European Stocks That May Be Trading Below Estimated Value

As European markets show mixed returns with the STOXX Europe 600 Index remaining relatively flat, investors are closely monitoring economic indicators such as inflation and labor market stability. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF142.00 | CHF277.82 | 48.9% |

| SNGN Romgaz (BVB:SNG) | RON6.74 | RON13.17 | 48.8% |

| QPR Software Oyj (HLSE:QPR1V) | €0.822 | €1.62 | 49.3% |

| innoscripta (XTRA:1INN) | €100.20 | €195.81 | 48.8% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.54 | €6.96 | 49.1% |

| Green Oleo (BIT:GRN) | €0.795 | €1.58 | 49.6% |

| cyan (XTRA:CYR) | €2.20 | €4.39 | 49.9% |

| Cambi (OB:CAMBI) | NOK21.70 | NOK43.04 | 49.6% |

| Apotea (OM:APOTEA) | SEK87.70 | SEK173.54 | 49.5% |

| Almirall (BME:ALM) | €10.68 | €21.21 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

CVC Capital Partners (ENXTAM:CVC)

Overview: CVC Capital Partners plc is a private equity and venture capital firm focusing on middle market secondaries, infrastructure, credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales and spinouts with a market cap of €18.62 billion.

Operations: The company's revenue segments include Credit (€135.64 million), Secondaries (€94.99 million), Infrastructure (€89.56 million), and Private Equity (€861.04 million).

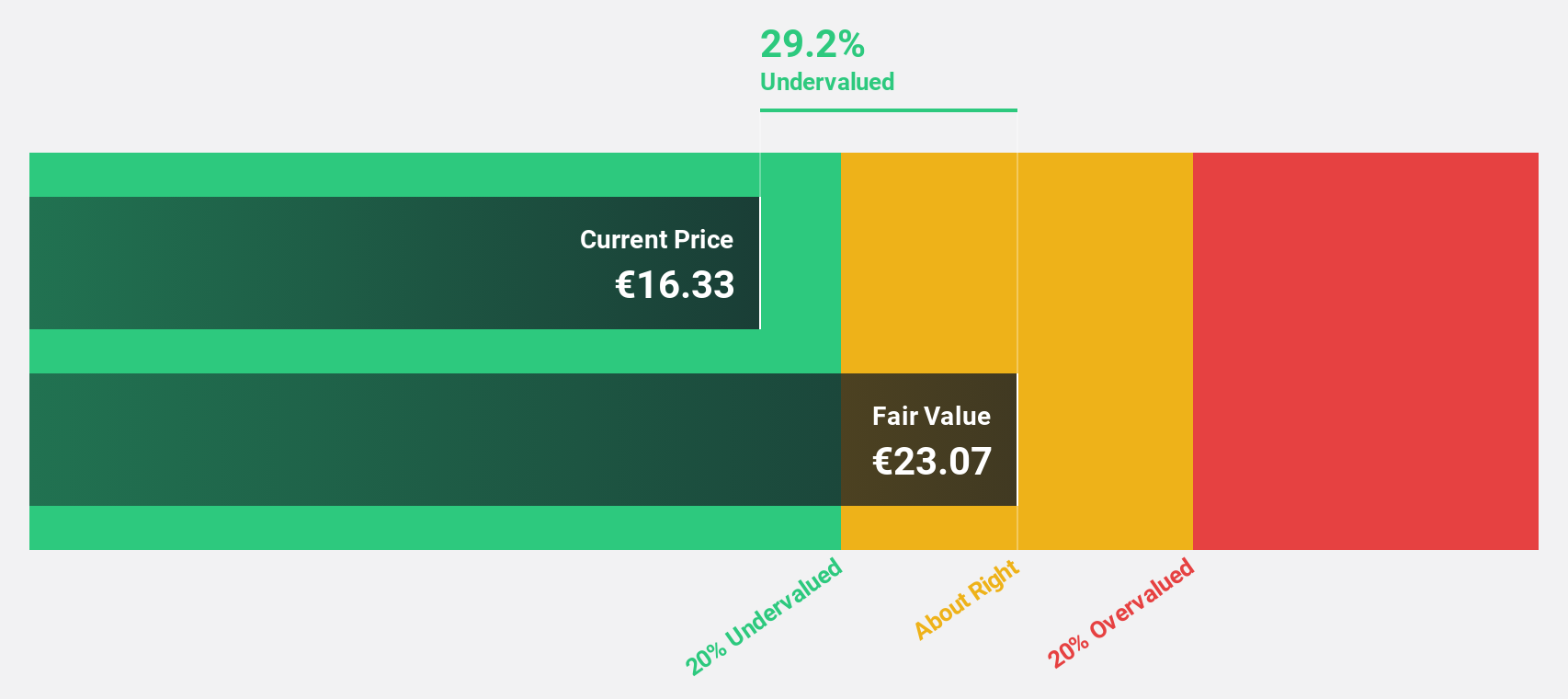

Estimated Discount To Fair Value: 22.4%

CVC Capital Partners is trading 22.4% below its estimated fair value of €22.57, with earnings expected to grow significantly at 24.5% annually over the next three years, surpassing the Dutch market's growth rate. Despite a drop in profit margins from last year and a high debt level, CVC's strategic ventures like Therme Horizon bolster its investment potential by expanding into high-traffic wellness destinations across Europe through significant co-investments and partnerships.

- The analysis detailed in our CVC Capital Partners growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of CVC Capital Partners.

Camurus (OM:CAMX)

Overview: Camurus AB is a biopharmaceutical company that develops and commercializes medicines for severe and chronic diseases across Europe, Africa, the Middle East, North America, and Asia, with a market cap of SEK40.11 billion.

Operations: The company generates revenue from the development of pharmaceutical products based on its technology platform, amounting to SEK2.04 billion.

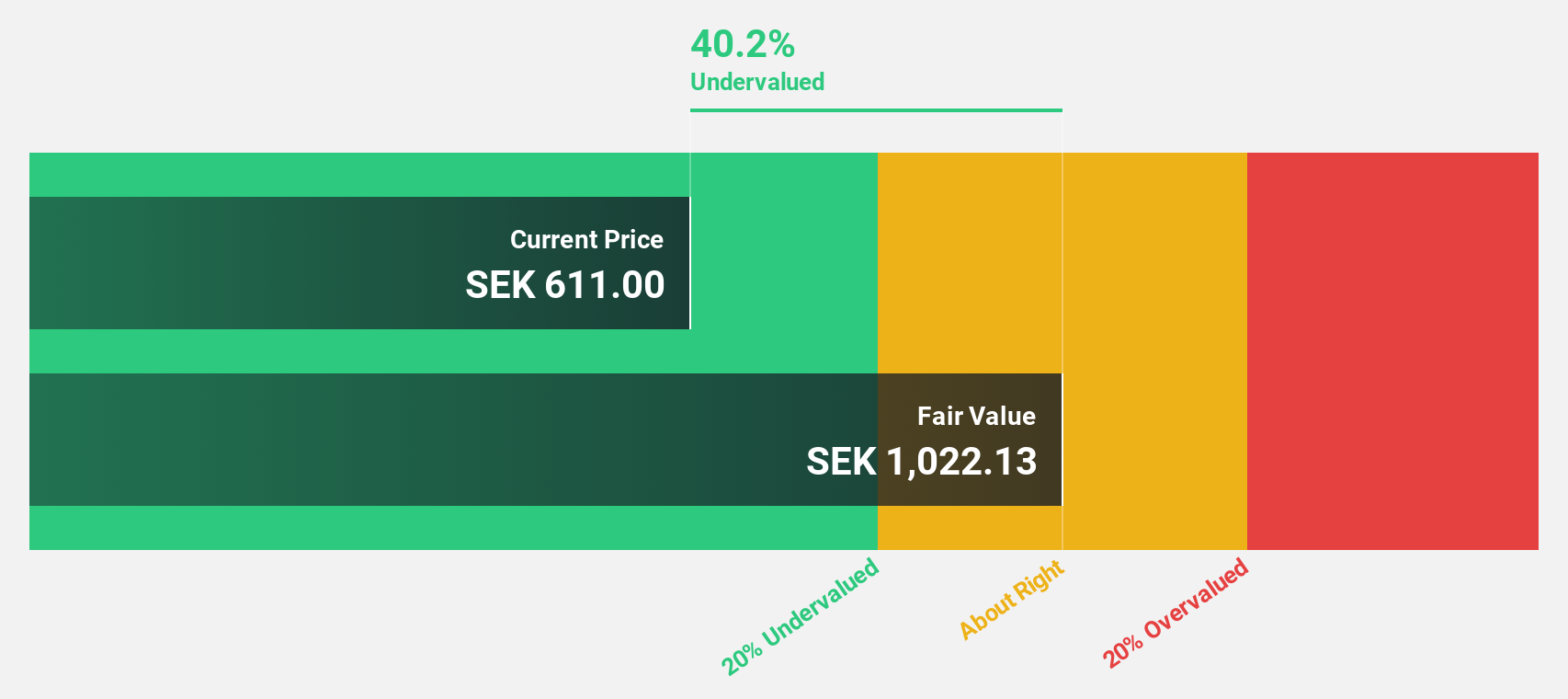

Estimated Discount To Fair Value: 48.8%

Camurus is trading significantly below its estimated fair value of SEK1317.33, at SEK675, suggesting potential undervaluation based on cash flows. The company forecasts robust annual earnings growth of 37%, outpacing the Swedish market. Recent European Commission approval for Oczyesa® enhances its revenue prospects in treating acromegaly, while strategic collaborations with Eli Lilly and product advancements like CAM2029 support future growth despite recent share price volatility and high non-cash earnings levels.

- Our expertly prepared growth report on Camurus implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Camurus.

Rheinmetall (XTRA:RHM)

Overview: Rheinmetall AG is a global provider of mobility and security technologies, with a market cap of €82.52 billion.

Operations: The company's revenue is primarily derived from its Vehicle Systems segment (€4.25 billion), followed by Weapon and Ammunition (€3.02 billion), Power Systems (€2.00 billion), and Electronic Solutions (€1.87 billion).

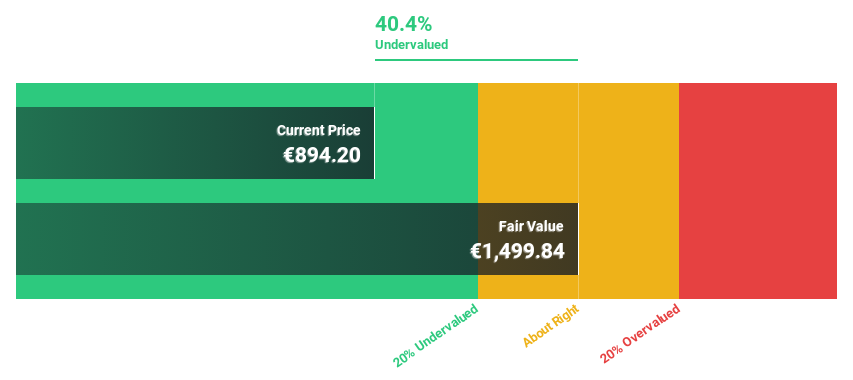

Estimated Discount To Fair Value: 27.7%

Rheinmetall is trading 27.7% below its estimated fair value of €2,493.23, with a current price of €1,803. Recent strategic partnerships and strong order intake have bolstered its defense segment, contributing to significant earnings growth over the past year and a forecasted annual profit increase of 30.2%. The company's revenue is expected to grow at 23.8% annually, surpassing the German market's average growth rate and highlighting its potential for undervaluation based on cash flows.

- According our earnings growth report, there's an indication that Rheinmetall might be ready to expand.

- Click to explore a detailed breakdown of our findings in Rheinmetall's balance sheet health report.

Taking Advantage

- Unlock more gems! Our Undervalued European Stocks Based On Cash Flows screener has unearthed 178 more companies for you to explore.Click here to unveil our expertly curated list of 181 Undervalued European Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal