Tire's gross profit was 1,871 billion yuan, 3.61 billion yuan, and 4.344 billion yuan respectively, corresponding to gross profit margins of 11%, 17.9%, and 19.7%. Among them, the company's gross margin jumped sharply in '23, mainly due to a combination of factors such as economies of scale brought about by increased production and sales, and the decline in raw material prices represented by natural rubber and synthetic rubber in this year. During the reporting period, Linglong Tire's net profit was 292 million yuan, 1,391 billion yuan, and 1,752 billion yuan respectively, which also showed the characteristics of “rising tide”.

It is worth mentioning that not only is it making great strides in the domestic market, but Linglong Tire's overseas performance is also gradually improving. And this is probably due to the fact that the company attaches great importance to overseas markets,

Previously, Linglong Tire formulated a “7+5” strategy (that is, 7 domestic factories and 5 overseas factories) to continue to advance the global layout. By the end of last year, Linglong Tire had established seven major production bases around the world, including two overseas bases in Thailand and Serbia. In the prospectus, Linglong Tire stated that through measures such as optimizing the industrial layout and increasing strategic production capacity, the pace of the company's global expansion will be further accelerated.

Domestic substitution accelerates “7+5” strategy to promote globalization

From an industry perspective, the global tire industry has been growing steadily in market size since 2020, with global tire sales reaching 1,784 billion tires in 2023. Currently, the global tire replacement market is dominated by demand. Taking 2023 as an example, the replacement market demand is about 1,321 million tires, while the supporting market demand is about 464 million tires, accounting for 74% and 26% respectively. The industry concentration is high, and the three largest companies in the industry, Michelin, Bridgestone, and Goodyear have a combined market share of nearly 40%.

In fact, in the field of various automobile parts, foreign manufacturers occupy the vast majority of the market share. Mainly, the domestic manufacturing industry started late, mainly by introducing foreign capital, and there is an urgent need to solve the problem of stuck necks. However, in recent years, domestic brands have increased research and development, and the level of technology is in sync with the international level, especially artificial intelligence, which is at the cutting edge of the industry, and these technological advances have also promoted the increase in the penetration rate of domestic brands.

In the tire industry, for example, in the list of the top 75 global tires released by the tire business in 2023, there are 36 companies in China. Among them, domestic leaders such as Zhengxin Rubber, Sailun Tire, and Linglong Tire all entered the top 20 global tire companies. Recently, the US launched a tariff war and raised tariffs on auto parts. This has undoubtedly boosted the acceleration of domestic substitution, and high-quality suppliers represented by Linglong Tire will also receive key attention from domestic car manufacturers.

Linglong Tire insists on combining supporting business with retail business. This is closely related to the industry structure. The main market of the retail business is tire replacement demand. The products are sold to 173 countries around the world, covering Europe, the Middle East, America, Asia Pacific and Africa, and the market distribution is quite balanced. The supporting business mainly provides supporting services for more than 200 production bases of more than 60 OEMs around the world, including Volkswagen, Audi, BMW, BYD and Geely, and the customer guarantee level is high.

In addition, the company is actively developing supporting the high-end market and changing the image of domestic low-end brands, including strengthening cooperation with BBA and making new breakthroughs. For example, during 2024, it has become a supporting supplier for many domestic high-end brand models, and has also become the main tire supplier for the German Volkswagen Tiguan, entering the global high-end supporting market. In addition to benefiting from domestic substitution, the company is expanding steadily globally, and the industry's export demand is strong. The company has taken the lead in overseas markets and has already landed several production bases. As its market share increases, it is expected to compete on the same stage as the Big Three.

Facing the future, Linglong Tire plans to firmly promote the internationalization of manufacturing around the “7+5” and “3+3” strategies. In terms of the “7+5” strategy, Linglong Tire currently has 5 production bases in Zhaoyuan, Dezhou, Liuzhou, Jingmen, and Changchun in China, and plans to build two other domestic production bases in Shaanxi and Anhui. It has 2 overseas production sites in Thailand and Serbia, and continues to inspect and build factories around the world, making full use of global resources to develop the global tire market.

Based on the “7+5” global strategic layout, Linglong Tire has also carried out “3+3” off-road tire strategic production based on strategic planning. The goal is to establish off-road tire production capacity at three domestic production bases and three overseas production bases.

In recent years, with the booming development of the global port transportation industry, the expansion of the mining industry, and the spread of mechanized automation in modern manufacturing logistics, developing countries have vigorously promoted infrastructure. At the same time, benefiting from the continuous increase in agricultural machinery and equipment and the increasing demand for agricultural replacement tires, it has strongly promoted the continued growth in demand for off-road tires. At present, off-road tires have good market prospects, and their potential in overseas regions is particularly impressive. Also, judging from the business model, the high off-road tire barrier is obviously a very attractive field for Chinese tire companies represented by Linglong Tire. In response, Linglong Tire plans to achieve the goal of producing a total of 339,900 tons of off-road tires by the end of 2030.

Linglong Tire's opening of the Hong Kong Stock Exchange is not only an important part of its “7+5” globalization strategy, but also a key measure to accelerate the internationalization process and enhance global competitiveness. Relying on the rise of China's tire industry, Dongfeng and its continuous deep cultivation in products, technology, and global layout, the company has firmly occupied a leading position in the domestic OE market and has established significant advantages globally, especially in the field of NEV support. The capital raised from its second Hong Kong stock listing will be a powerful engine to support its global expansion, technological research and development upgrades, and a jump in brand value.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal