Asian Growth Companies With High Insider Ownership In July 2025

As global markets experience mixed performances, with the U.S. indices hitting record highs and Asian markets showing varied trends, investors are increasingly focused on identifying growth opportunities in Asia that align with current economic conditions. In this context, companies with high insider ownership often attract attention due to the confidence insiders have in their business prospects, making them an interesting focus for those seeking potentially resilient growth stocks in a fluctuating market environment.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 25.7% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 94.4% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 41.8% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

We're going to check out a few of the best picks from our screener tool.

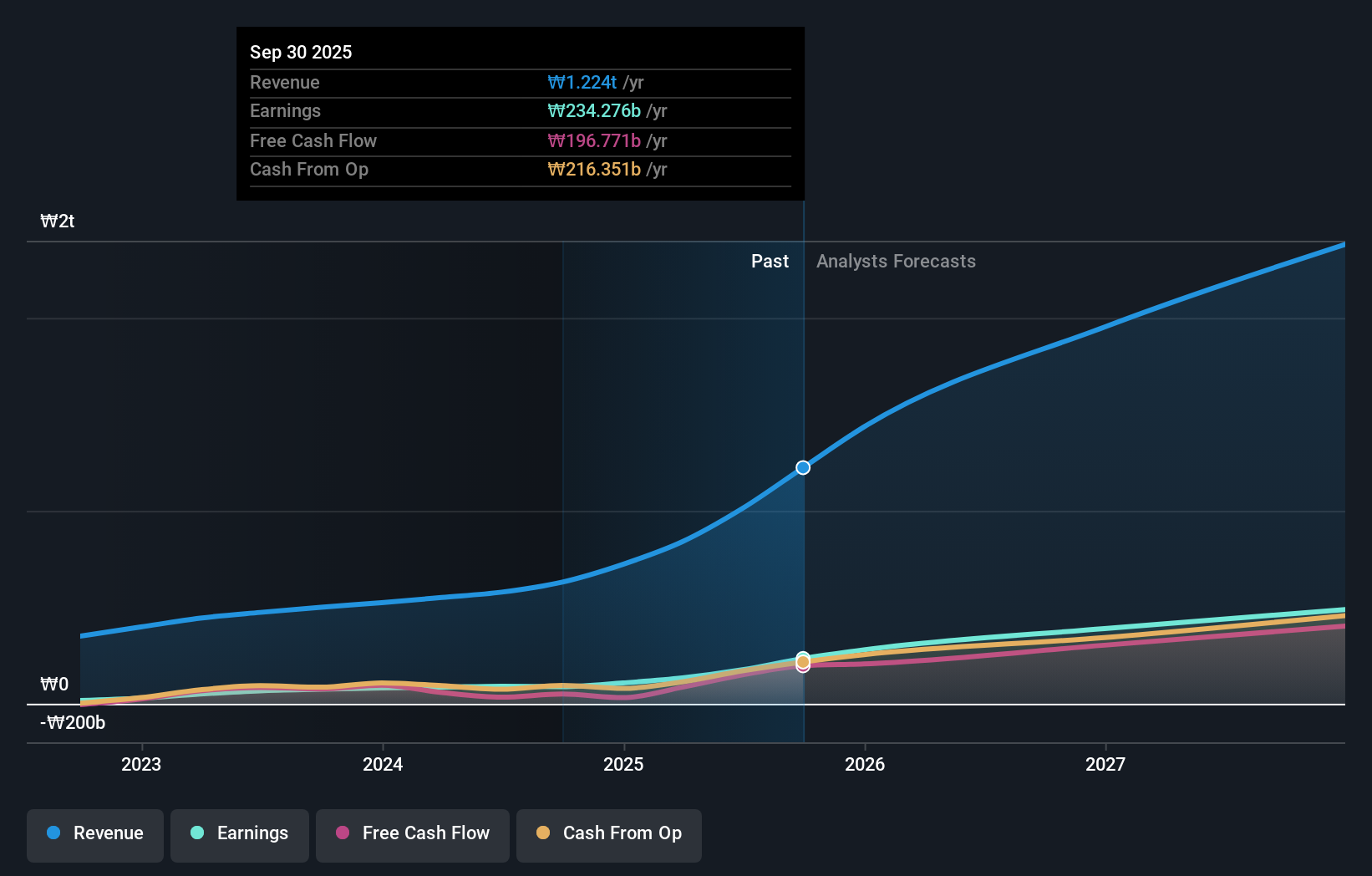

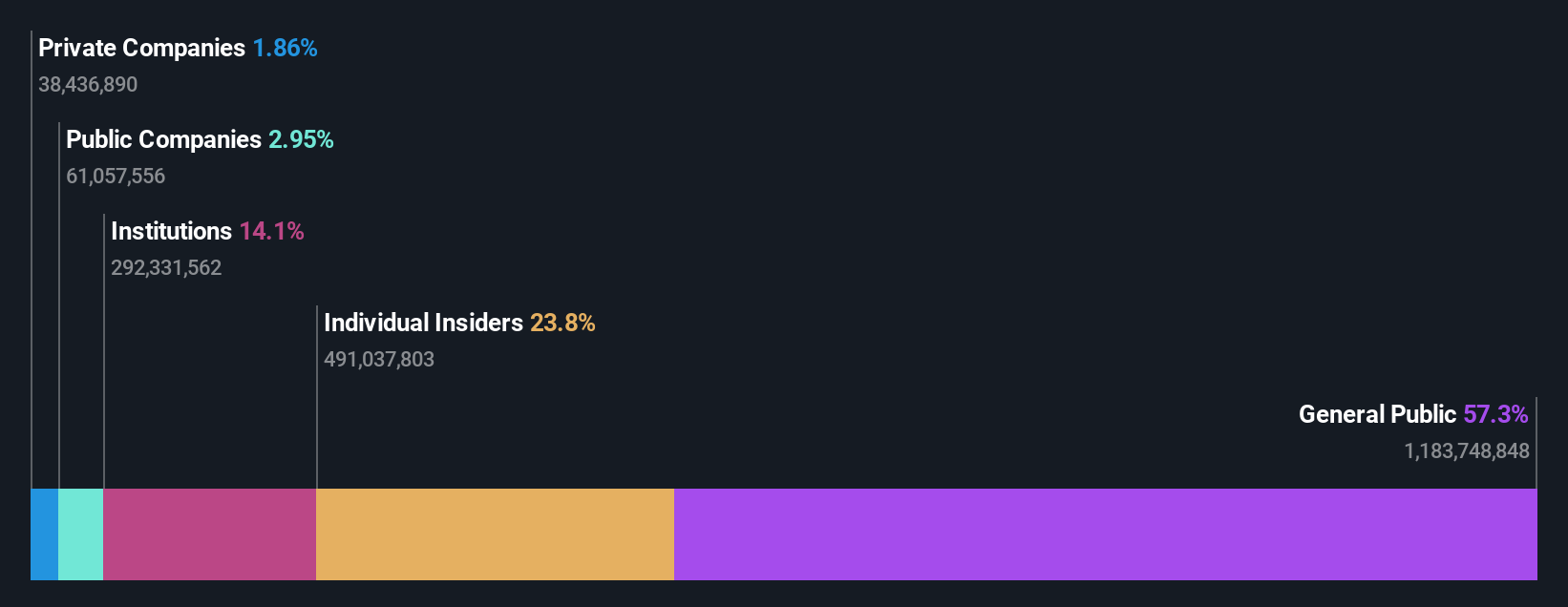

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★★

Overview: APR Co., Ltd is a company that manufactures and sells cosmetic products for both men and women, with a market cap of ₩6.11 trillion.

Operations: The company's revenue is primarily derived from the Cosmetics Sector at ₩1 billion and the Clothing Fashion Sector at ₩49.44 million.

Insider Ownership: 33.2%

Revenue Growth Forecast: 28.2% p.a.

APR Co., Ltd. is positioned for robust growth, with earnings expected to rise 29.9% annually, outpacing the Korean market's 21%. Despite recent share price volatility, it trades at a 27% discount to its estimated fair value. The company completed a buyback of shares worth KRW 30 billion, enhancing shareholder value. Revenue is projected to grow at 28.2% per year, significantly faster than the market average of 6.6%, supported by high-quality earnings and strong return on equity forecasts at 39.3%.

- Click here and access our complete growth analysis report to understand the dynamics of APR.

- According our valuation report, there's an indication that APR's share price might be on the expensive side.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Doushen (Beijing) Education & Technology is a company focused on educational technology operations, with a market cap of CN¥18.31 billion.

Operations: The company's revenue from Information Technology Service amounts to CN¥755.62 million.

Insider Ownership: 24.1%

Revenue Growth Forecast: 52.9% p.a.

Doushen (Beijing) Education & Technology is poised for substantial growth, with revenue and earnings projected to increase significantly above the China market average. Despite a recent decline in annual sales and revenue, net income surged to CNY 137.13 million. However, auditors have expressed concerns about its ability to continue as a going concern. The company's high insider ownership could align management interests with shareholders, potentially fostering long-term value creation amidst these challenges.

- Get an in-depth perspective on Doushen (Beijing) Education & Technology's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Doushen (Beijing) Education & Technology shares in the market.

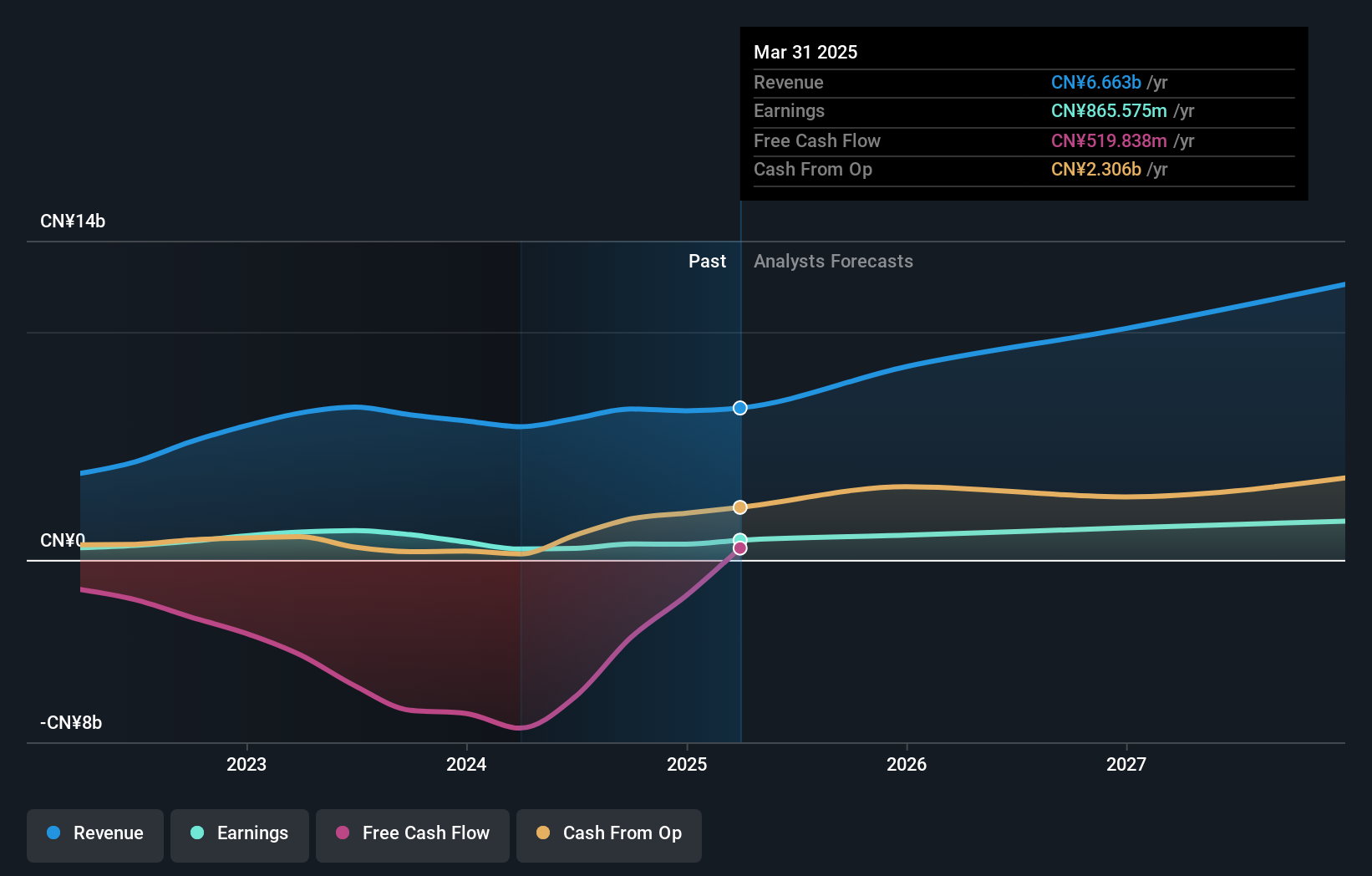

Ginlong Technologies (SZSE:300763)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ginlong Technologies Co., Ltd. is involved in the research, development, production, service, and sale of string inverters globally and has a market cap of CN¥25.13 billion.

Operations: Ginlong Technologies Co., Ltd. generates revenue through the global research, development, production, service, and sale of string inverters.

Insider Ownership: 38.2%

Revenue Growth Forecast: 20.7% p.a.

Ginlong Technologies is experiencing robust growth, with earnings and revenue forecast to significantly outpace the China market. Despite a high level of debt, its price-to-earnings ratio suggests good value relative to peers. Recent financial results showed a substantial increase in net income to CNY 194.7 million for Q1 2025, reflecting strong operational performance. High insider ownership might align management objectives with shareholder interests, potentially supporting sustained growth and value creation over time.

- Navigate through the intricacies of Ginlong Technologies with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Ginlong Technologies is trading behind its estimated value.

Turning Ideas Into Actions

- Unlock our comprehensive list of 605 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal