3 Stocks Estimated To Trade Below Intrinsic Value By Up To 48.5%

The United States market has experienced a positive trajectory, rising 1.8% over the last week and showing a 14% increase over the past year, with earnings anticipated to grow by 15% annually in the coming years. In this environment, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SharkNinja (SN) | $107.24 | $210.75 | 49.1% |

| Roku (ROKU) | $88.27 | $173.23 | 49% |

| Robert Half (RHI) | $42.85 | $83.19 | 48.5% |

| Privia Health Group (PRVA) | $22.11 | $43.37 | 49% |

| Insteel Industries (IIIN) | $39.23 | $77.39 | 49.3% |

| Definitive Healthcare (DH) | $4.03 | $7.85 | 48.7% |

| Community West Bancshares (CWBC) | $21.22 | $42.33 | 49.9% |

| Carter Bankshares (CARE) | $18.25 | $35.50 | 48.6% |

| Atlantic Union Bankshares (AUB) | $33.54 | $65.94 | 49.1% |

| Acadia Realty Trust (AKR) | $18.64 | $36.60 | 49.1% |

Let's explore several standout options from the results in the screener.

Simmons First National (SFNC)

Overview: Simmons First National Corporation is the bank holding company for Simmons Bank, offering a range of banking and financial services to individuals and businesses, with a market cap of $2.56 billion.

Operations: Simmons First National generates revenue primarily through its Community and Commercial Banking segment, which accounts for $687.13 million.

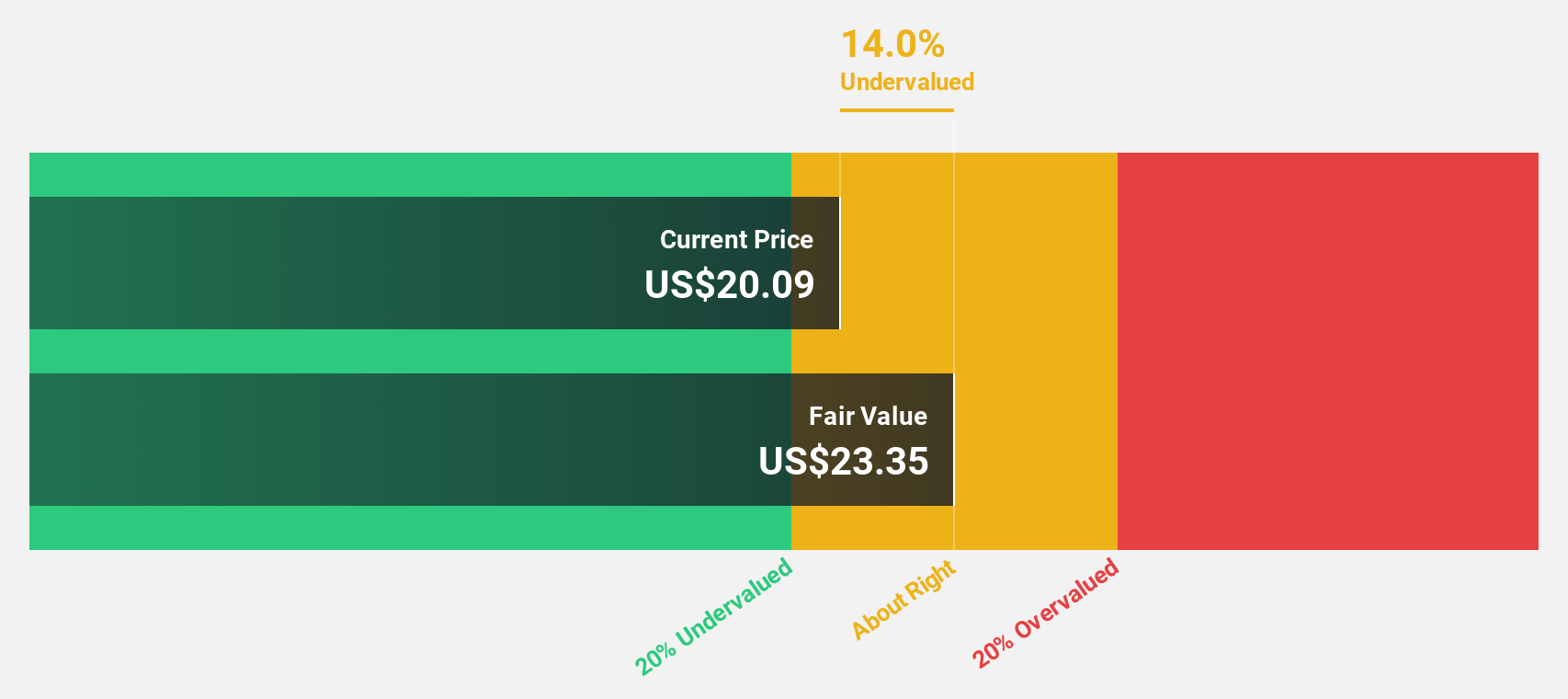

Estimated Discount To Fair Value: 12.3%

Simmons First National is trading at US$20.34, below its estimated fair value of US$23.2, making it undervalued based on discounted cash flows. Earnings are forecast to grow significantly at 25.4% annually, outpacing the broader U.S. market's expected growth rate of 14.7%. Recent earnings showed a decrease in net income to US$32.39 million from US$38.87 million a year ago, while net interest income increased to US$163.42 million from US$151.91 million.

- According our earnings growth report, there's an indication that Simmons First National might be ready to expand.

- Dive into the specifics of Simmons First National here with our thorough financial health report.

Robert Half (RHI)

Overview: Robert Half Inc. offers talent solutions and business consulting services both in the United States and internationally, with a market cap of approximately $4.30 billion.

Operations: The company generates revenue through its segments: Protiviti ($1.96 billion), Contract Talent Solutions ($3.71 billion), and Permanent Placement Talent Solutions ($474.53 million).

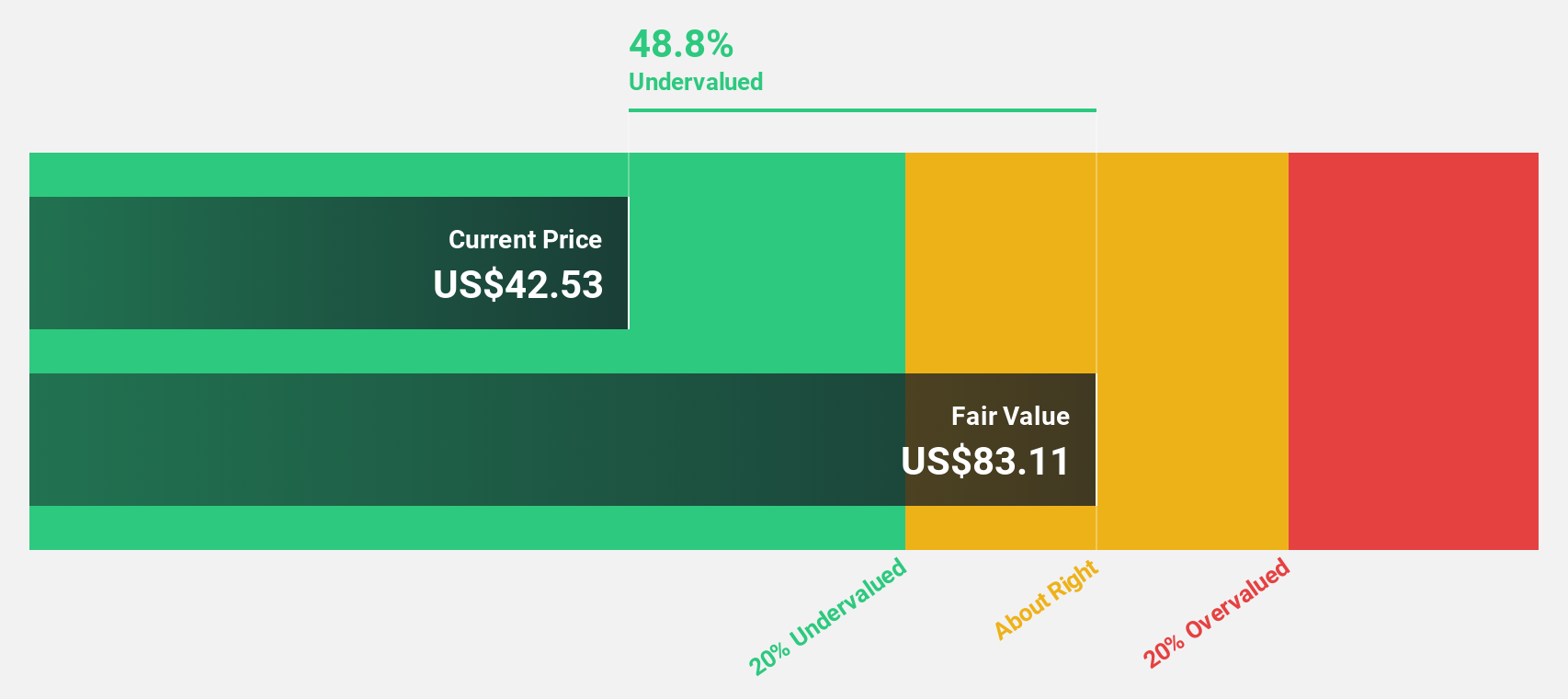

Estimated Discount To Fair Value: 48.5%

Robert Half is trading at US$42.85, significantly below its estimated fair value of US$83.19, indicating undervaluation based on discounted cash flows. Despite a decline in profit margins from 5.7% to 3.6%, earnings are expected to grow substantially by 22.8% annually, surpassing the U.S. market's growth rate of 14.7%. Recent inclusion in the Russell 1000 Dynamic Index and a new US$100 million credit agreement may enhance its financial flexibility moving forward.

- Our growth report here indicates Robert Half may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Robert Half stock in this financial health report.

Starwood Property Trust (STWD)

Overview: Starwood Property Trust, Inc. is a real estate investment trust (REIT) that operates both in the United States and internationally, with a market cap of $7.04 billion.

Operations: The company's revenue segments include Property ($24.98 million), Infrastructure Lending ($105.35 million), Investing and Servicing ($188.89 million), and Commercial and Residential Lending ($553.46 million).

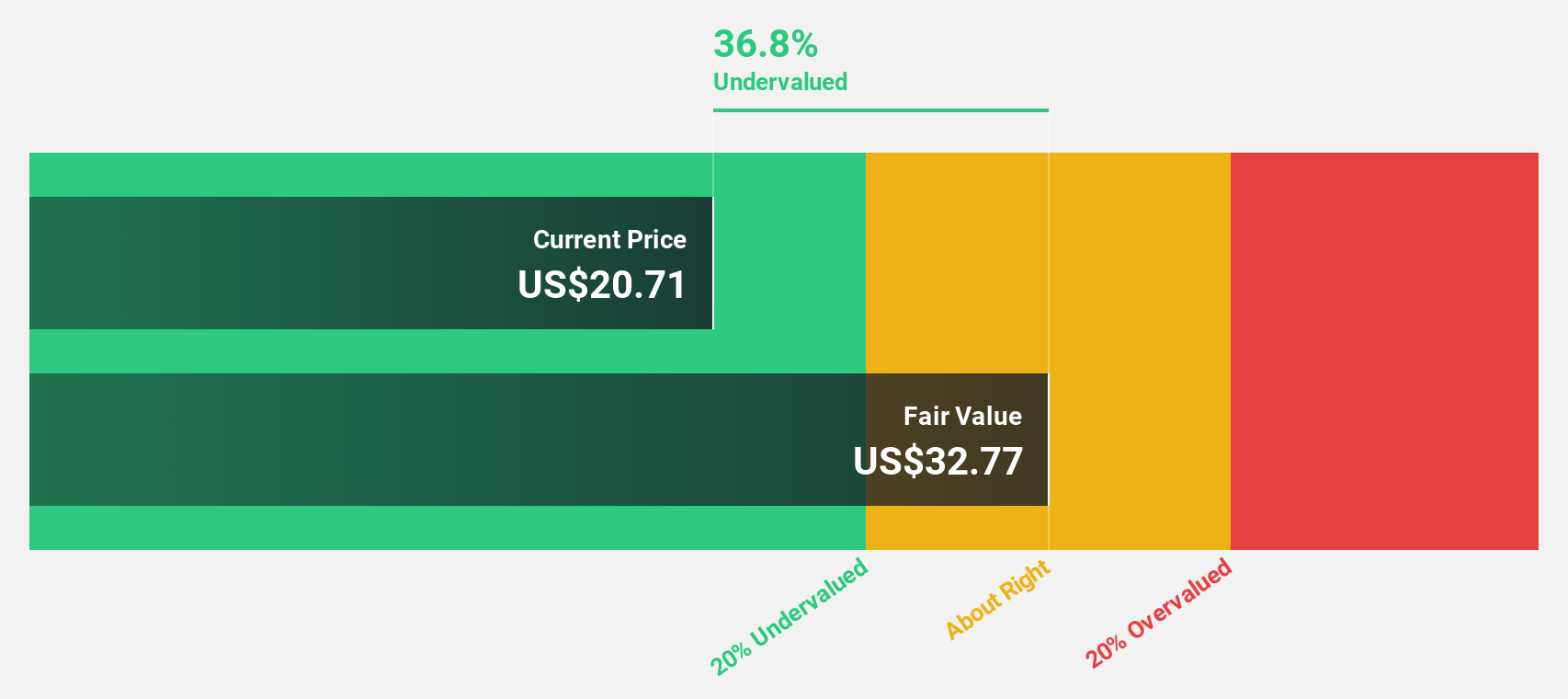

Estimated Discount To Fair Value: 37.1%

Starwood Property Trust is trading at US$20.74, significantly below its estimated fair value of US$32.96, suggesting undervaluation based on discounted cash flows. Despite earnings growth forecasted at 17.7% annually and revenue growth at 36.9%, the dividend yield of 9.26% is not well covered by earnings, and operating cash flow does not sufficiently cover debt levels. Recent additions to the Russell 1000 Value-Defensive Index may bolster investor confidence in its defensive positioning.

- Our earnings growth report unveils the potential for significant increases in Starwood Property Trust's future results.

- Delve into the full analysis health report here for a deeper understanding of Starwood Property Trust.

Taking Advantage

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 179 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal