Rockwell Medical, Inc. (NASDAQ:RMTI) Held Back By Insufficient Growth Even After Shares Climb 25%

Rockwell Medical, Inc. (NASDAQ:RMTI) shareholders have had their patience rewarded with a 25% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

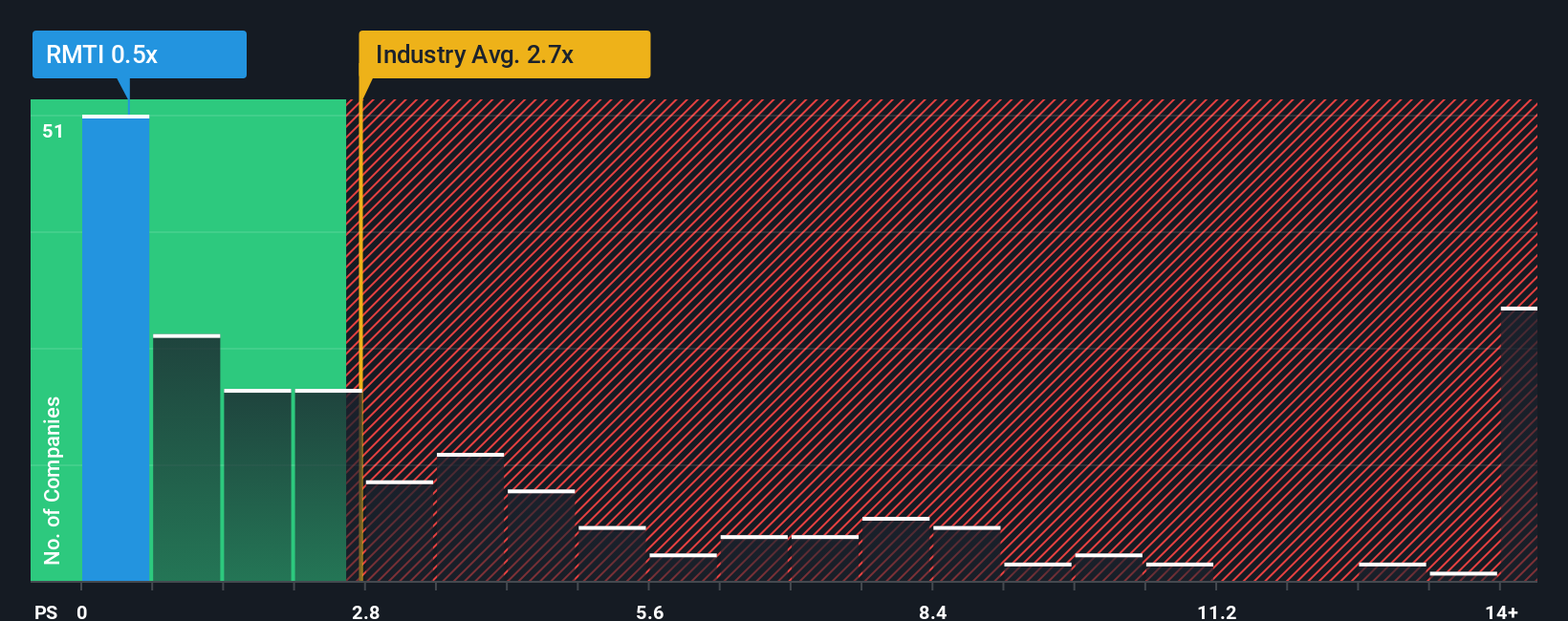

Even after such a large jump in price, Rockwell Medical's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a strong buy right now compared to the wider Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 2.7x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Rockwell Medical

How Rockwell Medical Has Been Performing

Recent revenue growth for Rockwell Medical has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Rockwell Medical will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Rockwell Medical will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Rockwell Medical's to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 56% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 28% over the next year. Meanwhile, the broader industry is forecast to expand by 9.5%, which paints a poor picture.

In light of this, it's understandable that Rockwell Medical's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Rockwell Medical's P/S?

Shares in Rockwell Medical have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Rockwell Medical's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 4 warning signs we've spotted with Rockwell Medical (including 1 which is a bit unpleasant).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal