We Like The Quality Of Ricoh Company's (TSE:7752) Earnings

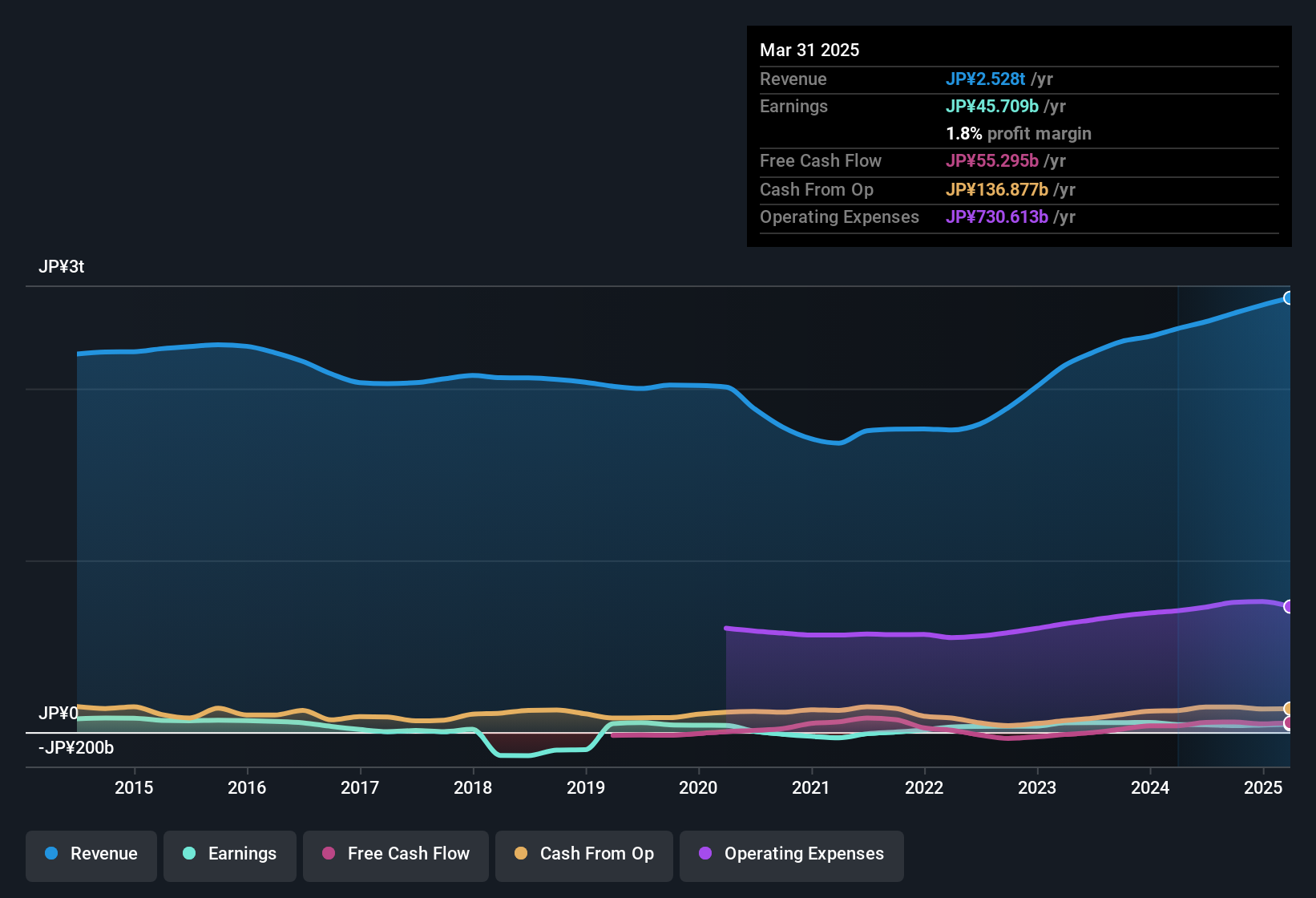

Ricoh Company, Ltd.'s (TSE:7752) solid earnings announcement recently didn't do much to the stock price. Our analysis suggests that shareholders might be missing some positive underlying factors in the earnings report.

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Ricoh Company's profit was reduced by JP¥25b, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Ricoh Company doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Ricoh Company's Profit Performance

Unusual items (expenses) detracted from Ricoh Company's earnings over the last year, but we might see an improvement next year. Based on this observation, we consider it likely that Ricoh Company's statutory profit actually understates its earnings potential! Better yet, its EPS are growing strongly, which is nice to see. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example - Ricoh Company has 2 warning signs we think you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Ricoh Company's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal