Arm Holdings (NasdaqGS:ARM) Reports Mixed Earnings With Rising Sales But Declining Net Income

Arm Holdings (NasdaqGS:ARM) experienced a significant share price increase of 55% in the last quarter, reflecting recent strategic developments and market trends. The partnership with Cerence Inc. to enhance AI capabilities likely bolstered investor confidence, aligning with the broader market rally driven by improving geopolitical stability and positive economic indicators. Despite a mixed earnings report, where sales rose but net income declined, the favorable market environment for tech stocks, coupled with Arm's strong industry position, supported its appreciation. Additionally, the decision not to pursue the Alphawave acquisition may have stabilized market perceptions, contributing positively to the overall price movement.

Buy, Hold or Sell Arm Holdings? View our complete analysis and fair value estimate and you decide.

The recent developments at Arm Holdings, notably the strategic partnership with Cerence Inc. to bolster AI capabilities, could significantly influence the company's revenue and earnings forecasts. With the tech sector thriving amid improving economic conditions, Arm's focus on AI and partnerships with hyperscalers like AWS and NVIDIA is expected to drive robust growth in smartphones, autos, and IoT. Despite hurdles such as the Qualcomm lawsuit and concentrated customer risks, Arm's R&D investments and CSS technology are poised to enhance its licensing revenues and royalty rates.

Over the last year, including dividends, Arm's total return was 1.12%. This is a stark contrast to its recent quarterly performance, which saw a share price increase of 55%. In comparison, Arm underperformed the US market's 13.7% return and the Semiconductor industry's 18.7% return over the past year. The company's execution of strategic measures and industry positioning offers a mixed performance narrative in the longer term.

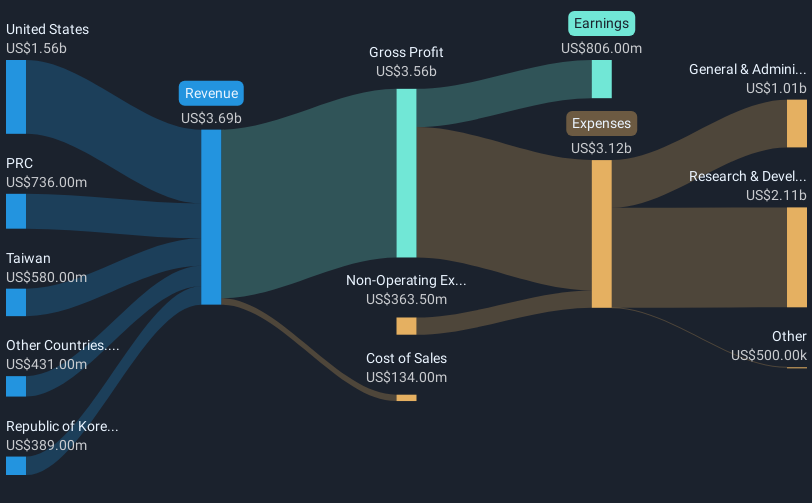

As for valuation, Arm's current share price of US$122.44 stands at a 20.04% discount to the consensus analyst price target of US$132.31. The disparity between the bullish analyst target of US$203.0 and the most bearish of US$73.0 reflects differing anticipations of future growth rates and valuation multiples. While Arm's share price has appreciated, aligning future price movements with analysts’ forecasts will be contingent on revenue reaching US$7.4 billion and earnings US$2.8 billion by 2028, against an anticipated PE ratio of 108.0x.

The valuation report we've compiled suggests that Arm Holdings' current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal