US stock outlook | Futures on the three major stock indexes are rising, and the non-agricultural industry is on the rise tonight! US stocks close early and the market will be closed tomorrow

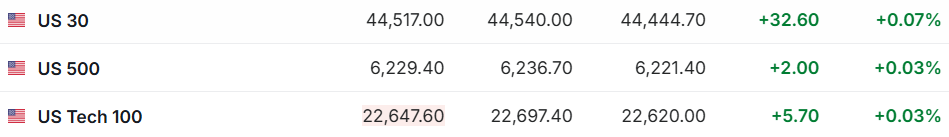

1. On July 3 (Thursday), the futures of the three major US stock indexes rose sharply before the US stock market. As of press release, Dow futures were up 0.07%, S&P 500 futures were up 0.03%, and NASDAQ futures were up 0.03%.

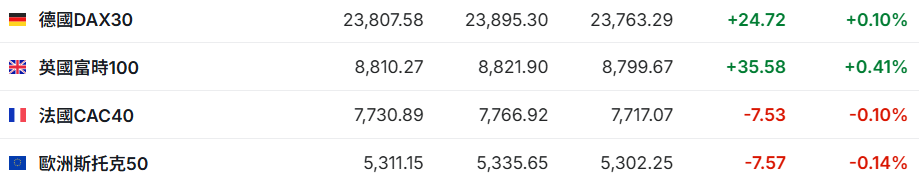

2. As of press release, the German DAX index rose 0.10%, the UK FTSE 100 index rose 0.41%, the French CAC40 index fell 0.10%, and the European Stoxx 50 index fell 0.14%.

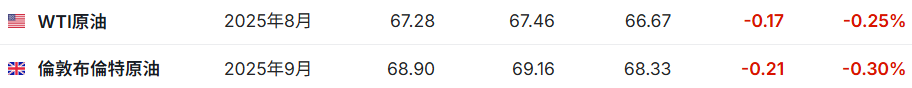

3. As of press release, WTI crude oil fell 0.25% to $67.28 per barrel. Brent crude oil fell 0.30% to $68.90 per barrel.

Market news

Trading reminder: US stocks closed early today, and the market will be closed for one day tomorrow. Due to the US Independence Day holiday, the US stock market was closed for one day on July 4. The US non-farm payrolls report for June was released ahead of schedule at 20:30 on July 3. On the same day, trading of US stocks and stock index futures contracts under CME ended ahead of schedule at 01:15 Beijing time on the 4th.

Nonghong is making a big hit tonight! The impact of Trump's policy is evident, and the US job market is afraid to “turn a red light.” As the Trump administration's trade and immigration policies begin to have an impact, forecasters expect the monthly US employment report to show a slowdown in employment growth and the unemployment rate to its highest level since 2021. According to reports, the US Department of Labor will release the June non-farm payrolls data at 20:30 Beijing time. The market expects the number of employed people to increase by 106,000, the lowest increase in four months, and by 139,000 in May; the unemployment rate is expected to rise slightly to 4.3%. Thursday's non-farm payrolls data may cause Federal Reserve officials to postpone interest rate cuts until September, as investors currently expect. However, if there are signs that the economy is deteriorating at an accelerated pace, then the market will increase bets that the Federal Reserve will act ahead of time at the upcoming policy meeting on July 29-30.

Goldman Sachs is weakening the US job market: the increase in non-farm payrolls in June is expected to be only 85,000. Goldman Sachs predicts that the number of non-farm payrolls in the US will increase by 85,000 in June. This forecast is far below the market's general expectation of 113,000, and lower than the average of 135,000 over the past three months. Goldman Sachs believes that the factors that dragged down the number of new non-farm payrolls in the US in June include weak large-scale data indicators, changes in immigration policies, and federal government layoffs. Meanwhile, Goldman Sachs expects the unemployment rate to rise to 4.3% from 4.24% in May, and the average hourly wage is expected to increase 0.3% month-on-month. The bank added that the end of the workers' strike brought some positive news, but not enough to substantially boost the overall data. The June non-farm payrolls report will confirm that the US labor market is slowing down. This should reinforce the Fed's gradual shift to a dovish stance and put continuing downward pressure on the US dollar, especially as wage growth shows further signs of slowing inflation.

MAGA Midnight Big Reversal! Trump lobbied key lawmakers in the early hours of the morning, and the House of Representatives thrilled the tax cut bill. Early Thursday morning EST, House Republicans successfully pushed President Trump's large-scale tax cuts and spending bill into the final voting process. This indicates that differences within the Republican Party over the fiscal impact of the bill have basically been resolved. After a day of closed-door discussions between Capitol Hill and the White House, legislators cleared procedural barriers at 3:30 a.m. (7:30 GMT) with a result of 219 votes to 213, and immediately restarted the debate process to prepare for the final vote at about 5:30 a.m. The procedural vote previously held on Wednesday lasted seven hours to buy time for Trump and House Speaker Mike Johnson to persuade party dissidents to support this landmark bill.

The debt ceiling was raised by 5 trillion dollars + benefits were cut, and the “Big Beauty” bill was blocked due to internal differences within the Republican Party. US President Donald Trump lashed out at congressional Republicans via social media on July 3, pointing out that they are delaying signing the “Big Beautiful” economic bill he promoted, and issued a warning: if the bill is vetoed, the Republican Party will lose the support of the “MAGA Again” (MAGA) core voters. This intense game surrounding fiscal policy is pushing America's political polarization to a new level. The turmoil stemmed from serious differences within the Republican Party over Trump's economic blueprint. Although House Republicans initiated the bill review process on July 2, the voting process stalled due to opposition from a minority of conservative lawmakers. The positions of these hawkish fiscal lawmakers rarely coincide with those of the Democrats, and they all strongly questioned the content of the bill.

Individual stock news

Oracle (ORCL.US)'s 30 billion bid has surfaced: rumor has it that it will expand cooperation with OpenAI to build more data centers. OpenAI has agreed to rent significant computing resources from Oracle's data centers as part of its “Stargate (Stargate)” project, which highlights the extremely high level of requirements required to develop cutting-edge artificial intelligence products. According to people familiar with the matter, the artificial intelligence company will rent a total of about 4.5 GW of data center power capacity from Oracle. These power facilities are located in the US. Earlier this week, Oracle announced that it had signed a $300 billion single cloud services agreement that will take effect beginning in fiscal year 2028, without revealing the names of customers. According to one of the people familiar with the matter, this “Stargate” agreement is at least part of the disclosed contract.

Starbucks (SBUX.US) offered “sky-high” incentives to push forward reforms: executives were rewarded with $6 million in stocks per person, but they must turn a loss into a profit. Starbucks will implement stock incentives to its executives, with a target reward value of $6 million per person — provided the company turns a loss into a profit as soon as possible and at the same time controls costs. These rewards will be distributed in the form of restricted stock units, and the basis for payment will depend on the company's performance. The company said in a regulatory filing on Wednesday that these rewards will begin to be realized after the company's fiscal year 2027 ends, which will end around the end of September 2027. These grants are directly linked to whether senior management can implement key aspects of CEO Brian Nichol's “Back to Starbucks” plan as soon as possible. According to the document, the awards “include a goal aimed at actually reducing operating costs to support continued investment in the in-store experience.”

After Tesla (TSLA.US) deliveries weakened and declined, Musk took over sales in the US and Europe. CEO Elon Musk has taken over Tesla's sales efforts in Europe and the US, after Omead Afshar, who had been his deputy for a long time, left his job. Afshar was responsible for Tesla's sales and production operations in North America and Europe before leaving the electric vehicle manufacturer late last month. After his departure, Musk and Senior Vice President Tom Zhu will each assume different reporting responsibilities, and Tesla is also struggling to recover from several consecutive quarters of declining car deliveries. According to people familiar with the relevant changes, Zhu, who is currently based in China, will continue to be responsible for Tesla's sales work in Asia and will be fully in charge of global production and operation matters.

Has the “big wave of layoffs” begun in the AI era? Microsoft (MSFT.US) began a second round of large-scale layoffs, affecting about 9,000 people. Microsoft officially launched the second round of large-scale layoffs in 2025 this week. It is expected to cut about 9,000 jobs, accounting for less than 4% of its total global workforce. The layoffs affected multiple teams, regions, and ranks to streamline processes, reduce management levels, and fulfill the company's “cost control” goals promised to Wall Street. According to a Microsoft spokesperson, the sales department and the Xbox business line will be the focus of this round of adjustments. This is Microsoft's second layoff in the year. In May of this year, the company laid off 6,000 jobs, with the product and engineering teams being the hardest hit. By the end of June 2024, the total number of Microsoft employees reached 228,000, of which sales and marketing personnel accounted for nearly 20% (45,000).

It is rumored that Apple (AAPL.US)'s first folding screen iPhone has been tested as a prototype and is expected to be launched in the second half of next year. Apple's first folding screen iPhone has begun prototype (P1) testing. It is expected that it will have an opportunity to enter engineering verification testing (EVT) by the end of this year, and will be launched as soon as the second half of next year. The P1 phase generally lasts about two months, mainly to confirm whether the appearance, thickness, and weight of the whole machine meet design expectations, and to initially inspect the folding times and feel of the hinge. If there is no major problem, it will enter the subsequent P2 and P3 stages to gradually improve the hardware design and optimize details such as heat dissipation and antennas. After all prototype tests have been completed, the product will enter the EVT phase to ensure that the design idea has no major flaws. If all goes well, the design verification (DVT) and production verification (PVT) stages will begin before the end of this year to verify the completeness and consistency of the whole machine design, as well as the stability of the process flow and production line, respectively. It is expected that mass production will enter the 2026 phase.

Key economic data and event forecasts

20:30 Beijing time: After seasonal adjustment of the US non-farm payrolls in June (10,000), the US trade balance for May (100 million US dollars), and the number of US jobless claims for the week ending June 28 (10,000).

22:00 Beijing time: Revised monthly rate of US durable goods orders in May (%), US monthly factory order rate in May (%), US ISM non-manufacturing PMI for June.

The next day at 01:00 a.m. Beijing time: The total number of US drills (ports) for the week ending July 4.

23:00 Beijing time: 2027 FOMC voting committee and Atlanta Federal Reserve Chairman Bostic delivered a speech on US monetary policy.

July 4 - US Independence Day, the US - New York Stock Exchange and NASDAQ Exchange will close early at 01:00 Beijing time on the 4th.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal