Restarting the crypto business ignites SoFi Technology (SOFI.US)'s new growth engine, a golden opportunity, or detonates upward valuation potential

The Zhitong Finance App notes that although SoFi Technology (SOFI.US) has announced excellent financial results since withdrawing from the cryptocurrency sector at the end of 2023, its stock price has soared to multi-year highs just by announcing that it is about to restart the crypto business.

Analyst Mark Holder believes the fintech company should be able to use this to unlock a new business area — a field that once pushed similar stocks to higher market capitalization. Given that its valuation is still relatively cheap and facing huge market opportunities, Holder is optimistic that SoFi's stock price will continue to rise, even if the current valuation is already high.

A golden opportunity

As far back as June 25, SoFi announced that it would resume cryptocurrency services on its fintech platform. The company plans to initially provide transactions for popular tokens such as Bitcoin and Ethereum, and plans to launch stablecoins, provide loan services secured by crypto assets, and expand payment options.

Currently, members need to join the waitlist, and the exact launch time of the product has not been announced. The Genius Act, which has just been passed by the US Senate, provides a regulatory path for stablecoins and opens the door for fintech companies such as SoFi to launch such products.

The stablecoin market is expected to grow more than tenfold by 2030, reaching $3 trillion to $4 trillion, while the current size is only about $250 billion. Analysts at Citizens JMP believe that the potential annual revenue from stablecoins could open up a business opportunity worth $100 billion.

SoFi initially offered limited cryptocurrency transactions of up to 20 tokens in 2023, then withdrew from this opportunity to pursue digital banking. At the time, Sofi handed over the operation of the business to Blockchain.com and apparently transferred just under $140 million in crypto assets.

The fintech company didn't provide many details about the size of the crypto business, probably because it's still in its infancy, but SoFi has experience in this field and is expected to successfully restart. Robinhood began providing cryptocurrency services a few years ago, and it wasn't until the first quarter of 2024 that the company achieved quarterly revenue of over $50 million for the first time.

Robinhood's revenue recently jumped to $610 million during the fourth/first quarter, with an annualized rate of over $1 billion. The company reported a nominal cryptocurrency transaction volume of $46 billion in the first quarter, far higher than the limited balance SoFi held at the end of 2023.

As of the end of March, the online broker listed a balance of $28 billion in cryptocurrency assets. Robinhood's total platform assets are US$221 billion, so outsiders will seriously question whether SoFi has investment products that can achieve any degree of success, because brokerage is not its core focus.

Lags behind the competition

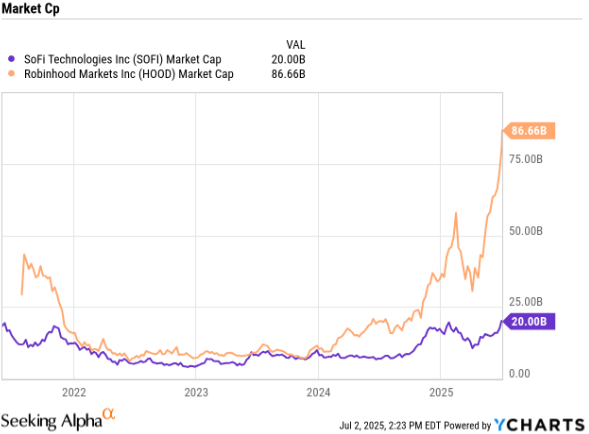

With revenue from cryptocurrency and stock options trading (based on trading volume), Robinhood has achieved a market capitalization of $87 billion, which is more than four times the value of SoFi, which previously focused on lending products and is similar in size. SoFi has the opportunity to capitalize on additional growth from trading revenue to boost its stock valuation.

Even the recently listed Circle (code CRCL) has begun to hit $45 billion in market capitalization by providing the second-largest stablecoin product. Clearly, the market gives fintech companies involved in the crypto sector higher valuations.

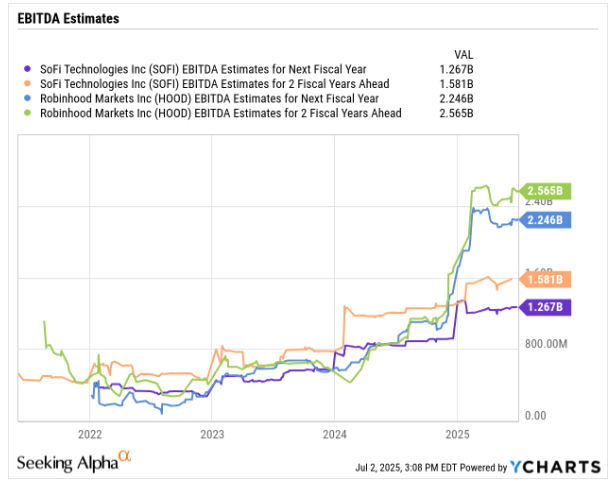

Robinhood's adjusted EBITDA target suddenly doubled SoFi's expectations. Robinhood's current stock price is close to 40 times its 2026 $22.5 billion EBITDA target, while SoFi is only 16 times its expected $12.7 billion EBITDA next year.

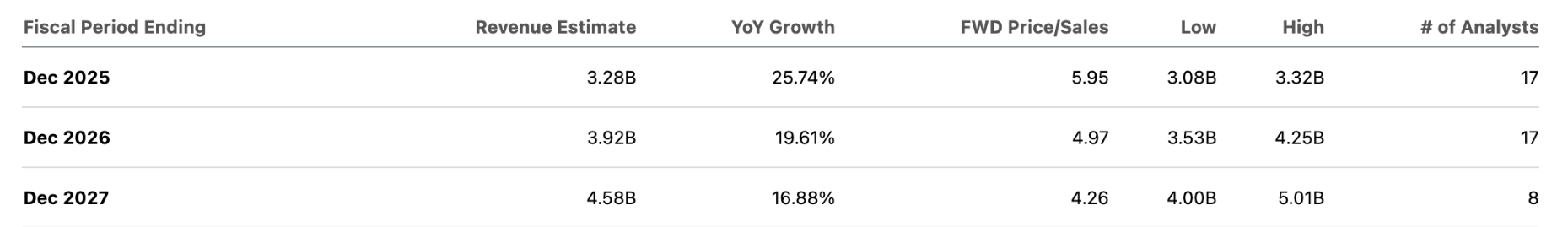

SoFi has an opportunity to unlock revenue potential in the crypto business while vigorously promoting the SoFi Plus subscription service — similar to how Robinhood uses its Gold Card product to attract a large number of new customers. SoFi had previously predicted an annual growth rate of 25% over the next three years, yet analysts generally did not anticipate the same growth rate; growth expectations for 2026 and 2027 were lower than 20%.

If cryptocurrency becomes SoFi's next inflection point, its stock price will have huge upside. As a result, the fintech company will receive a double boost: on the one hand, it will raise its already steady sales growth expectations, and on the other hand, it will take profits to a new level, and at the same time, it may receive a corresponding increase in valuation multiples as it shifts from relying on loan product growth to a scalable, capital-light income model.

The risk is that SoFi is now lagging behind in providing crypto products, and Coinbase (COIN.US), Robinhood, and other platforms already have a pioneer advantage. Furthermore, SoFi's valuation may always be linked to risks associated with borrowing products.

Investment views

Holder said that the key point investors need to grasp is that SoFi already provides a compelling valuation and business model, but the crypto business may take this fintech company to new heights. The stock's current valuation is attractive (only 16 times the adjusted EBITDA target), and the outlook is promising, combined with its faster growth rate and opportunities for crypto businesses and new subscription services to boost SoFi to the next level.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal