IPO Foresight | Scanning Almighty Wang continues to contribute more, and the information (688615.SH) “perfected” by AI went to Hong Kong to “fight again”?

After many years of focusing on refining the “Scan the Omnipotent King” merger information (688615.SH), after successfully landing on the Shanghai Stock Exchange Science and Technology Innovation Board at the end of September last year, it has continued to sprint to Hong Kong stocks this year.

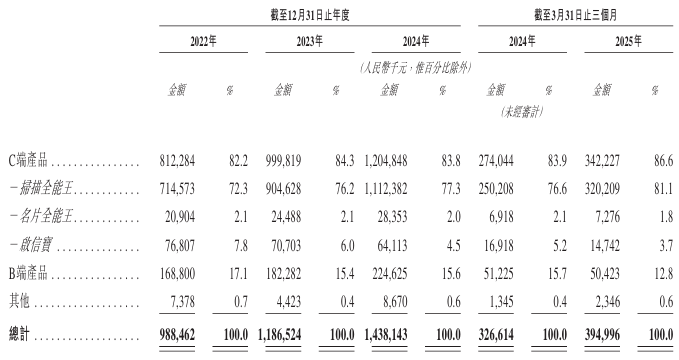

Not long ago, Cooperative Information officially submitted a listing application to the main board of the Hong Kong Stock Exchange. According to the prospectus, among companies with a global C-end efficiency AI product MAU (number of monthly active users) of hundreds of millions in 2024, in terms of revenue from the corresponding products, consolidated information ranked first in the country and fifth in the world. And in a series of product matrices covering the C-side and B-side of Agile Information, the “Scanning Almighty”, the AI product with the largest number of users in the world, naturally deserves to be the company's best product. As far as the most intuitive financial data is concerned, “Scanning King” accounted for 72.3%, 76.2%, and 77.3% of the company's total revenue, respectively. Looking at the results for the first quarter of this year, the product's revenue share further rose to 81.1%. The strong meaning of being strong and strong can be seen.

It is also under the impetus of “Scanning the Omnipotent King,” that the financial data of Hughe Information has been rising steadily over the past few years. Data show that in 22-24, the company's total revenue was 988 million yuan, 1,187 billion yuan, and 1,438 billion yuan, respectively. In the first quarter of this year, Hedge Information's revenue reached 395 million yuan, an increase of 20% over 327 million yuan in the same period last year. The high performance of Kaige, combined with the company's many products and technologies, just involves the AI field, which has received much attention in recent years. It is not surprising that Huahui Information is popular in the capital market. Zhitong Finance will also keep an eye on whether or not Hehe Information can break into the Hong Kong Stock Exchange “while it is hot” in the future.

Leveraging the performance of “Scan Almighty King” to make a comeback

Looking back on the performance of consolidated information, the company's revenue has always mainly come from C-end products. In addition to the “Scan Almighty King” mentioned above, Hehe Information also has two C-end products, Business Card Almighty King and Qi Xinbao. In 22-24, the company's revenue from C-end products accounted for 82.2%, 84.3%, and 83.8%, respectively. In the first quarter of this year, the sector's revenue contribution increased further to 86.6%.

Looking further, the revenue scale of Business Card King increased year by year during the period, from 20.904 million yuan in '22 to 28.353 million yuan in '24. It was 7.276,000 yuan in the first quarter of this year, which is also a slight increase over the same period last year. In the same period, Qi Xinbao's performance was exactly the opposite, shrinking from 76.807 million yuan in '22 to 64.113 million yuan in '24. This year's Q1 was 147.42 million yuan, which continued to decrease by more than 2 million yuan over the same period last year.

It is easy to see from this that the main driving force of the C-end products of Hedge Information has continued to rise in revenue over the years is that the company's flagship product “Scan Almighty” continues to contribute a major increase.

At the same time as C-side products continued to expand, the overall B-side products of Hughe Information also maintained a growth trend. According to reports, the company's B-side products include TextIn, Qixin Insight, etc. Data show that in 22-24, the sector contributed 169 million yuan, 182 million yuan, and 225 million yuan respectively, accounting for 17.1%, 15.4%, and 15.6% of the corresponding revenue, respectively. In addition, the company also derives some of its revenue from other businesses, but the share of revenue is always small.

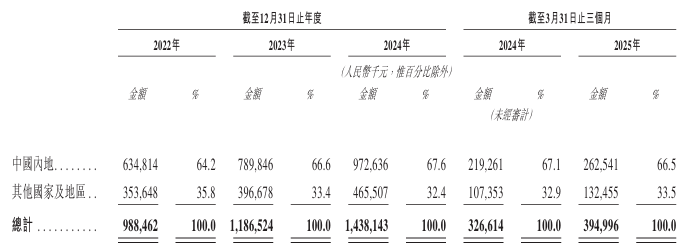

By region, the vast majority of the revenue from Hehe Information came from mainland China. In 22-24, the region accounted for 64.2%, 66.6%, and 67.6% of revenue, respectively. In the same period, although the company's share of revenue from other countries and regions continued to decline, it actually continued to grow in terms of revenue scale, increasing continuously from $354 million in '22 to $466 million in '24.

Also, in terms of profit, the gross profit of consolidated information has also increased in an orderly manner over the years, from 827 million yuan in 22 to 1,212 million yuan in 24, and the corresponding gross margin increased from 83.7% to 84.3%. In the first quarter of this year, the company's gross margin increased further to 85.6%. As gross profit continued to grow, the company's net profit indicators also rose at the same time. They were 284 million yuan, 323 million yuan, and 401 million yuan respectively in 22-24.

Is the pace of unlocking growth potential accelerated with the support of AI?

In recent years, the combination of optical character recognition (OCR) technology and AI has become a new development trend. Under the trend of this era, combined information that already has a first-mover advantage has significantly improved the performance of intelligent text recognition in complex scenarios through the addition of deep learning and natural language processing (NLP) technology. Currently, it has the ability to cope with challenges such as distortion, handwriting, and multi-language recognition, and in a certain sense, it may be said that it has taken the “dividend” of technology.

Judging from quantifiable indicators, it is understood that even in complex scenarios such as multiple languages, multiple layouts, and multiple surfaces, the average character recognition rate of compatible information reached 81.9%, which is significantly ahead of similar products in the market. In the Chinese ID card recognition test, the entry recognition rate of the compatible AI open platform reached 99.6%, which is also higher than comparable products in the market. Moreover, the “King of Scanners” also has a recognition rate of over 90% for ordinary documents and multi-language data sets, difficult data sets, handwritten data sets, and complex scene data sets, which also surpasses many domestic and foreign applications. In addition, in the field of intelligent document processing, integrated information products also have outstanding performance, and also support 52 mainstream languages, and have strong overall market competitiveness.

It is presumably a glimpse into the rapidly changing AI technology that has unlimited commercial application prospects, and it is still planning to increase investment in this field in the future. For example, on the basis of standardized AI products such as TextIn that have already been launched, Coaltech Information is also actively developing new functions, including RPA (Robotic Process Automation, Robotic Process Automation) /Agent (Agent), to enhance automated processing capabilities for complex documents.

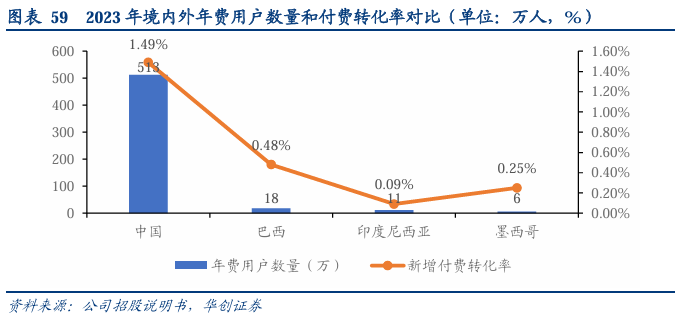

The overseas market, which has broad prospects for development, may be one of the company's next priorities for cooperation, for which it has already obtained quite competitive cooperation information. According to information, by the end of last year, the “King of Scanners” had covered more than 200 countries and regions around the world, but in emerging markets such as Brazil, Indonesia, and Mexico with a large population base and rapid digital economy, the monthly active payment conversion rate is still less than 1/4 of China, and its huge potential has yet to be unleashed. In response, Hehe Information is planning to establish a global technical support center to provide customers with comprehensive services covering pre-sales, in-sales and after-sales services, including product upgrades and technical training. At the same time, the company is actively expanding its global marketing network, building a localized sales and service system, and planning to enhance brand influence through new media operations.

From its establishment in 2006, to landing on the Science and Technology Innovation Board as desired last year, to now setting its sights on the Hong Kong stock market, the growth path of Align Information certainly has elements of its own efforts, but it is also “aided” by the external environment. Faced with the growing wave of AI, Syndication has taken a stand. However, the merger information “incense” of AI technology will later be interpreted in the Hong Kong stock market. This is definitely worth looking forward to.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal