Undiscovered Gems In Canada With Strong Fundamentals July 2025

As the Canadian market rebounds from a volatile first half of 2025, marked by policy shifts and trade tensions, the TSX has surged to new all-time highs alongside global indices. In this dynamic environment, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and potential growth amidst ongoing uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 11.60% | 32.30% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Pinetree Capital | 0.20% | 63.68% | 65.79% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Andean Precious Metals (TSX:APM)

Simply Wall St Value Rating: ★★★★★★

Overview: Andean Precious Metals Corp. focuses on acquiring, exploring, developing, and processing mineral resource properties in the United States with a market capitalization of CA$485.45 million.

Operations: Andean Precious Metals generates revenue from its operations in the USA and Bolivia, with $132.91 million and $139.99 million respectively. The company's market capitalization is CA$485.45 million.

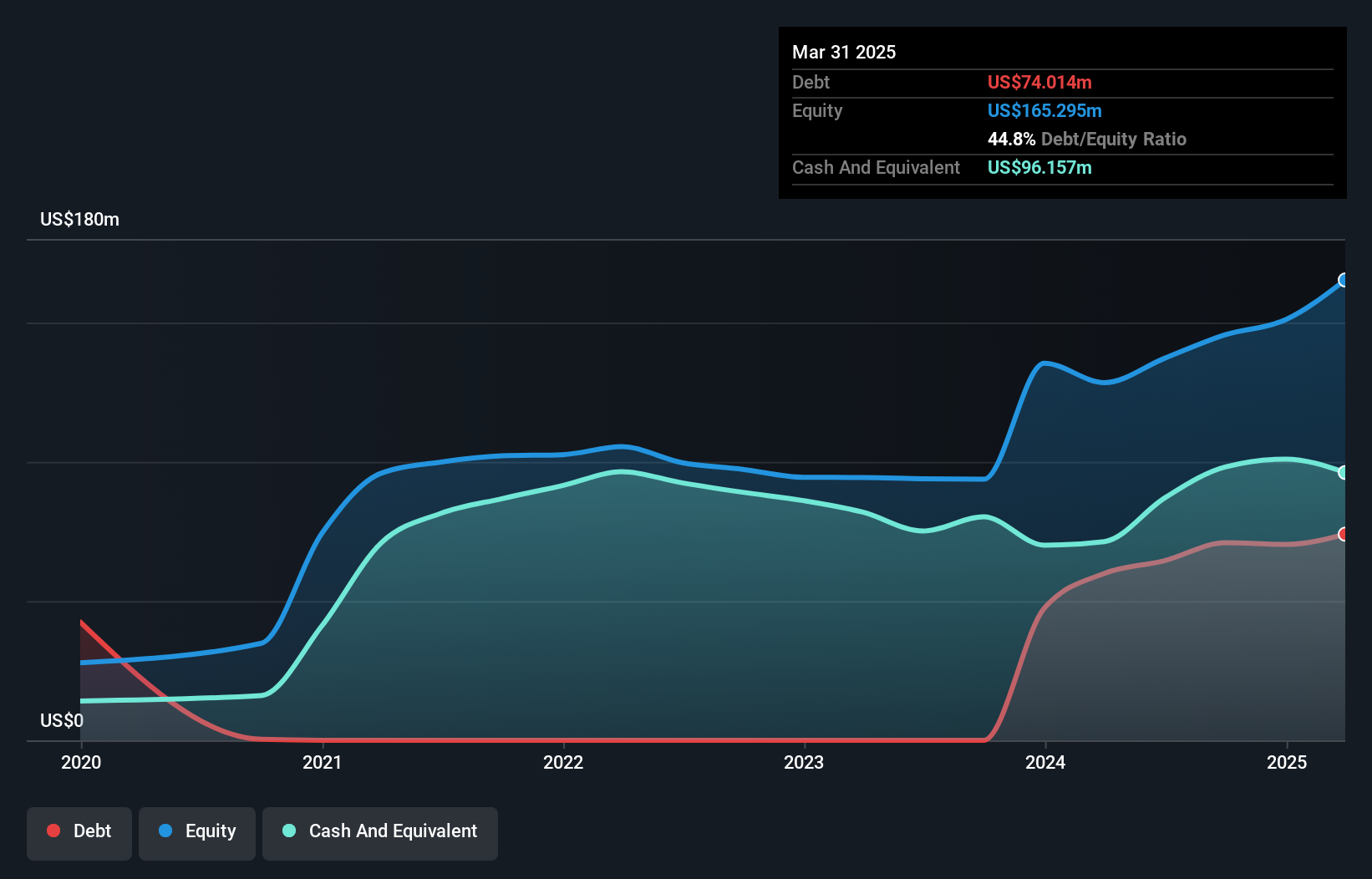

Andean Precious Metals, a notable player in the mining sector, has faced challenges with an 18.6% negative earnings growth compared to the industry average of 37.1%. Despite this, it trades at a significant discount of 90.1% below its estimated fair value and maintains strong interest coverage at 17.6 times EBIT over debt payments. The company recently repurchased shares worth CA$0.98 million and reported Q1 sales of US$61.98 million with net income turning positive to US$14.61 million from a previous loss, reflecting potential for operational improvements amidst ongoing strategic investments and exploration efforts.

TWC Enterprises (TSX:TWC)

Simply Wall St Value Rating: ★★★★★★

Overview: TWC Enterprises Limited owns, operates, and manages golf clubs under the ClubLink One Membership More Golf brand in Canada and the United States with a market capitalization of CA$559.33 million.

Operations: The company's primary revenue streams come from its Canadian Golf Club Operations, generating CA$157.13 million, and US Golf Club Operations, contributing CA$24.58 million.

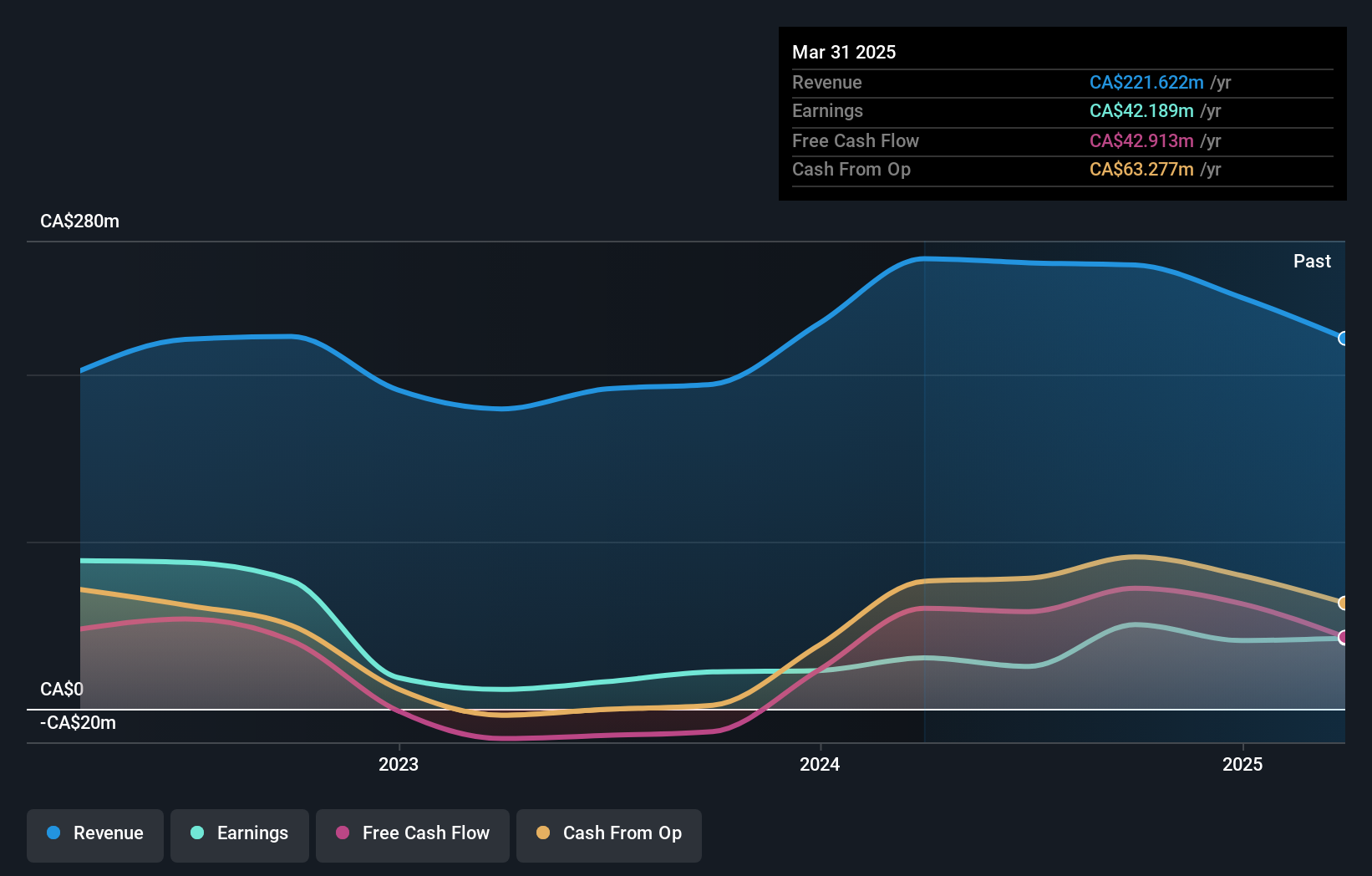

TWC Enterprises, a smaller player in the Canadian market, has shown impressive financial health with earnings growth of 38.4% over the past year, outpacing the Hospitality industry’s -4.5%. Its debt to equity ratio improved significantly from 36.8% to just 4% in five years, reflecting prudent financial management. Despite sales dipping to C$40.76 million from C$65.35 million a year ago, net income turned positive at C$1.08 million compared to a loss previously recorded. Trading at 12% below estimated fair value and offering dividends of C$0.09 per share further underscores its potential as an undervalued asset with strong fundamentals.

- Get an in-depth perspective on TWC Enterprises' performance by reading our health report here.

Evaluate TWC Enterprises' historical performance by accessing our past performance report.

Westshore Terminals Investment (TSX:WTE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Westshore Terminals Investment Corporation operates a coal storage and unloading/loading terminal at Roberts Bank, British Columbia, with a market capitalization of approximately CA$1.69 billion.

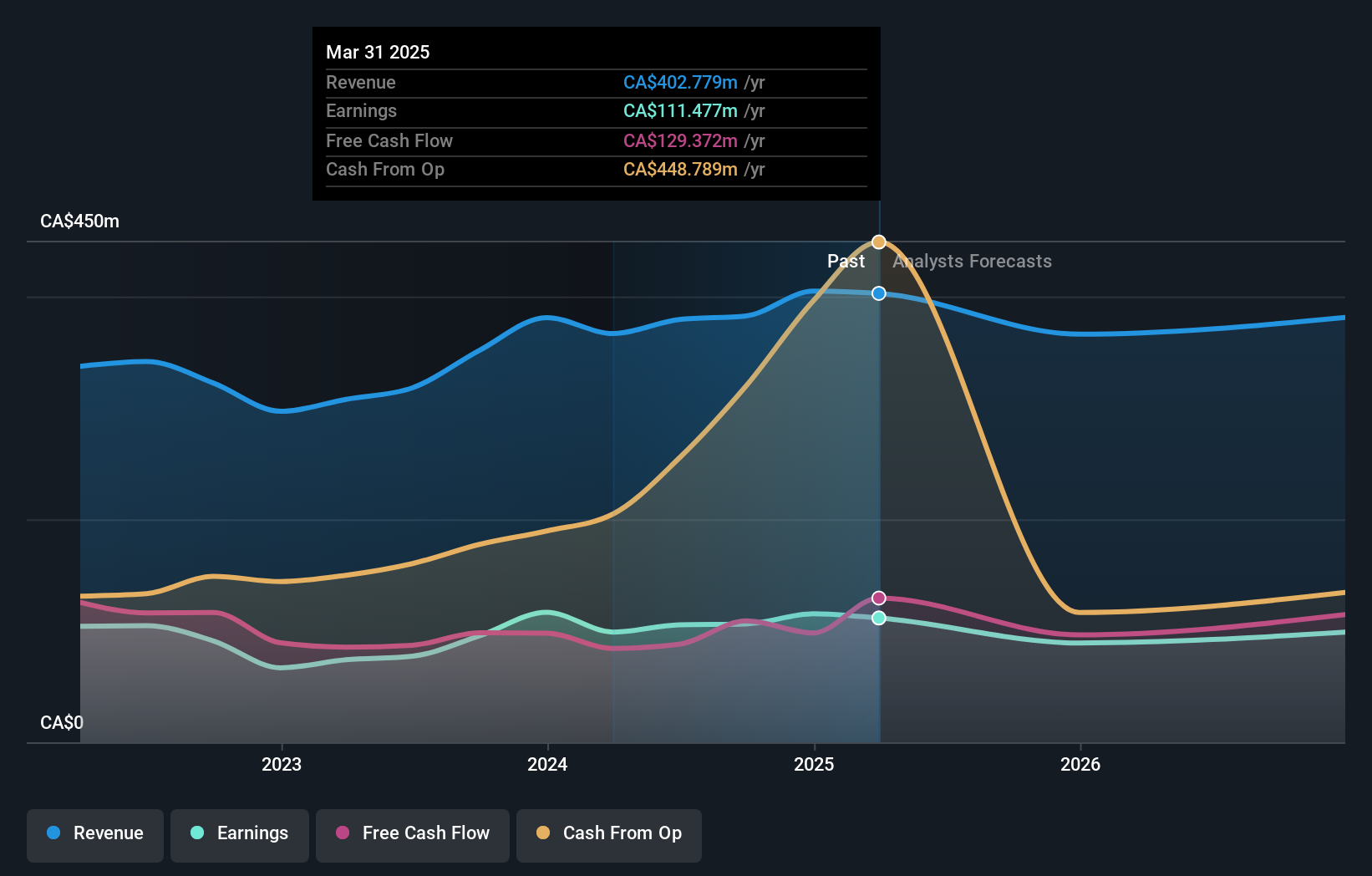

Operations: Westshore generates revenue primarily from its transportation infrastructure segment, totaling CA$402.78 million. The company's financial performance includes a focus on net profit margin trends, which reflect its operational efficiency and cost management strategies.

Westshore Terminals, a Canadian infrastructure player, showcases robust financial health with no debt and impressive earnings growth of 12.7% over the past year, outpacing the industry average of 10.1%. Despite trading at 34.6% below its estimated fair value, future earnings are projected to decline by an average of 6.3% annually over the next three years. Recent executive changes include Glenn Dudar stepping in as CEO and Dallas Ross becoming Chair of the Board following William Stinson's retirement after decades at the helm. The company remains profitable with positive free cash flow and announced a dividend payment of CAD 0.375 per share scheduled for July 15, 2025.

Taking Advantage

- Navigate through the entire inventory of 45 TSX Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal