Tempus AI Raises 2025 Financial Outlook: What's Backing It?

Tempus AI TEM expects full-year 2025 revenues of $1.25 billion (up from the previous $1.24 billion guidance), which represents approximately 80% annual growth. The company also expects adjusted EBITDA of $5 million for the full year of 2025, an improvement of approximately $110 million over 2024.

Factors Fueling the Raised 2025 Guidance

Robust First-Quarter Performance: Total sales in the first quarter amounted to $255.7 million, which grew 75.4% year over year. Quarterly gross profit increased 99.8% year over year, reaching $155.2 million. The gains were fueled by lab efficiencies, increased adoption of AI tools like Tempus One and xM and a higher mix of data services. These improvements narrowed down adjusted EBITDA loss to $16.2 million, from $43.9 million a year ago.

Strategic Collaborations With AstraZeneca & Pathos: Tempus signed a three-year, $200 million data and modeling license agreement with AstraZeneca (AZN) and Pathos to build a multimodal foundation model in oncology, leveraging more than 300 petabytes of rich multimodal healthcare data that Tempus has built over the past decade. Notably, the deal raised the total remaining contract value to greater than $1 billion as of April-end.

Upside in Hereditary Testing: Hereditary testing revenues hit $63.5 million on 23% volume growth, outpacing the first-quarter guidance. This growth was driven by the acquisition of Ambry Genetics, a recognized leader in genetic testing. The company anticipates long-term potential in this business beyond oncology, extending to cardiovascular, Alzheimer’s and other genetic predispositions.

Tempus AI Competitors’ 2025 Financial Outlook

For full-year 2025, Exact Sciences EXAS anticipates total revenues in the range of $3.070-$3.120 billion (previously $3.025-$3.085 billion). The adjusted EBITDA forecast is updated to the $425-$455 million band (up from the earlier range of $410-$440 million). A major catalyst for the guidance hike was the successful launch of Cologuard Plus, the company’s next-generation colorectal cancer screening test. The test has already seen rapid adoption, with over 30,000 completed tests. TEM reported first-quarter revenues of $706.8 million, marking a 10.9% year-over-year increase. Adjusted EBITDA surged 61%, while free cash flow reached breakeven, an improvement of $120 million from the prior year. These results gave management the confidence to raise its full-year outlook.

Exelixis EXEL raised its full-year 2025 financial guidance following strong first-quarter results, driven by higher demand for CABOMETYX and the recent U.S. FDA approval for its use in treating advanced neuroendocrine tumors (NET). The company expects total revenues in the range of $2.25-$2.35 billion (up from the earlier guidance range of $2.15-$2.25 billion). A major factor behind this upward revision was the FDA approval in March 2025 of CABOMETYX for the treatment of advanced pancreatic and extra-pancreatic NET, making it the first and only systemic treatment approved for previously treated NET regardless of tumor site or grade. Additionally, TEM is optimistic about several upcoming clinical milestones in the second half of the year, including pivotal trial readouts for its next-generation therapy zanzalintinib in colorectal and non-clear cell renal cancers. These developments reinforce Exelixis’ strategy to expand its oncology portfolio and transition into a multi-franchise cancer company.

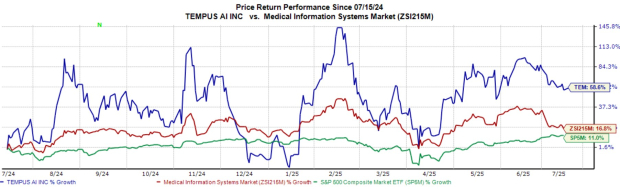

TEM Stock Outperforms Industry & Benchmark

In the past year, Tempus AI shares have surged 58.6%, outperforming the industry’s 16.8% growth and the S&P 500 composite’s 11% improvement.

Image Source: Zacks Investment Research

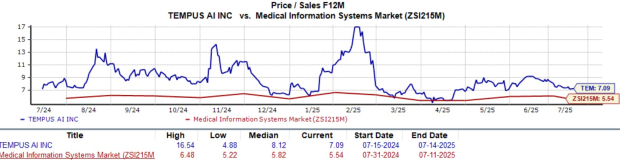

Expensive Valuation

TEM currently trades at a forward 12-month Price-to-Sales (P/S) of 7.09X compared to the industry average of 5.82X.

Image Source: Zacks Investment Research

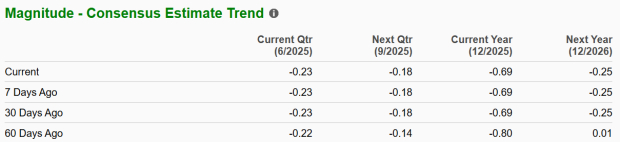

TEM Stock Estimate Trend

Earnings estimates for Tempus AI in 2025 and 2026 are showing a mixed picture.

Image Source: Zacks Investment Research

TEM stock currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Exact Sciences Corporation (EXAS): Free Stock Analysis Report

Tempus AI, Inc. (TEM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal