Relying on innovation to reshape the domestic TAVR market pattern and explore the core logic behind Peijia Medical-B (09996)'s “outperforming the market”

Since this year, thanks to the recovery in profit growth and the logic of valuation repair, the innovative pharmaceutical sector of Hong Kong stocks has seen impressive growth. This has driven the Hang Seng Healthcare Index out of a “big positive line” market. The index has risen by more than 50% since the beginning of the year.

Recently, the State Drug Administration issued the “Notice on Issuing Measures to Optimize Full-Life Cycle Supervision to Support the Innovation and Development of High-end Medical Devices”, announcing the top ten measures to support the innovation and development of high-end medical devices, which further boosted the market's medium- to long-term investment expectations for innovative device companies.

It is against the backdrop of today's warming investment environment that Peijia Medical-B (09996), a leading domestic innovative medical device company, has emerged from a period of continuous upward growth independent of the “TAVR Three Musketeers” of Hong Kong stocks in the past. The Zhitong Finance App observed that as of July 17 of this year, Peijia Healthcare's stock price has accumulated a cumulative increase of more than 95% from the beginning of the year to date, outperforming the index by a large margin while also driving the company's market value to the HK$5 billion range.

The reason for this is that current policy dividends are compounded by the warming investment in the pharmaceutical device sector of Hong Kong stocks, driving the continuous increase in the weight of enterprise innovation value verification in valuation evaluations. Compared with the previous conservative attitude, investors now pay more attention to whether innovative equipment companies' new technology release can be verified, and whether the companies' innovative pipeline varieties have significant unanticipated benefits in subsequent commercialization. However, the above stock price increase data reflects the market's high recognition of the company's value.

With rapid commercialization in recent years, steady and rapid revenue growth, and a well-laid out and highly competitive product pipeline, Peijia Healthcare has established itself as the leading brand in the field of interventional valvular treatment in China, and is reshaping the market pattern of leading companies with predictable continuous growth.

It later took the lead and reshaped the domestic TAVR market pattern

At the cutting edge of structural cardiac intervention, transcatheter aortic valve replacement (TAVR) has become one of the most popular innovative technologies today and is entering a stage of steady growth.

The Zhitong Finance App learned that currently all aortic stenosis treatment technologies on the global market use TAVR as the main line technology to carry out next-generation innovations (such as recyclable, positionable, etc.), and no technology has emerged that can replace TAVR (from drugs to devices). Multinational giant Edward has been continuously optimizing the layout of TAVR for more than ten years. Currently, the main idea is still to upgrade the interventional valve system.

In this context, the domestic TAVR circuit essentially competes for the company's strategic layout, channel and management capabilities. The intrinsic value of leading companies is reflected in faster R&D efficiency and higher market share.

Judging from R&D efficiency, according to SPDB International Research Report, although the company's first-generation product TaurusOne was approved later than its main competitor, the company's second-generation/third-generation TAVI products are progressing ahead of schedule. Among them, the company's second-generation product has basically caught up with the launch time, becoming the second manufacturer of the second-generation approved second-generation product in the domestic brand, while its third-generation product, Long-Term Dry Valve TaurusNXT, entered the registration research stage ahead of the competition. It is expected to be the first to be launched in the first half of next year. At the same time, the reflux valve TaurusRio has also completed enrollment and follow-up for registered clinical trials, and is expected to be approved for marketing between the end of this year and the first half of next year.

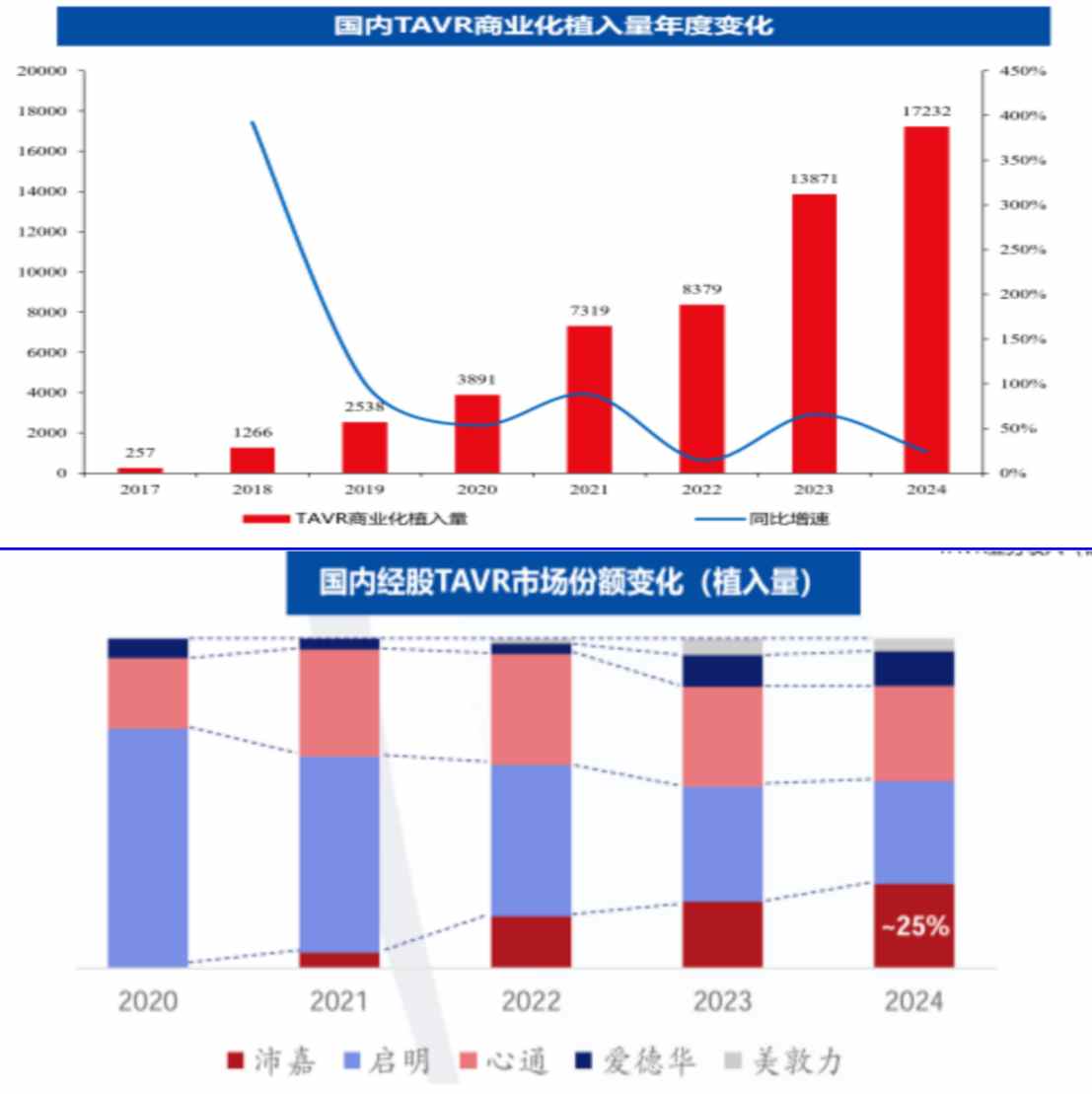

In terms of market share, Peijia Healthcare has jumped from 5% in the first year of commercialization in 2021 to 25% + at present, making the leap from a latecomer to an industry leader. The Zhitong Finance App learned that the company's 2024 financial report shows that the number of TAVR terminals installed in the current period reached 3,400, an increase of about 37% over the previous year. The growth rate significantly exceeded the industry average and competitors such as Qiming Healthcare and Xintong Healthcare. At the 2024 annual results briefing, the management further proposed guidelines to increase the market share share ratio of TAVR to 25-30% in 2025, fully demonstrating its determination and confidence to “point to the number one TAVR brand in China”.

It is worth mentioning that Peijia Healthcare revealed at its corporate open day held last week that in the first half of 2025, the number of terminals implanted exceeded 2,000 units, with a year-on-year growth rate of nearly 20%, once again outperforming the market. Of these, 418 units were implanted in a single month in April, a record high.

The value of “true innovation” continues to be unleashed

Although research in the field of heart valves in China started later than developed countries, the market space has continued to expand in recent years under the influence of technological innovation, growing market demand, and policy drivers.

According to Frost & Sullivan data, the number of TAVR surgeries in China is expected to reach 109,500 by 2030, and the compound growth rate from 2021 to 2030 will reach 36.6%. The compound annual growth rate of TAVR surgery cases in China is higher than the global average for the same period. As a result, the market expects China's TAVR market to reach 11.36 billion yuan by 2030, with a compound growth rate of 32.4% from 2021 to 2030.

In order to promote the healthy development of the TAVR market, the policy side is also continuing to make efforts to guide the TAVR market to efficiently release innovative value.

According to the Zhitong Finance App, as mentioned above, on July 3, the State Drug Administration issued policies to support the innovation and development of medical devices, focusing on the five major fields of surgical robots, AI medical devices, brain-computer interfaces, high-end imaging equipment, and novel biomaterials, and proposed ten major initiatives. In response, Jianghai Securities pointed out that the new regulations mark that China's high-end medical devices have entered a dual-track driving cycle of “innovation+going overseas”. The medium- to long-term full-life cycle regulatory framework is driving the industry from “heavy sales” to “heavy technology,” and companies with core patents and global compliance capabilities will take the lead in reshuffling.

As an innovation pioneer within the domestic TAVR circuit, Peijia Medical has relied on continuous technological breakthroughs and patent accumulation in recent years. Through endogenous research and development and external cooperation (BD), Peijia Medical has established rich platform technology and patent reserves in the TAVR field, including non-formaldehyde crosslinked dry valve technology, shock wave calcification reconstruction technology, and polymer valve technology. In the field of aortic valve, mitral valve, and tricuspid valve, a commercial product matrix centered on TaurusOne, TaurusElite, and TaurusMax, and TaurusMax, and TaurusNXT TAVR, TaurusTRIO aortic valve reflux TAVR, HighLife TSMVR (transatrial septum transcatheter mitral valve replacement), GeminiOne TEER (transcatheter edge repair), MonarQ TTVR (transcatheter tricuspid valve replacement), and monarQ TTVR (transcatheter tricuspid valve replacement) An innovative research matrix centered on shock waves and Reachtactile robot-assisted TAVR systems.

According to the Zhitong Finance App, Peijia Healthcare is expected to launch three products in succession in the next 1-2 years: TauriO, TaurusNXT, and GeminiOne. Among them, Taurito, which targets aortic regurgitation, is particularly noteworthy. This product is manufactured by Peijia Medical based on an exclusive license in Greater China obtained from JenaValve in the US at the end of 2021. It has completed pre-marketing clinical trials in China and submitted a registration application to the NMPA. (Note: Edward Life Sciences announced in July 2024 that it will acquire JenaValve). According to Frost & Sullivan data, the size of the aortic valve reflux market is comparable to the size of the aortic valve stenosis market, and there are currently no domestic aortic valve reflux TAVR products approved through the stock market. Given the vast market space and scarcity of products, TaurriO's launch is highly anticipated and is expected to bring significant revenue growth to Pegasus Healthcare next year.

It can be seen from this that Peijia Healthcare is already far ahead of domestic competitors in terms of pipeline width (covering types of valvular diseases), depth (technical platform and reserves), and speed of advancement, and its layout is no less compromising than international giant Edward Life Sciences.

Statistics show that in 2024, the number of TAVR surgeries in China was only 17,000, or 5.7% of the world, indicating that there is still a lot of room for improvement in TAVR penetration in China. In this context, in recent years, “new players” such as Bairen Healthcare, Neumai Healthcare, Lepu Healthcare, and Jinshi Biotech have entered the market one after another. However, in the context of the collection and expansion of innovative medical devices, it is difficult for “new players” to form large-scale commercialization capabilities to seize the market in a short period of time, and subsequent competitiveness is limited.

In addition, Peijia Healthcare is also speeding up the process of going overseas and actively promoting global layout and cooperation. Peijia Healthcare recently announced the completion of the first patient implantation of the MonarQ TTVR system in a global clinical study. Also, during the recent development day event, it was mentioned that Geminione is planning to apply for CE certification. The latest clinical results of its shockwave calcification reconstruction technology applied in the field of mitral valve stenosis were also presented at the recent New York Valve Conference, which attracted widespread attention from overseas experts.

Regarding the company's future planning and development, during the recent development day event, Peijia Medical's management explained in detail the company's future development strategy, focusing on showcasing the latest innovative R&D progress and innovative product echelon in TAVR product pipeline development. At the conference, Peijia Medical said that the company will fully build a main valve “combo punch” composed of TaurusOne, TaurusElite and TaurusMax in 2025, launch Taurustrio, TaurusNXT and GeminiOne in 2026 to fully enter the aortic valve reflux, AS dry valve, and mitral valve reflux markets in the next 3-5 years, and lead the domestic mitral valve replacement and tricuspid valve reconstruction system through innovative products such as HighLife, MonarQ TTVR, and shock wave calcification reconstruction systems Replace and intervene in non-implantable fields, thus forming a complete ecosystem layout for peritoneal valvular disease.

Summarize

Judging from the endogenous development logic of the industry, the domestic medical device industry has now entered an innovation-driven era, and pricing based on the company's dual values of “true innovation” and “scale growth” has gradually become a market consensus.

In this context, Peijia Healthcare, which has the ability to integrate R&D, production and marketing and accelerates innovation, has clearly adapted to the major trend of industry development. As the company's major innovative products are launched one after another, Peijia Healthcare is expected to continue to consolidate its position as the leading TAVR brand in China at the commercial level.

At the same time, as a leading innovative medical device company with two-wheel drive, Peijia Healthcare has also established a foothold in the field of neurological intervention. In 2024, Peijia Medical's neurological intervention segment had revenue of 356 million yuan, an increase of 39.1% over the previous year. While achieving initial profit, it also contributed to positive cash flow, and led the company to achieve total revenue of 615 million yuan in the current period, and overall profit is expected.

Referring to the Hong Kong stock market, Guichuang Tongqiao, was approved by the Hong Kong Stock Exchange in May of this year after achieving its first full-year profit in 2024 to officially remove the “B” mark from the stock code.

Benefiting from the scale effect brought about by continued revenue growth, Peijia Healthcare is also expected to enter a new stage of large-scale profit in the near future, and “picking B” is probably just around the corner. This steady, moderate and positive trend in Peijia Healthcare's fundamentals is clearly in line with the current trend of investment in innovative pharmaceutical devices in Hong Kong stocks, and will further open up room for improvement in the company's valuation in the future.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal