3 UK Stocks Estimated To Be Up To 42.2% Below Intrinsic Value

In the wake of recent global economic challenges, particularly the faltering trade data from China, the UK market has seen its blue-chip FTSE 100 index close lower as companies closely tied to China's fortunes face increased pressure. Amidst this backdrop, identifying undervalued stocks becomes crucial for investors seeking opportunities in a volatile environment where intrinsic value may not be fully reflected in current market prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topps Tiles (LSE:TPT) | £0.38 | £0.7 | 45.5% |

| TBC Bank Group (LSE:TBCG) | £47.45 | £93.06 | 49% |

| Moonpig Group (LSE:MOON) | £2.11 | £4.00 | 47.3% |

| Marlowe (AIM:MRL) | £4.40 | £8.35 | 47.3% |

| LSL Property Services (LSE:LSL) | £3.22 | £5.96 | 45.9% |

| Informa (LSE:INF) | £8.11 | £15.09 | 46.3% |

| Gooch & Housego (AIM:GHH) | £6.15 | £11.22 | 45.2% |

| Burberry Group (LSE:BRBY) | £12.56 | £23.89 | 47.4% |

| Benchmark Holdings (AIM:BMK) | £0.246 | £0.45 | 44.9% |

| AstraZeneca (LSE:AZN) | £102.18 | £188.70 | 45.9% |

Let's take a closer look at a couple of our picks from the screened companies.

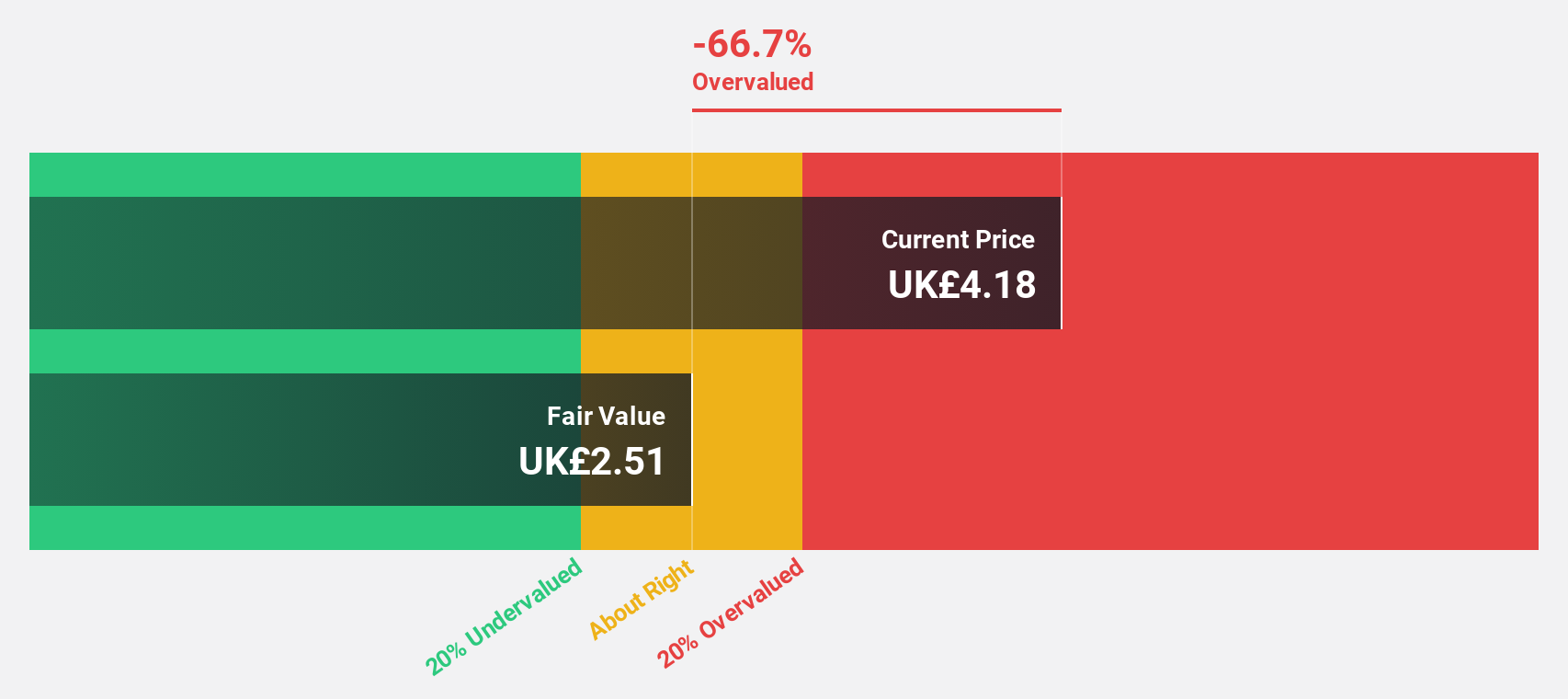

Barratt Redrow (LSE:BTRW)

Overview: Barratt Redrow plc operates in the housebuilding industry within the United Kingdom and has a market capitalization of approximately £5.99 billion.

Operations: The company generates revenue primarily from its housebuilding segment, amounting to £4.60 billion.

Estimated Discount To Fair Value: 42.2%

Barratt Redrow is trading at £4.21, significantly below its estimated fair value of £7.27, indicating it may be undervalued based on discounted cash flows. However, profit margins have declined from 5% to 2.6%, and the dividend yield of 4.11% is not well covered by earnings or free cash flows. Despite these challenges, earnings are forecast to grow significantly at 32.9% annually over the next three years, outpacing UK market growth expectations.

- Our comprehensive growth report raises the possibility that Barratt Redrow is poised for substantial financial growth.

- Dive into the specifics of Barratt Redrow here with our thorough financial health report.

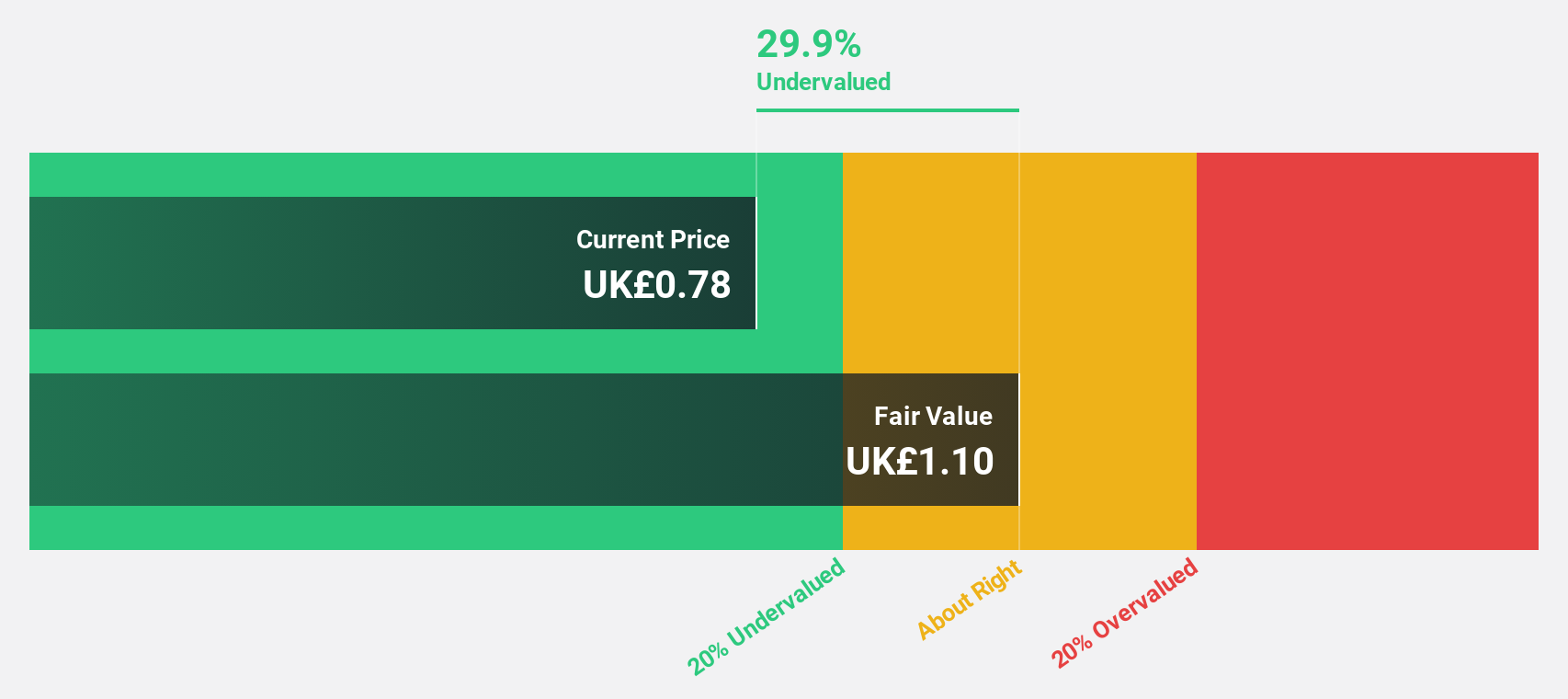

Coats Group (LSE:COA)

Overview: Coats Group plc is a global company involved in manufacturing threads, structural components for apparel and footwear, and performance materials, with a market cap of £1.27 billion.

Operations: The company's revenue segments consist of $769.80 million from apparel, $403.50 million from footwear, and $327.60 million from performance materials.

Estimated Discount To Fair Value: 30.1%

Coats Group is trading at £0.80, below its estimated fair value of £1.14, highlighting potential undervaluation based on cash flows. Despite revenue growth projections trailing the UK market, earnings are expected to grow significantly at 21.2% annually, surpassing market expectations. However, debt coverage by operating cash flow remains a concern and large one-off items affect financial results. Recent board changes include Wu Gang's appointment as Non-Executive Director, potentially enhancing strategic direction with his extensive investment banking experience.

- According our earnings growth report, there's an indication that Coats Group might be ready to expand.

- Click here to discover the nuances of Coats Group with our detailed financial health report.

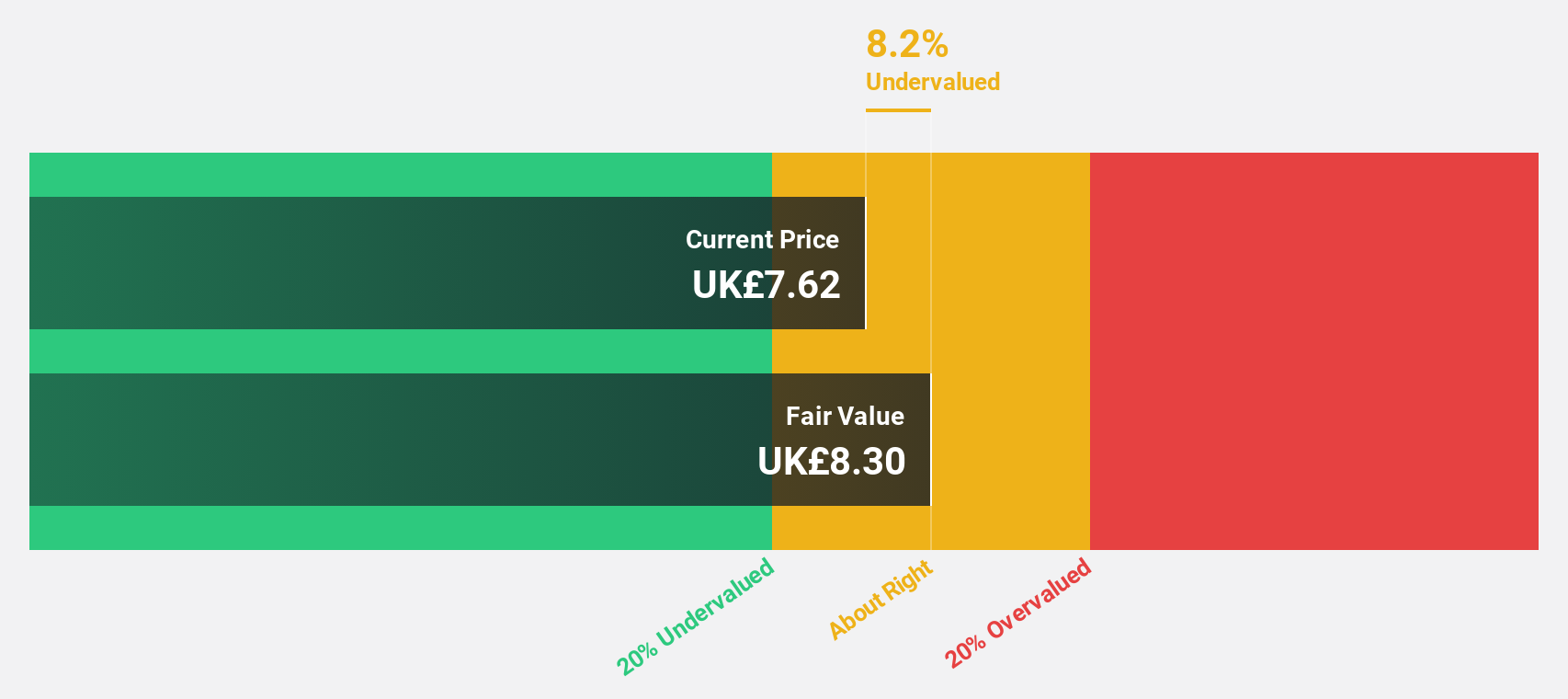

Kainos Group (LSE:KNOS)

Overview: Kainos Group plc provides digital technology services across the UK, Ireland, North America, Central Europe, and internationally with a market cap of approximately £886.20 million.

Operations: Kainos Group's revenue is primarily derived from Digital Services (£197.17 million), Workday Products (£71.35 million), and Workday Services (£98.72 million).

Estimated Discount To Fair Value: 15.9%

Kainos Group, currently priced at £7.29, trades below its estimated fair value of £8.67 by 15.9%, suggesting undervaluation based on cash flows. Although earnings growth is forecasted at 16.9% annually, outpacing the UK market's 14.5%, revenue growth remains modest at 7.1%. Recent financials show a decline in net income to £35.56 million from £48.72 million year-on-year, while a recent share buyback program worth £30 million indicates confidence in long-term value creation despite current challenges.

- Our earnings growth report unveils the potential for significant increases in Kainos Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Kainos Group.

Turning Ideas Into Actions

- Click this link to deep-dive into the 58 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal