730 billion dollars of capital to restructure the Hong Kong stock ecosystem: in-depth analysis of the two main lines of high dividends and hard technology in the first half of 2025

In the first half of 2025, Hong Kong stocks experienced an impressive overall rebound. The Hang Seng Index surged 20% to take the lead among the world's major stock indexes. The core driving force behind this rebound is the massive influx of mainland capital through the “Hong Kong Stock Connect” channel, compounded by global capital's revaluation of “cheap Chinese assets.”

Behind this global reallocation, led by incremental capital, surging southbound capital inflows played a decisive role. Wind data shows that in the first half of 2025, the cumulative net inflow of capital from Hong Kong Stock Connect to the South was over HK$730 billion, reaching 90% of last year's record, the highest in the same period in history, indicating a surge in demand from mainland investors for Hong Kong stock allocation.

This article will systematically analyze the overall status of Hong Kong Stock Connect's capital flows in the first half of the year, sector preferences and individual stock choices, and thoroughly explore the driving factors behind capital flows. Through data analysis on dimensions such as transaction amount, net inflow size, and industry distribution, the structural impact of southbound capital on the Hong Kong stock market, as well as the investment opportunities and risks of domestic and foreign investors working together to drive the Hong Kong stock market are revealed.

The capital flow of Hong Kong Stock Connect reached a record high, and the characteristics of a structured bull market were remarkable

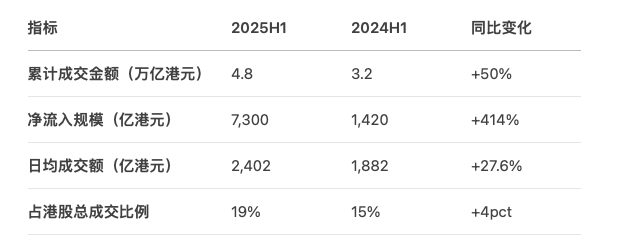

In the first half of 2025, the capital flow of Hong Kong Stock Connect reached a record high, and south-bound capital dominated the market. The cumulative turnover of Hong Kong Stock Connect was HK$4.8 trillion, an increase of 50% over the previous year, accounting for 19% of the total turnover of the Hong Kong stock market, and its influence continues to increase. Furthermore, the return of foreign capital resonated markedly. Foreign capital returned to Hong Kong stocks through ETFs and other channels. The net inflow of iShares MSCI Hong Kong ETF exceeded 700 million US dollars during the year, forming a synergy with southbound capital.

Judging from trading activity, the average daily turnover of Hong Kong Stock Connect in the first half of the year was HK$240.2 billion, a record high, far exceeding the 2021 bull market level (HK$188.2 billion), which is in line with the historical “full bull market” characteristics. Furthermore, compared with the market environment in 2021, there has been a fundamental change in 2025 — the current valuation of Hong Kong stocks is at a historically low level, while 2021 is at a high valuation level. This difference makes current capital inflows more sustainable and value-based.

It is particularly noteworthy that the net monthly net purchase of Southbound Capital reached HK$152.8 billion in February, a record high in the last 4 years. It is also the second highest in a single month in Hong Kong Stock Connect history, after HK$310.6 billion in January 2021. This intensity of capital inflows has been extremely rare in history, showing that mainland investors' confidence in the Hong Kong stock market has increased significantly.

From a market perspective, southbound capital is reshaping the Hong Kong stock ecosystem, and new characteristics have even emerged in conjunction with the global market. On the one hand, the continued large-scale inflow of capital to the south has significantly changed the investor structure of the Hong Kong stock market. Currently, the share of southbound capital in total Hong Kong stock transactions has risen from less than 10% in 2020 to nearly 20%, and even contributed more than half of the market's turnover on some trading days. On the other hand, this structural change has further strengthened the linkage between the Hong Kong stock market and the A-share market, while also enhancing the independence of Hong Kong stocks compared to the global market.

One of the underlying reasons for the financial boom in the Hong Kong stock market is the expectation that the Federal Reserve will cut interest rates: the market is betting that interest rate cuts will begin in September 2025, global capital will pour into high-dividend assets, and Hong Kong stocks will become an important destination. The second is the “siphon effect” of A-shares: the southbound capital inflow continues to be high, and some of the liquidity of A-shares is being diverted, driving the “Hong Kong stock market leading the way in A-shares” phenomenon. Finally, policy arbitrage is also an important reason. The Mainland's “Nine Rules of the New Country” strengthened dividend supervision, and part of the capital was transferred to high-yield stocks in Hong Kong stocks (such as telecommunications and energy sectors).

Incremental capital sector preferences: high dividend+innovative drug dual main line “barbell strategy” is popular

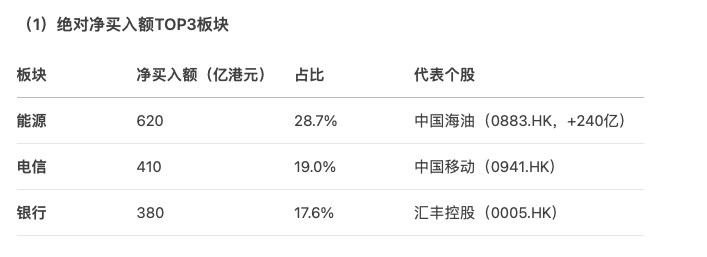

In the first half of 2025, the industry allocation of southbound capital showed obvious structural characteristics, and high dividends and innovative drugs became the main sectors for capital inflows. According to Wind data, the top three sectors with absolute net purchases were Energy, Telecom and Banking, which bought $62 billion, $41 billion, and $38 billion respectively, accounting for 28.7%, 19.0% and 17.6% respectively.

The appeal of these sectors mainly comes from two aspects: first, the valuation advantage — the net market ratio is generally less than 1 times, with a discount of more than 20% compared to A-shares; the second is dividend return — the dividend yield of H shares of the four major state-owned banks is above 5%, which is significantly higher than the deposit interest rate of mainland banks and the yield of most wealth management products. CNOOC (00883) received a net purchase of HK$24 billion, benefiting from the recovery in oil prices and high dividends (dividend rate of more than 8%). This combination of “high dividend+undervaluation” is particularly valuable in a low interest rate environment.

From the perspective of proportional changes, capital inflows to the utilities, biotechnology, and semiconductor sectors grew most significantly, with holdings increasing by 3.8%, 2.5%, and 1.9%, respectively.

Specifically, the Hong Kong Stock Innovative Drug Index unquestionably dominated the list of gains in the first half of the year. Among them, the two Hong Kong Stock Connect Innovative Drug Indices (codes 987018 and 931250) both increased by more than 60%. With an average increase of 146%, 18A significantly outperformed the Hang Seng Index (+20%).

This outbreak was no accident. There is a saying in the stock market: “How long is the horizontal and how tall is the vertical.” After four years of sharp decline, the innovative drug circuit ushered in a Jedi reversal under the “Davis Double Strike” of valuation and fundamentals.

On the one hand, the R&D achievements of innovative Chinese pharmaceutical companies have been continuously recognized by international giants, and the amount of authorized overseas transactions has repeatedly reached new highs, providing a global value anchor for the industry. On the other hand, the Hong Kong Stock Exchange's unique 18A rule brings together a large number of high-growth unprofitable biotech companies with scarce A-shares. They are gradually entering a commercial cash-out period and have become the focus of capital pursuit.

This shift in the allocation of southbound capital not only reflects the market's dual pursuit of deterministic returns and growth potential, but also reflects the special value of the Hong Kong stock market as a “ballast stone” connecting China and global capital — when high-dividend assets become the “ballast stone” of the downward interest rate cycle, the innovative medicine sector relied on its ability to compete globally to reassess the value of “created by China.”

In the future, as the Federal Reserve's monetary policy shifts and domestic innovative drugs go overseas, this “barbell strategy” may continue to deepen, driving the Hong Kong stock market to form more distinct structural characteristics: one end is a value bastion with stable cash flow, and the other end is a growth pioneer with technological breakthroughs, which together form a new coordinate system for the international pricing of Chinese assets.

Hong Kong Stock Connect's Top Ten Bullish Stocks: Significant Diversification, New Highly Flexible Dark Horses Concentrate Hard Technology Track

By sorting through the top ten bullish stocks of Hong Kong Stock Connect in the first half of the year, we can clearly see the main logic of capital chasing and the structural opportunities in the market.

Judging from the final ranking of growth, Laostore Gold (06181) took the lead with an impressive increase of 330.18%, followed by Sansheng Pharmaceutical (01530) and Rongchang Biotech (09995) with increases of 288.98% and 278.12%, respectively. It is worth noting that the entry threshold is as high as 179.36%, an increase of nearly 50 percentage points over the same period in 2024, indicating a significant increase in the money-making effect in the market.

It is worth noting that the current increase list shows diversified characteristics. The biomedical sector leads the way, with three seats (Sansheng Pharmaceutical, Rongchang Biotech), two seats for retail consumption (Old Store Gold, Bubble Mart), two seats for the Internet (Meitu Company, Yixin Group), and the traditional cycle industry taking three seats (Shandong Molong, Dekang Agriculture and Animal Husbandry, and Wanguo Gold Group).

Specifically, Rongchang Biotech's ADC drug overseas clinical progress exceeded expectations, driving up the stock price by 278.12%, and the Hong Kong Stock Connect shareholding ratio has broken through the 50% mark. Old-fashioned gold became the biggest dark horse in the first half of the year. Against the backdrop of continuing to rise in international gold prices, the company has won wide recognition from consumers with its unique ancient gold process and rapidly expanding store network. Hong Kong Stock Connect increased its holdings of 7.068,200 shares in the first half of the year, reaching 11.32% of shares.

However, in-depth analysis revealed that capital flows showed a clear divergence. Sansheng Pharmaceutical, Yixin Group, etc. received a significant increase in capital holdings from Hong Kong Stock Connect; Rongchang Biotech Hong Kong Stock Connect held more than 50% of the shares, indicating that the institution is highly recognized.

Furthermore, among the new targets transferred to Hong Kong Stock Connect in March 2025, Huahong Semiconductor (01347), Colunbotai Bio-B (06990), and CGN Mining (01164) became key targets for southbound capital allocation. As of June 30, the Hong Kong Stock Connect shareholding ratio of the three companies had risen rapidly to 31.57%, 22.15% and 16.08%, respectively. This phenomenon mainly reflects the strong preference of mainland capital for the hard technology circuit — the three main investment lines of domestic semiconductor substitution, internationalization of innovative drugs, and energy security are continuing to increase.

It is worth noting that the average daily turnover of these three companies increased 3-5 times compared to the previous one after transferring to Hong Kong Stock Connect, showing that the interconnection mechanism has effectively improved target liquidity and valuation discovery efficiency. It also highlights that in a complex international environment, enterprises with the ability to break through core technology are becoming an important choice for hedging and adding value to capital.

Summary: Three major trends and prospects

Based on the Hong Kong Stock Connect capital flow in the first half of the year, Zhitong Finance App believes that structural opportunities and risks coexist in the Hong Kong stock market in the second half of the year, and the core trends are the following three aspects:

First, the “barbell strategy” of capital allocation continues.

Southbound capital's simultaneous allocation of high-dividend assets (energy, telecommunications) and high-growth tracks (innovative drugs, semiconductors) will continue to dominate the market. As expectations of the Federal Reserve's interest rate cut come to fruition, the defensive value of the high-dividend sector will be further highlighted, and the progress and commercialization capabilities of innovative pharmaceutical companies will become a watershed moment in the performance of growth stocks.

Second, the hard technology circuit continues to benefit from policy dividends.

The three main lines of domestic semiconductor substitution (such as Huahong Semiconductor), internationalization of innovative drugs (such as Columbotai), and energy security (such as CGN Mining) will be favored by mainland capital for a long time. The combination of large national funds, industrial policies and the Hong Kong Stock Connect mechanism will continue to improve liquidity and valuation levels in these fields.

Third, market fragmentation has intensified.

There is a clear trend of concentration of capital towards leading targets. Individual stocks with Hong Kong Stock Connect holding more than 50% of shares, such as Rongchang Biotech, may enjoy liquidity premiums, while small and medium capitalization stocks that lack fundamental support may face the risk of marginalization.

In summary, the outstanding performance of the Hong Kong stock market in the first half of 2025 not only showed the repricing of Chinese assets by mainland and global capital, but also revealed the role of Hong Kong stocks as an important bridge connecting Chinese and foreign capital markets. Looking ahead to the second half of the year, the market will find a new balance in the game of multiple forces. Investors need a more refined perspective to seize the structural opportunities in the Hong Kong stock market under an allocation framework of “high dividends as a shield and hard technology as a spear”.

What is worth looking forward to is that with the continuous deepening of the interconnection mechanism and the continuous improvement of the Hong Kong stock market system, 2025 is expected to be a key year for the Hong Kong stock market to achieve “qualitative change” — not only the restoration of valuation, but also the restructuring of the market ecology and pricing system. In this process, high-quality enterprises that truly have core competitiveness and can go through the cycle will continue to be favored by capital for a long time.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal