Are the expectations of the US non-agricultural agricultural super market rate cuts in July being shattered in June?

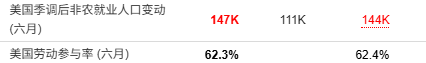

The Zhitong Finance App notes that US employment growth in June exceeded expectations for the fourth month in a row, and the unemployment rate fell, indicating that the labor market remained resilient despite the economic slowdown. The US Bureau of Labor Statistics report on Thursday, which was released one day earlier due to the Independence Day holiday, showed that the number of non-farm payrolls increased by 147,000 last month, which was significantly higher than the forecast of 110,000. This was mainly driven by a surge in employment in state and local governments.

The unemployment rate fell to 4.1%. The number of people employed in the private sector increased by only 74,000 in June, the lowest increase since October last year, mainly from the healthcare industry.

These figures are in line with a slowing trend in recruitment activity, as employers deal with President Trump's erratic trade policies and await congressional approval of his iconic tax legislation. Despite the slowdown in economic activity and increased uncertainty in the first half of the year, most companies were unwilling to lay off workers.

The employment data will also influence discussions among Federal Reserve officials about when to resume interest rate cuts. Federal Reserve Chairman Jerome Powell said there is no rush to reduce borrowing costs until the impact of tariffs on inflation becomes more clear.

Price pressure has been moderate since this year. Powell recently told members of Congress that if the labor market weakens significantly, interest rates may be cut earlier than expected.

Industry insiders said investors are expected to pay close attention to tonight's extremely rare “Thursday non-farm night” to measure the possibility that the Federal Reserve will cut interest rates as early as this month. If the performance of this June non-farm payrolls report, which will be released the day before the US Independence Day holiday on July 4, weakens, it may open the door for the Federal Reserve to resume cutting interest rates at a meeting later this month.

Although the market currently believes that interest rate cuts in July are still very unlikely, and many Fed policymakers also tend to wait and see, at least two Federal Reserve governors — Waller and Bauman — have recently stated that they are open to this.

With the non-agricultural sector exceeding 145,000, Komo believes this is the first late-stage event that may trigger a reassessment of the US economic growth trajectory, and it largely means that the possibility of interest rate cuts in July has gone up in smoke. If companies feel this confident, then this is likely due to lower tariff expectations and higher than expected transmission of tariff costs to consumers.

According to the latest Komo report, after adjusting for inflation, the overall cash reserves of US consumers (including checking accounts, savings accounts and money market funds) are currently more abundant than in the fourth quarter of 2019. The Komo analysis team predicts that US bond yields will soar under this scenario, which may inhibit stock returns within a few trading days — due to increased volatility, but in the end, this will still be a positive result. The S&P 500 index and the Nasdaq 100 index, which includes tech giants such as Nvidia, Google, and Microsoft, are expected to continue the bullish trajectory in the medium to long term.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal