Wayfair Inc.'s (NYSE:W) 36% Price Boost Is Out Of Tune With Revenues

Wayfair Inc. (NYSE:W) shares have continued their recent momentum with a 36% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 9.7% isn't as impressive.

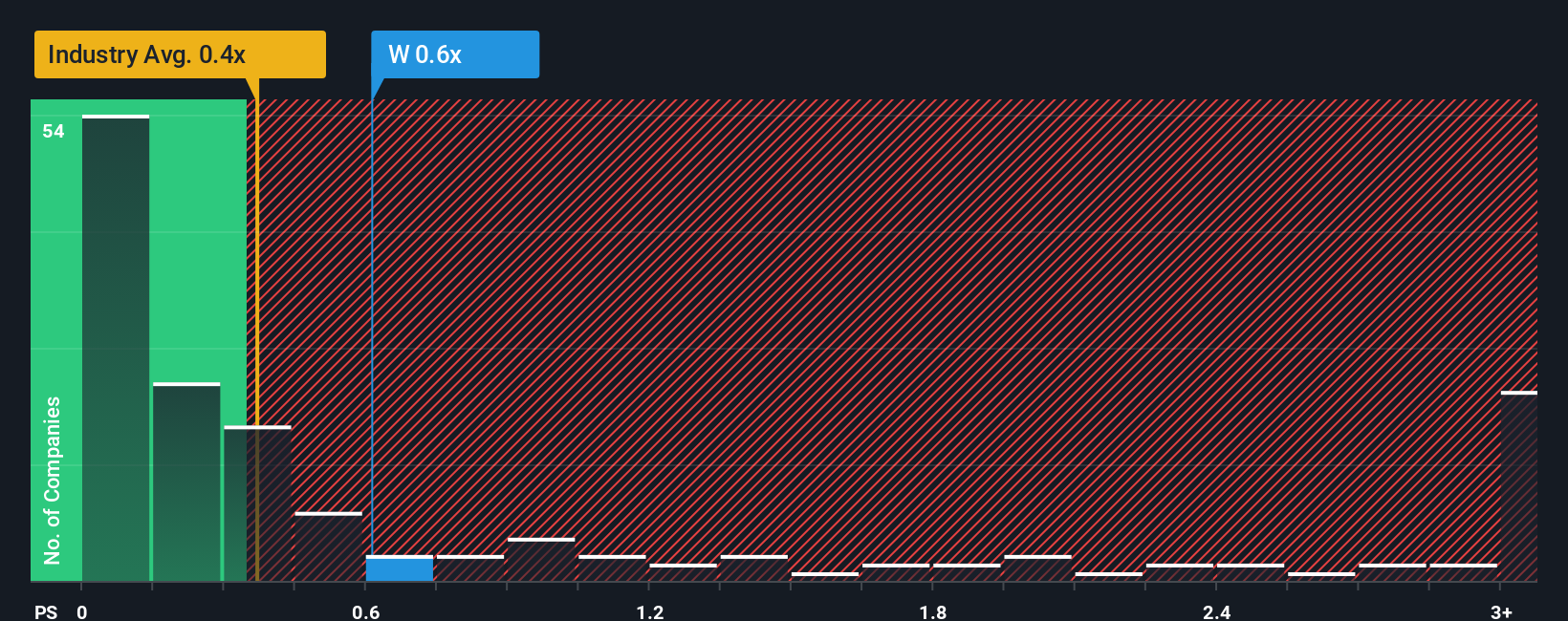

Even after such a large jump in price, it's still not a stretch to say that Wayfair's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United States, where the median P/S ratio is around 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Wayfair

How Wayfair Has Been Performing

Wayfair hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wayfair.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Wayfair would need to produce growth that's similar to the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 10% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 3.5% each year during the coming three years according to the analysts following the company. With the industry predicted to deliver 6.2% growth each year, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Wayfair's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Wayfair's P/S Mean For Investors?

Its shares have lifted substantially and now Wayfair's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at the analysts forecasts of Wayfair's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Wayfair (1 can't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Wayfair, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal