Asian Growth Companies With High Insider Ownership In July 2025

As of July 2025, Asian markets are navigating a complex landscape marked by mixed economic signals and evolving trade dynamics, particularly with the backdrop of recent developments in U.S.-Asia trade negotiations. In this environment, growth companies with high insider ownership can be appealing as they often indicate strong confidence from those closest to the business, potentially aligning well with investor interests seeking stability and growth amidst broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 25.7% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 94.4% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 41.8% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

We'll examine a selection from our screener results.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces, sells, and trades solar glass products across Mainland China, the rest of Asia, North America, Europe, and internationally with a market cap of HK$26.42 billion.

Operations: The company's revenue is primarily derived from the sales of solar glass, amounting to CN¥18.82 billion, and its solar farm business, including EPC services, which contributes CN¥3.02 billion.

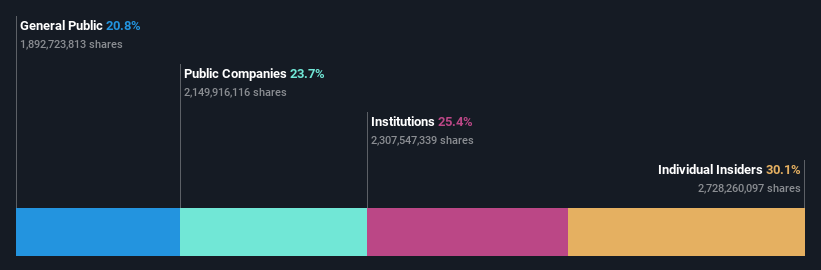

Insider Ownership: 26.8%

Xinyi Solar Holdings demonstrates strong insider confidence with substantial insider buying and no significant selling in recent months. The company is trading at a significant discount to its estimated fair value, suggesting potential upside. Despite a low forecasted return on equity, earnings are expected to grow significantly at 33.6% annually, outpacing the Hong Kong market. Recent issuance of RMB 800 million Panda Bonds strengthens its financial position, though profit margins have decreased compared to last year.

- Navigate through the intricacies of Xinyi Solar Holdings with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Xinyi Solar Holdings' current price could be quite moderate.

Quzhou Xin'an Development (SHSE:600208)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quzhou Xin'an Development Co., Ltd. operates in real estate development, technology manufacturing, and financial services in China, with a market cap of CN¥25.59 billion.

Operations: Quzhou Xin'an Development Co., Ltd. generates revenue through its operations in real estate development, technology manufacturing, and financial services within China.

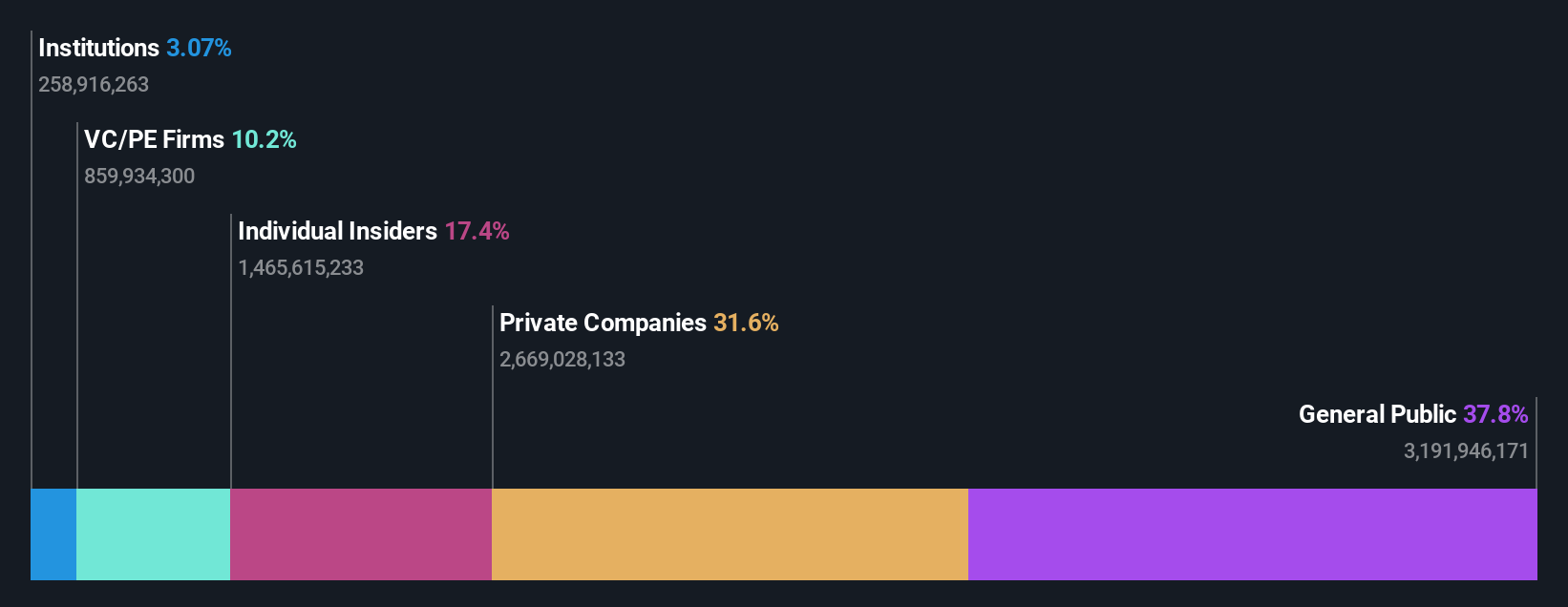

Insider Ownership: 17.4%

Quzhou Xin'an Development is poised for robust growth with forecasted revenue and earnings expected to grow significantly, outpacing the broader Chinese market. Trading at a favorable price-to-earnings ratio of 24x compared to the market's 39.7x, it offers good relative value. Despite a substantial drop in first-quarter sales to CNY 344.89 million from CNY 2,243.24 million last year, net income increased to CNY 423.95 million, indicating strong profitability potential amidst insider stability without recent significant trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Quzhou Xin'an Development.

- According our valuation report, there's an indication that Quzhou Xin'an Development's share price might be on the cheaper side.

Novoray (SHSE:688300)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Novoray Corporation supplies industrial powder materials for diverse applications both in China and internationally, with a market cap of CN¥12.23 billion.

Operations: The company generates revenue from the manufacturing of non-metallic mineral processing products, amounting to CN¥996.77 million.

Insider Ownership: 23.6%

Novoray demonstrates strong growth potential with forecasted earnings expected to rise significantly at 24.04% annually, outpacing the Chinese market's 23.3%. The company's Q1 2025 performance showed a revenue increase to CNY 238.69 million and net income improvement to CNY 63.04 million, reflecting solid financial health. Despite no recent insider trading activity, high insider ownership could align management interests with shareholders, supporting long-term growth strategies amidst competitive market conditions in Asia.

- Dive into the specifics of Novoray here with our thorough growth forecast report.

- According our valuation report, there's an indication that Novoray's share price might be on the expensive side.

Next Steps

- Access the full spectrum of 607 Fast Growing Asian Companies With High Insider Ownership by clicking on this link.

- Seeking Other Investments? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal