Top 3 European Penny Stocks With Market Caps Under €300M

As the European markets show signs of resilience, with indices like the STOXX Europe 600 Index gaining ground amid easing geopolitical tensions and potential economic stimulus measures, investors are exploring diverse opportunities. Penny stocks, often representing smaller or newer companies, continue to intrigue investors with their potential for growth and value. Despite being an outdated term, penny stocks remain relevant for those seeking under-the-radar opportunities; this article highlights three such stocks that combine financial strength with promising prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.52 | €80.27M | ✅ 4 ⚠️ 1 View Analysis > |

| Maps (BIT:MAPS) | €3.50 | €46.49M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.81 | €59.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.63 | €17.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.22 | PLN11.37M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.545 | SEK2.44B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.74 | SEK227.54M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.11 | €291.32M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.988 | €33.32M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 326 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

SSH Communications Security Oyj (HLSE:SSH1V)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SSH Communications Security Oyj is a cybersecurity company that provides solutions for humans, systems, and networks across the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of €70.67 million.

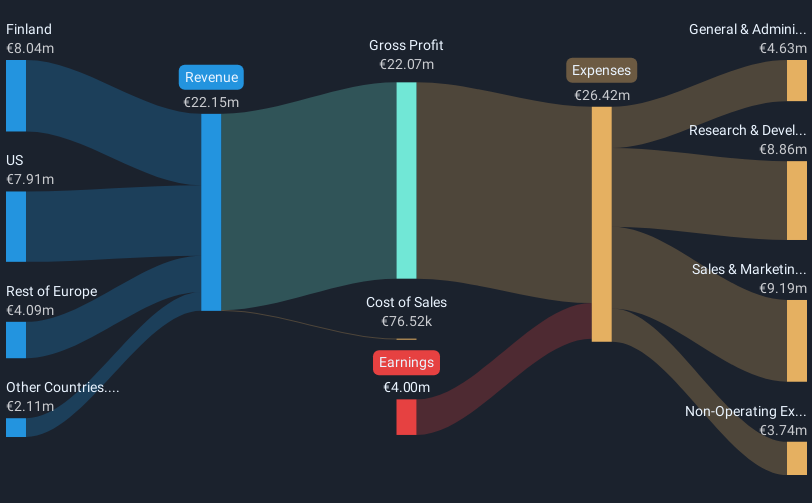

Operations: The company generates revenue primarily from its Software Business, amounting to €22.55 million.

Market Cap: €70.67M

SSH Communications Security Oyj, with a market cap of €70.67 million, is navigating the volatile penny stock landscape with strategic initiatives and partnerships. Despite being unprofitable, it has a positive free cash flow and sufficient cash runway for over three years. Recent developments include a strategic alliance with Leonardo S.p.A., focusing on Zero Trust Privileged Access Management and Quantum-Safe network encryption, which could enhance its commercial prospects significantly. However, challenges remain as short-term liabilities exceed assets by €7.1 million, and the company has reported increasing losses over recent years despite revenue growth in its software business segment.

- Jump into the full analysis health report here for a deeper understanding of SSH Communications Security Oyj.

- Examine SSH Communications Security Oyj's earnings growth report to understand how analysts expect it to perform.

Airthings (OB:AIRX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Airthings ASA is a hardware-enabled software company that develops products and systems for monitoring indoor air quality, radon, and energy efficiency globally, with a market cap of NOK326.86 million.

Operations: Airthings generates revenue through three primary segments: Consumer ($29.14 million), Business ($6.96 million), and Professional ($2.10 million).

Market Cap: NOK326.86M

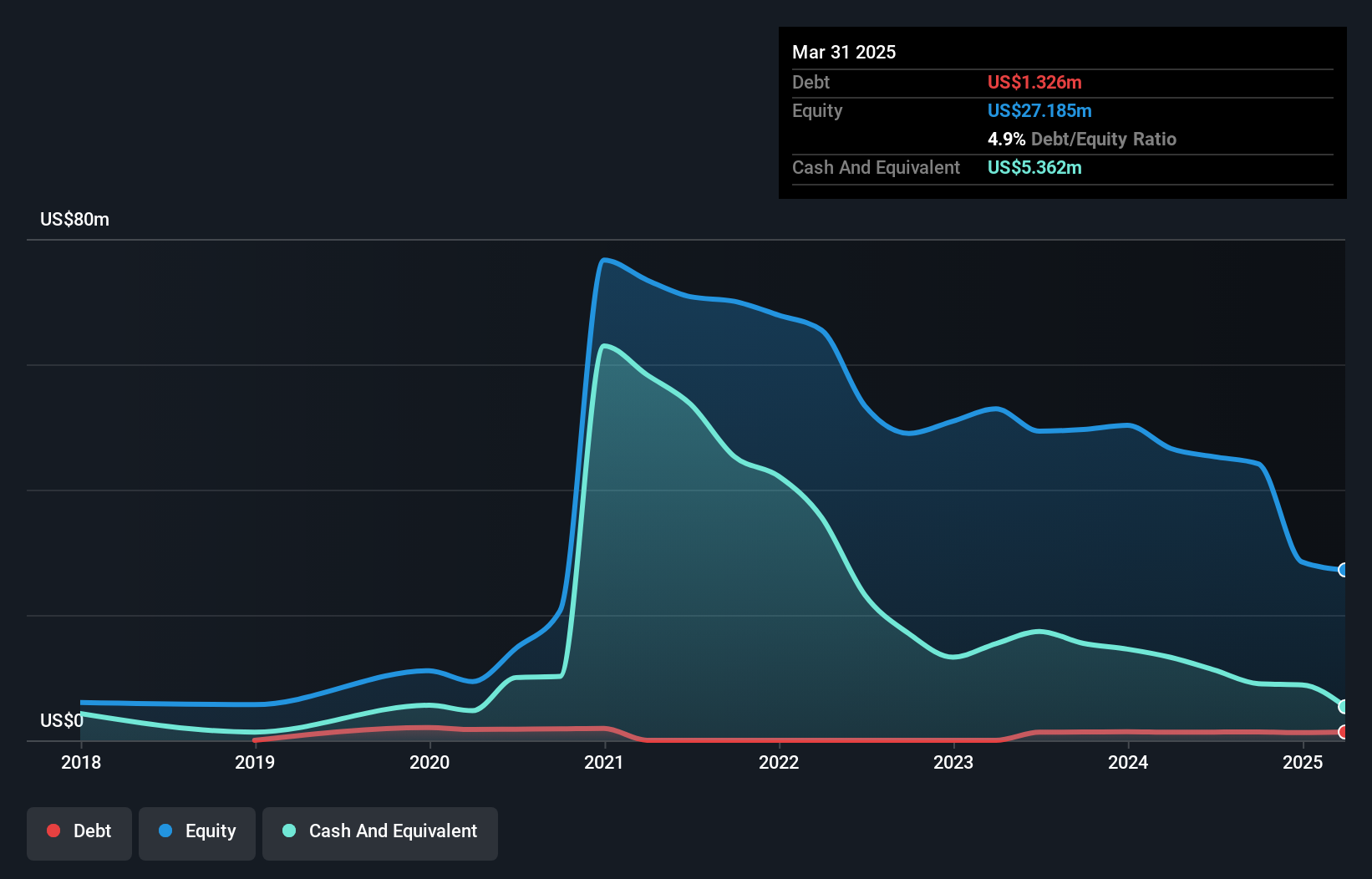

Airthings ASA, with a market cap of NOK326.86 million, is navigating the penny stock terrain amid financial challenges and potential opportunities. The company is unprofitable with a negative return on equity and losses increasing at 24.4% annually over five years. Despite this, Airthings maintains short-term assets of $31.3 million exceeding its liabilities and has reduced its debt to equity ratio significantly over five years to 4.9%. Recent earnings show a net loss of $3.4 million for Q1 2025, with revenue guidance for Q2 between $7-$9 million, indicating ongoing efforts to stabilize revenue streams amidst volatility in share price and management turnover.

- Click to explore a detailed breakdown of our findings in Airthings' financial health report.

- Explore Airthings' analyst forecasts in our growth report.

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and businesses in Sweden, with a market cap of SEK 2.44 billion.

Operations: The company generates revenue primarily through its National Broadband Service, amounting to SEK 1.77 billion.

Market Cap: SEK2.44B

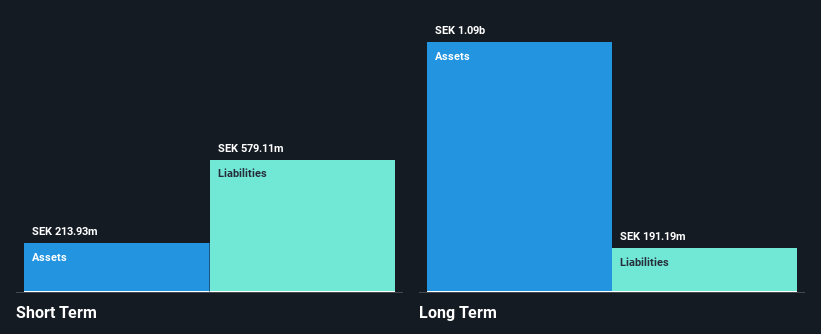

Bredband2 i Skandinavien AB, with a market cap of SEK 2.44 billion, demonstrates resilience in the penny stock sector through consistent earnings growth and sound financial health. The company reported Q1 2025 sales of SEK 456.21 million, reflecting revenue growth from the previous year. Its net profit margin improved to 6.2%, supported by strong cash flow coverage of debt and a high return on equity at 20.3%. Despite short-term liabilities exceeding assets, Bredband2 offers an attractive dividend yield of 3.93% and benefits from a seasoned management team with significant industry experience, enhancing its investment appeal amidst market fluctuations.

- Take a closer look at Bredband2 i Skandinavien's potential here in our financial health report.

- Review our growth performance report to gain insights into Bredband2 i Skandinavien's future.

Turning Ideas Into Actions

- Investigate our full lineup of 326 European Penny Stocks right here.

- Curious About Other Options? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal