European Dividend Stocks To Consider Now

As European markets show resilience with the STOXX Europe 600 Index climbing 1.32% amid eased trade tensions and economic stimulus promises, investors are increasingly turning their attention to dividend stocks for stable returns. In such an environment, a good dividend stock is often characterized by a strong balance sheet and consistent payout history, making it a potentially attractive option for those seeking income in uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.44% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.40% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.85% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.26% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.58% | ★★★★★★ |

| ERG (BIT:ERG) | 5.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.81% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.48% | ★★★★★★ |

Click here to see the full list of 236 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

B&C Speakers (BIT:BEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B&C Speakers S.p.A. specializes in producing and marketing professional loudspeakers under the B&C brand, with a market cap of €183.30 million.

Operations: B&C Speakers S.p.A. generates its revenue primarily from Acoustic Transducers, amounting to €102.34 million.

Dividend Yield: 5.9%

B&C Speakers shows a mixed dividend profile. The company offers a high dividend yield of 5.93%, placing it in the top 25% of Italian market payers, but its sustainability is questionable due to a high cash payout ratio of 104.7%. Although dividends have grown over the past decade, they have been volatile and unreliable. Recent earnings growth and trading below estimated fair value may appeal to some investors despite these concerns.

- Click to explore a detailed breakdown of our findings in B&C Speakers' dividend report.

- Insights from our recent valuation report point to the potential undervaluation of B&C Speakers shares in the market.

Sogeclair (ENXTPA:ALSOG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sogeclair SA offers engineering and production services to the aeronautics, space, civil, and military transport sectors in France with a market cap of €89.70 million.

Operations: Sogeclair SA generates revenue through its Solutions segment, accounting for €80.60 million, and its Engineering segment, contributing €76.40 million.

Dividend Yield: 3.3%

Sogeclair's dividend profile presents both strengths and weaknesses. The company maintains a sustainable dividend with a reasonable payout ratio of 66.2% and a low cash payout ratio of 19.2%, indicating strong coverage by earnings and cash flows. However, its 3.27% yield is below the top tier in France, and dividends have been volatile over the past decade despite overall growth. Currently trading at 61.8% below estimated fair value, it may attract value-focused investors.

- Get an in-depth perspective on Sogeclair's performance by reading our dividend report here.

- The analysis detailed in our Sogeclair valuation report hints at an deflated share price compared to its estimated value.

SAF-Holland (XTRA:SFQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SAF-Holland SE manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses with a market cap of €776.24 million.

Operations: SAF-Holland SE generates revenue from three main segments: €726.21 million from the Americas, €236.90 million from Asia/Pacific (APAC)/China/India, and €857.36 million from Europe, the Middle East, and Africa (EMEA).

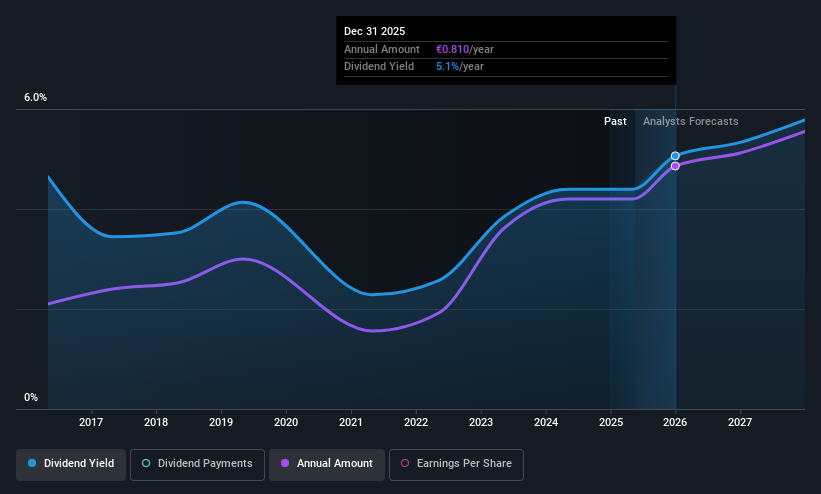

Dividend Yield: 5%

SAF-Holland's dividend profile is characterized by a top-tier yield of 4.97% in the German market, supported by a sustainable payout ratio of 60.1% and strong cash flow coverage at 23.3%. Despite this, dividends have been volatile over the past decade, raising concerns about reliability. Recent approvals include a dividend of €0.85 per share and board expansions following leadership changes, reflecting strategic adjustments amidst stable earnings guidance for 2025 with sales projected between €1.85 billion and €2 billion.

- Delve into the full analysis dividend report here for a deeper understanding of SAF-Holland.

- Our valuation report unveils the possibility SAF-Holland's shares may be trading at a discount.

Make It Happen

- Explore the 236 names from our Top European Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal