Expectations for interest rate cuts have taken a sharp turn! “Term premiums” hovered in the market, and US debt bulls staged a “major retreat”

The Zhitong Finance App learned that since last week, global treasury bond futures traders have been removing some large bullish bets on the US treasury bond market. After the unexpectedly strong non-farm payrolls report was released last week, as Trump sent a letter to various countries this week threatening further tariff increases and the prospects for inflation faced significant uncertainty, global traders' expectations for the Fed's interest rate cut can be described as having cooled down sharply.

Furthermore, the government budget deficit may expand drastically after the passage of the “Big and Beautiful” bill led by Trump, and the bond market spillover effects brought about by the turbulence in government spending expectations brought about by the Japanese Senate election and the sharp rise in Japanese long-term treasury yields. These factors have all increased the continued upward pressure on recent US Treasury yields. In particular, the 10-year US Treasury yield, which has been the “anchor of global asset pricing,” and the yield on longer-term US bonds may move towards a significant upward trajectory, putting innovative global stock markets that have been rising rapidly and repeatedly.

Prior to the release of strong non-farm payrolls data last Thursday, traders established a large number of long positions in the US treasury bond market. It is generally expected that weak employment data will strengthen the Fed's interest rate cut logic and make the July interest rate cut path more clear, but this is not the case.

However, as these dovish expectations were quickly overturned, futures traders' exposure to US debt — that is, the number of open contracts — has declined rapidly over the past few trading days. Deleveraging is having an extremely severe profit squeeze effect on US Treasury bonds. The changes are mainly focused on futures contracts linked to 5-year and 10-year US Treasury bonds, as well as longer-term 30-year US bonds.

After the release of non-agricultural data, 10-year US bond futures experienced large-scale liquidation, which is rare in history. Statistics show that on Thursday alone, contracts relating to 10-year US Treasury bonds had a risk exposure of approximately $5 million per base point. This is roughly equivalent to traders selling off 10-year US Treasury bonds worth about 7 billion US dollars in total.

Non-agricultural agriculture is strong, and the combination of “term premiums” that discourage the market is coming

The global treasury bond market came under pressure again this Tuesday, mainly due to a massive decline in global demand for long-term sovereign bonds due to a sharp rise in Japan's long-term treasury bond yields and the “big and beautiful” bill. The so-called “term premium” has returned to the spotlight — meaning that expectations of interest rate cuts are temporarily unable to dominate market trading logic due to rapid cooling. The market is beginning to worry about the spillover effects brought about by the sharp rise in Japanese long-term treasury bond yields. Governments rely too much on long-term bond financing, and are in turn demanding higher long-term treasury bond yields.

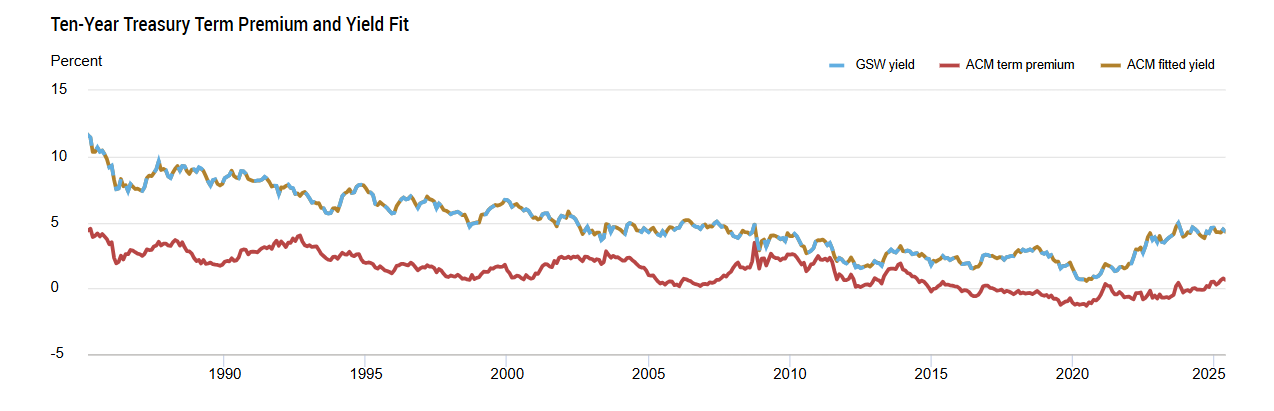

The 10-year US Treasury maturity premium, which measures investors' concerns about the size of Washington's huge future loans, continues to hover at its highest level since 2014.

The huge issuance of treasury bonds during the Biden administration drastically boosted the size of US Treasury bonds to 36 trillion US dollars in just a few years. This also caused the Treasury's budget deficit to rise and US debt interest expenses to repeatedly reach new highs. With the passage of the “Big and Beautiful” bill, which will cause even larger deficits, US bond yields of various matures may continue to boom in 2025. In particular, the yield on longer-term US bonds (10 years and more) may continue to break through many historical highs over decades under the impetus of “maturity premiums.”

The so-called term premium refers to the amount of foreign bond yield compensation required by investors to hold the risk of long-term bonds. According to some economists, the treasury debt and budget deficit in the Trump 2.0 era will be much higher than official forecasts, mainly due to the new Trump administration's economic growth and protectionist framework centered on “internal tax cuts+external tariffs”, compounded by the increasingly huge budget deficit, interest on US debt, and military and defense spending. The scale of debt issued by the US Treasury may be forced to expand more and more during the “Trump 2.0 era”. Coupled with “anti-globalization”, China and Japan may drastically reduce their holdings of US debt, and a “maturity premium” is inevitable. The data is higher than before.

“Strong non-farm payrolls data caused the market to drop expectations of interest rate cuts in July to almost zero. Recently, US debt bulls are undoubtedly under pressure, leading to lower prices due to clearance behavior,” Citibank strategist David Bieber (David Bieber) wrote in a report.

However, he added that as yields rise, the tactical position on US Treasury bonds “remains at a bullish level,” but recent long bets are now in a state of significant loss. According to statistics released by the US Commodity Futures Trading Commission (CFTC) this Monday, asset management institutions' bullish positions in 5-year and 10-year US Treasury futures have risen and are currently at record bullish levels.

As the “term premium” haze that has discouraged the market continues to hover over the treasury bond market, the upcoming issuance of up to 39 billion US dollars of 10-year US Treasury bonds and 22 billion US dollars of 30-year US Treasury bonds on Wednesday and Thursday may further squeeze the majority of US Treasury bonds concentrated in the long-term region, especially if signs of weak demand appear. Short-term US bonds are still favored by the market. This also shows that the US bond yield pattern is seriously divided due to “term premiums.” According to information, the 3-year treasury bond auction performance of up to 58 billion US dollars on Tuesday was more steady than expected.

The following is an overview of the latest position indicators in the US bond and interest rate market:

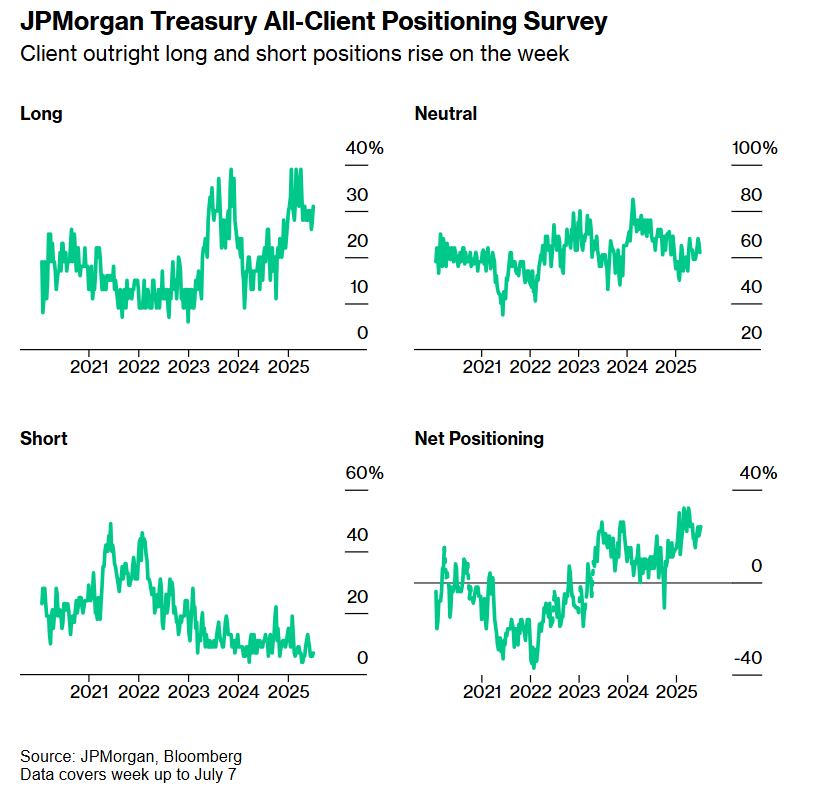

J.P. Morgan US Treasury Client Survey

According to J.P. Morgan Chase's survey data, during the week ending July 7, customers in the cash market increased their long and short positions at the same time. Net long positions in the US Treasury bond market are the highest since June 16, although direct short positions have reached their highest level in a month.

J.P. Morgan US Treasury Bonds All-Client Positions Survey — Direct long and short customer positions have risen this week

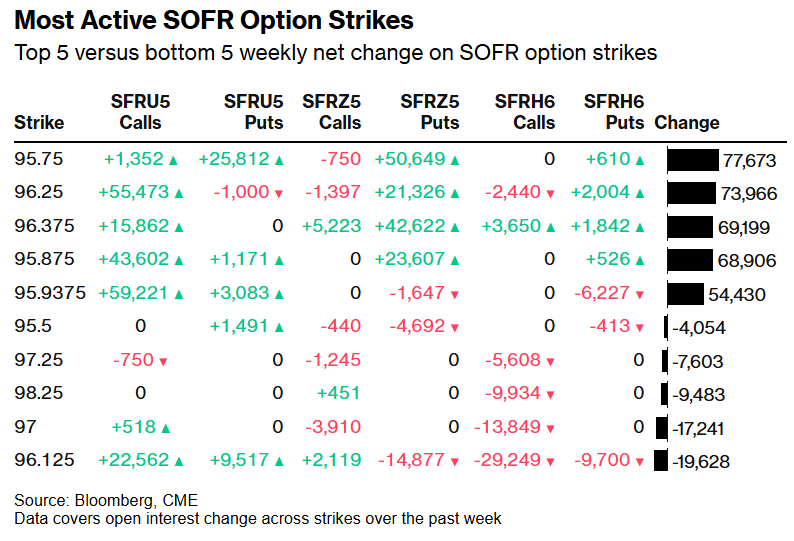

Most active SOFR options

In the SOFR options market before the expiration date in March 2026, a transaction dominated a sharp change in this week's unclosed contracts, that is, large purchases of the 96.375/96.25/95.875/95.75 bearish combination in December 2025. This position reflects the market's bet that the Federal Reserve may keep the benchmark interest rate unchanged during the next four FOMC meetings. This judgment contradicts the current market's expectations that interest rates will be cut twice by a cumulative total of 50 basis points during the next four FOMC meetings. Another major buyer bought a bullish combination of 95.875/95.9375/96.00/96.125 in September 2025, exacerbating new position changes in the past week.

The most active SOFR option execution price - the top five and bottom five SOFR option execution prices based on weekly net changes

The chart shows that the volume of “put condor” contracts surged in December 96.375, 96.25, 95.875, and 95.75 (large purchases of put combinations). This is a strategy that favors conservative interest rate trends, that is, it is expected that the Federal Reserve will maintain a policy of not cutting interest rates until the end of the year. This SOFR combination will reap the greatest benefits after the FOMC interest rate meeting, but the chart shows that the market is clearly betting that “the Federal Reserve will maintain policy suspension,” which is the exact opposite of the 50 basis point interest rate cut path that the market had previously bet on.

SOFR options are beginning to show signs of a heavy condor strategy, which is a financial expression of the market's expectation that the Federal Reserve “step back in place”. In other words, some options buyers are planning to fight against interest rate cuts and tough betting policies. This expectation is similar to Wall Street bank Morgan Stanley's interest rate cut expectations. Malaysian economists recently predicted that the Federal Reserve would not choose to cut interest rates in 2025, maintain the expectation that core PCE inflation will rise to 3.5% before the end of the year, and predict that Trump's tough immigration policy will push the labor force growth rate to maintain its position, thereby making the labor market continue to be tight.

The US bond market had previously accumulated a large number of long positions, yet non-agricultural and macroeconomic data “punched” expectations of interest rate cuts, and the sharp rise in yield on Japanese long-term treasury bonds, uncertainty about tariff policies, and the budget deficit expansion path brought about by the “Big and Beautiful” Act all fueled a comeback of the “term premium” — continuing to hit the highest level since 2014, and the 10-year US bond yield rapidly climbed upward. The SOFR options market allocation and yield trends are also showing consistent signs — betting on interest rate cuts is expected to burst and yield to rebound.

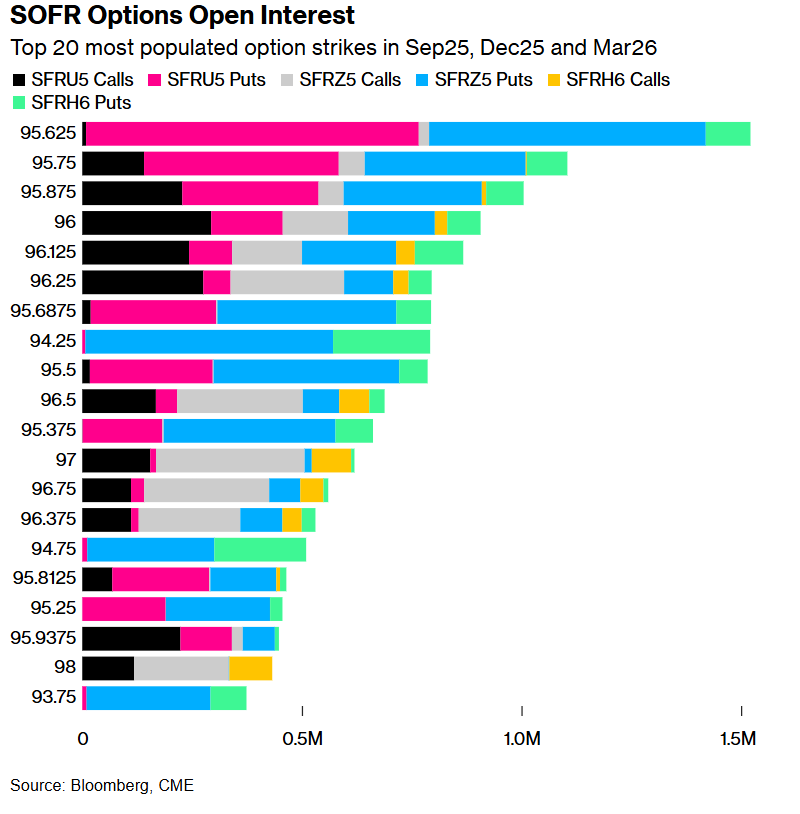

SOFR options heatmap

The execution price of 95.625 is the most popular option for September, December, and March 2026, including a large number of put options for September and December 2025. Other more active execution prices include 95.75 and 95.875, with put options prominent in September 2025. SOFR's recent capital flows include upward and downward protective bets after the release of strong non-farm payrolls data.

SOFR Options Open Positions — Execution Prices for the Top 20 Most Active Options in September, December, and March 2026

The chart highlights “Dec25 96.375/96.25/95.875/95.75 put condor” — that is, heavy purchases of Dec25-related selling combinations, with the goal of locking in the 95.75-96.375 range. This indicates that some traders expect that the Fed will not choose to cut interest rates until the end of the year, implying that expectations are close to zero relaxed expectations. The heat chart shows that most positions are concentrated at 95.625, 95.75, and 95.875. These points mainly have a large amount of selling power, indicating that some traders are actively hedging the downside and locking in interest rates will not decline significantly. These concentrated positions clearly show that some traders have a high level of confidence that “the Federal Reserve will continue to maintain its policy unchanged.”

US Treasury bond option bias

After the US Treasury bond market weakened last Thursday and this Monday, the bias in options for long-term bond futures turned bearish, indicating that traders are once again willing to pay a premium to hedge against bond sell-offs rather than increases. In the US Treasury options market, recent liquidity trends include an 8 million dollar empty volatility transaction (achieved through cross-option sales) and a 32 million dollar premium transaction, which is betting that the bond market may soon experience a larger rebound.

CFTC futures positions

Prior to the release of non-farm payroll data last week, traditional asset management institutions' long positions in US Treasury futures rose rapidly, especially when they recorded the highest net long positions in history in 5-year and 10-year treasury bonds, and also included ultra-long-term 10-year treasury bond futures, indicating that rising yields led traditional asset management institutions to gradually increase the size of US bond asset allocation.

According to CFTC data as of July 1, asset managers increased their net term long positions equivalent to 10-year treasury futures by about 582,000 contracts during the week, the biggest weekly increase since April 2024. In contrast, hedge funds are aggressively bearish on US bonds, and they have added about 148,000 net term short positions equivalent to 10-year US Treasury futures.

The upward trend in the “anchor of global asset pricing” is not conducive to the expansion of risk asset valuations such as stocks

Since this year, investors in US debt have generally felt pressured by concerns about US inflation caused by the Trump administration's global trade war and the increasing pressure on the US debt.

In particular, in anticipation of a massive expansion of the US government budget deficit, which continues to exist in the US bond market, and pessimistic expectations of increasingly huge US debt, bond traders are beginning to demand higher “term premiums.” As a result, the 10-year US Treasury yield has continued to hover above 4.5% this year, and recently it has continued to move from a relatively low level of 4.2% to a 4.5% yield during the year, putting a huge pressure on the valuation of risky assets such as stocks. If the 10-year US Treasury yield is 4.5% or even 5%, it will undoubtedly be an important suppressing force for the MSCI global stock market benchmark stock index and the S&P 500 index, which have recently reached new highs, especially for highly valued technology stocks closely related to artificial intelligence.

From a theoretical perspective, the 10-year US Treasury yield is equivalent to the risk-free interest rate indicator r on the denominator side of the DCF valuation model, an important valuation model in the stock market. Other indicators (especially the molecular side's cash flow expectations) have not changed significantly — for example, during the earnings season, the molecular side is in a vacuum due to a lack of active catalysts. At this time, if the denominator level is higher or continues to operate at historically high levels, the valuations of risky assets such as technology stocks, high-yield corporate bonds, and cryptocurrencies with historically high valuations are facing a trend of collapse.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal