IPO Foresight | Investing again in R&D to compete on the intelligent automotive circuit, is it good to rely on big trees to cool off?

Siwei Zhilian (Nanjing) Technology Co., Ltd. (hereinafter referred to as “Siwei Zhilian”), a shareholder of the intelligent driving industry integrator Siwei Tuxin (002405.SZ), officially launched a sprint into the capital market this year after receiving additional strategic investment from Didi Technology last year.

Not long ago, Siwei Zhilian submitted a listing on the Hong Kong Stock Exchange. According to the prospectus, judging from the 2024 situation, Siwei Zhilian ranked 10th among all domestic first-class smart cockpit solution providers, with a market share of 0.1%, and ranked third among the world's software-driven Chinese first-class suppliers. Furthermore, the company's integrated parking solution ranked second in the country in terms of service volume. Since its establishment, Siwei Zhilian has delivered more than 15.9 million sets of smart cockpit software solutions and more than 1.55 million integrated software and hardware solutions to customers. As of June 20, the company's smart cockpit solutions have been adopted by about 20% of the approximately 250 domestic automakers.

However, for Siwei Zhilian, if it wants to go further in the capital market, the company may still have many areas worth further optimization. For example, judging from the trend of changes in core financial data, although the company's revenue index in 2024 avoided the dilemma of a sharp decline in the previous year, it seems that at present it can only be said that it is stable; as for profit indicators, the company's net loss is still expanding at this stage, and whether profit expectations can be fulfilled as soon as possible in the future is also expected to be one of investors' core concerns.

Wouldn't it be nice to lean on a big tree to cool off?

The history of Siwei Zhilian can be traced back to 2015. At that time, Siweitu Xinbeijing first acquired 51% of Siwei Zhilian's shares. In 2018, Siweituxin Beijing underwent a business restructuring to split the intelligent network business carried out by Siwei Zhilian Beijing, thereby streamlining its business, core assets, intellectual property rights and main employees. During the restructuring process, Siwei Zhilian Beijing was reorganized into one of the subsidiaries of Siwei Zhilian. The clock was set to 2020, and Nanjing Siwei Zhilian Technology Co., Ltd., the predecessor of Siwei Zhilian, was formally established. In a blink of an eye, in April of this year, the company was restructured as a limited company and completed the name change at the same time.

Zhitong Finance notes that in addition to Siweitu New Group, Siwei Zhilian's shareholder list also includes Didi Technology, MTK, Tencent Mobility, and NIO Capital Fund. It is not hard to imagine that with the “support” of these shareholders in the automotive and technology sector, Siwei Smart Link will receive certain care when it continues to develop business and expand the market. Taking SiWTU New Beijing as an example, the two sides will cooperate in fields including map navigation, chips, integrated smart cockpits and autonomous driving in the future. Coincidentally, the two sides will also sign a strategic cooperation framework agreement with Didi Technology, the second largest shareholder. The two sides will cooperate on Orange TV equipment, and will also jointly explore and develop smart cockpit software solutions in conjunction with the Didi Technology ecosystem.

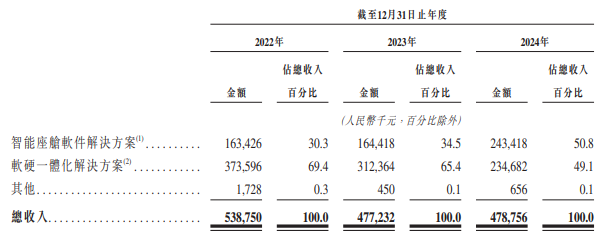

Many celebrity shareholders supported it, but for now, it seems that Siwei Zhilian still has a long way to go to fulfill its performance growth expectations. According to the data, in 2022 to 2024, Siwei Zhilian's revenue was 539 million yuan, 477 million yuan, and 479 million yuan respectively. Looking at the split structure, most of the company's revenue mainly comes from the software and hardware integrated solution business, which accounts for 69.4%, 65.4%, and 49.1% of revenue for each year, respectively. However, it should be noted that in terms of scale, the business is currently in a contraction channel, falling all the way from 374 million yuan in '22 to 235 million yuan in '24. In the same period, the revenue of Siwei Zhilian's smart cockpit software solution business rose steadily, from 163 million yuan in '22 to 243 million yuan in '24. Last year, the revenue share of this business had risen to 50.8%, and “taking over” became the company's largest business.

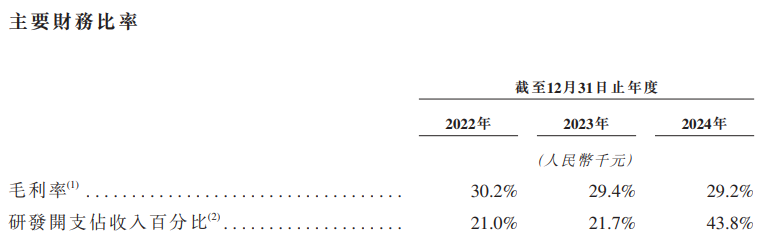

In terms of profit, Siwei Zhilian also has a lot of room for improvement. In 22-24, the company's gross profit was 163 million yuan, 140 million yuan, and 140 million yuan respectively, corresponding to gross profit margins of 30.2%, 29.4%, and 29.2%. At the same time, Siwei Zhilian's net loss is also continuing to expand. It was -204 million yuan, -265 million yuan, and -378 million yuan respectively during the period. There is still no sign of an inflection point.

Are Hong Kong stocks listed to compete with the wave of smart cars?

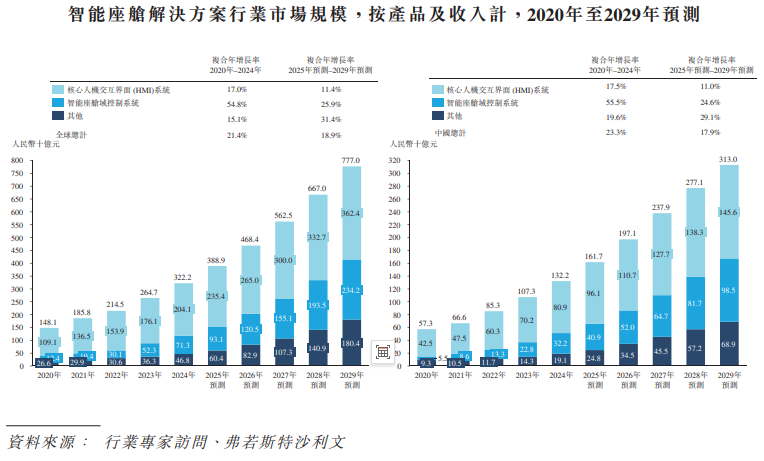

Driven by technological progress, the global smart cockpit solutions industry has evolved from the mechanization stage to the electronic and intelligent stage. Take the domestic market as an example. Thanks to cutting-edge technology, improving the industrial chain and co-catalysis of passenger car market demand, China's smart cockpit solutions industry has developed rapidly. By 2024, the market size in this field reached 132.2 billion yuan, with a compound annual growth rate of 23.3% between 2020 and 2024. According to another forecast, the market size is expected to expand further to 313 billion yuan by 2029.

Although it is a 100 billion dollar market, the competitive pattern in the domestic and even global smart cockpit solutions industry is still quite scattered, and there are no giant Mac companies that have reached the dominant level of market influence. According to the data, the total global market share of the top ten tier-1 suppliers in China's smart cockpit solutions in 2024 is still less than 15%. Among them, the leading company ranked number one has a global market share of only 5.7%.

In the face of a booming but at the same time very fragmented market, seize the opportunity to seize the card slot as soon as possible and take an advantage. Naturally, this is a top priority for Four-Way Smart Connect. This also seems to be true. In recent years, 4Wei Zhilian has continued to increase investment in research and development. In 22-24, the company's R&D expenditure accounted for 21%, 21.7%, and 43.8% of revenue, respectively. In particular, it showed a marked increase in 24. According to information, 4D Smart Link is improving and optimizing the integrated parking solution in a targeted manner based on the SA8155P chip, and added an automatic parking assistance function. At the same time, the company is also planning to fully upgrade the smart cockpit experience based on the high computing capabilities of various chips such as SA8255, SA8775, MT8676, and MT8678. Currently, the company's ongoing R&D projects include multi-screen interaction, 3D real-time HMI, AI panoramic vision and voice interaction, parking memory assistance, and intelligent driving companions.

While not fully capable of autonomous hematopoiesis, Siwei Zhilian is re-investing in R&D to enhance its competitiveness. This may also explain why the company wants to go public as soon as possible. After all, in the midst of such fierce market competition, it is expected that if it can land on the Hong Kong Stock Exchange as desired, it will not only help Siwei Smart Link broaden financing channels and thus meet the needs of subsequent development, but also have a positive effect on the company's further increasing popularity and developing more customers.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal