Nautilus Biotechnology Leads The Pack In Our Top 3 Penny Stocks

Over the last 7 days, the United States market has risen by 2.7%, and over the past year, it is up by 13%, with earnings expected to grow annually by 15% in the coming years. In light of these conditions, investors might find value in penny stocks—typically smaller or newer companies—that can offer growth opportunities when backed by strong financial health. Though considered a niche area today, penny stocks remain relevant for those seeking potential hidden value and long-term gains; here we explore three such stocks that combine balance sheet resilience with promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.35 | $488.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9265 | $148M | ✅ 4 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $95.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $3.66 | $376.5M | ✅ 3 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Flexible Solutions International (FSI) | $4.50 | $55.08M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8339 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.77 | $86.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Marine Petroleum Trust (MARP.S) | $4.43 | $8.76M | ✅ 1 ⚠️ 4 View Analysis > |

| TETRA Technologies (TTI) | $3.46 | $441.8M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 449 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Nautilus Biotechnology (NAUT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nautilus Biotechnology, Inc. is a development stage life sciences company focused on creating a platform technology to quantify and unlock the complexity of the proteome, with a market cap of approximately $100.09 million.

Operations: Nautilus Biotechnology has not reported any revenue segments.

Market Cap: $100.09M

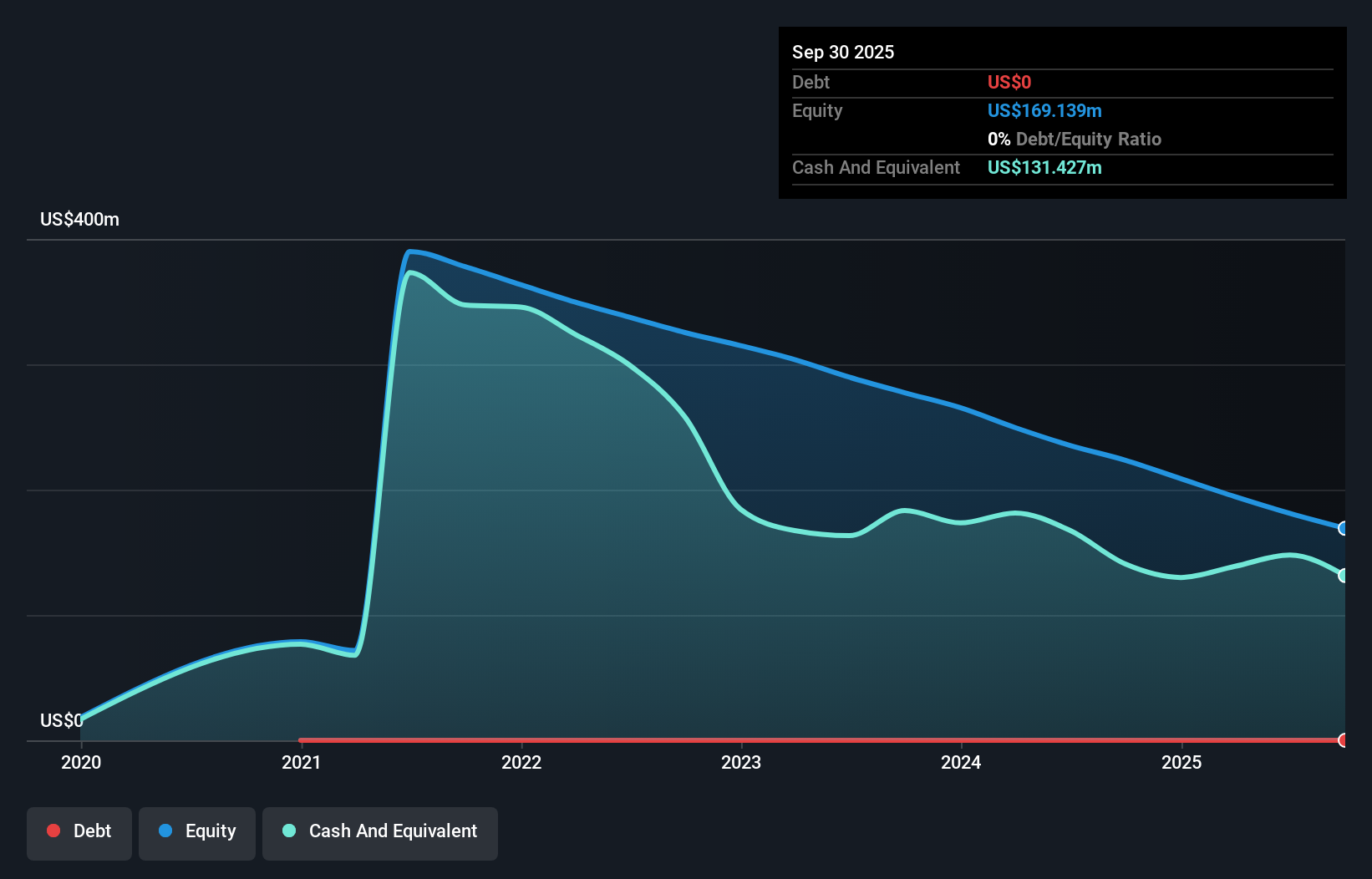

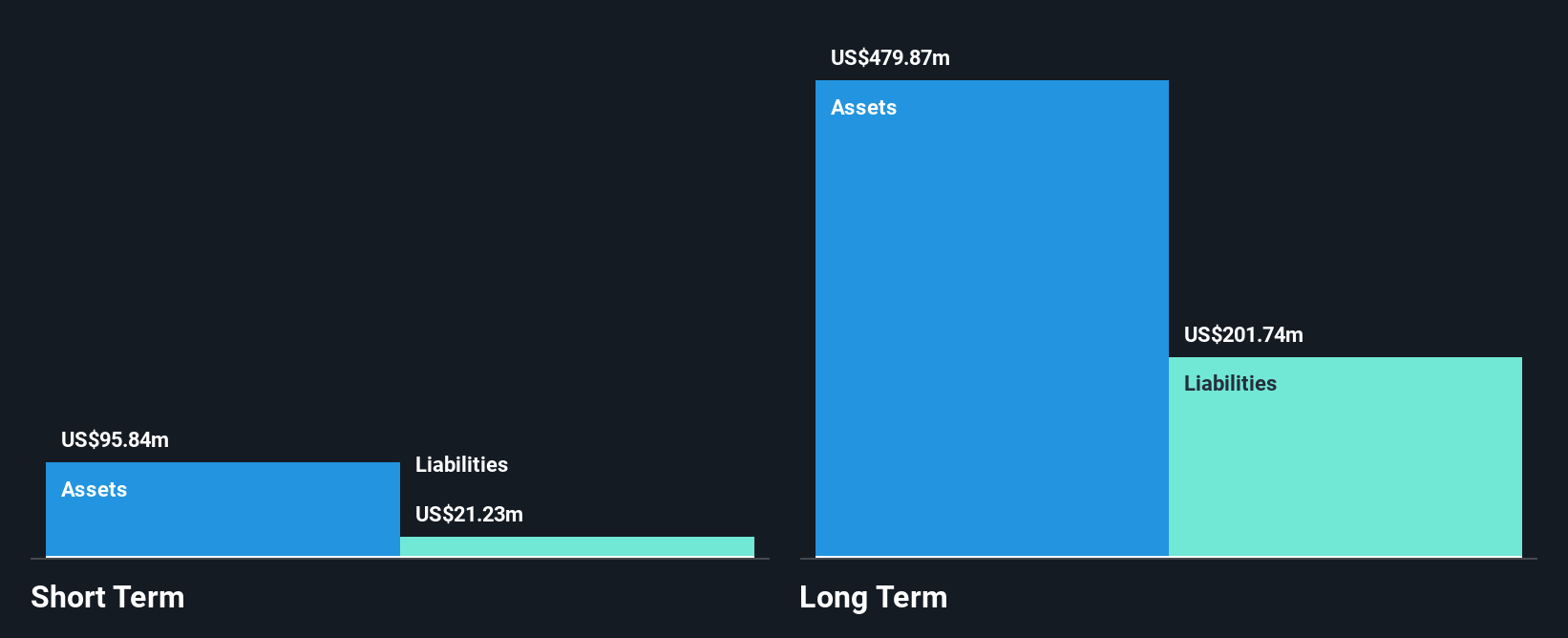

Nautilus Biotechnology, with a market cap of US$100.09 million, is a pre-revenue life sciences company facing challenges typical of penny stocks. It recently received notice from Nasdaq for not meeting the minimum bid price requirement but has until October 28, 2025, to regain compliance. Despite being debt-free and having short-term assets exceeding liabilities significantly (US$141.6 million vs. US$33.3 million), the company remains unprofitable with losses increasing at an annual rate of 20.5% over five years and no profitability forecast in the near term. Revenue is expected to grow substantially, yet earnings are projected to decline by 8.5% annually over three years.

- Jump into the full analysis health report here for a deeper understanding of Nautilus Biotechnology.

- Assess Nautilus Biotechnology's future earnings estimates with our detailed growth reports.

BARK (BARK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BARK, Inc. is a dog-centric company offering products, services, and content for dogs with a market cap of approximately $144.50 million.

Operations: The company's revenue is derived from two primary segments: Commerce, which generated $68.35 million, and Direct to Consumer, contributing $415.84 million.

Market Cap: $144.5M

BARK, Inc., with a market cap of US$144.50 million, is navigating the challenges typical of penny stocks with a focus on dog-centric products and services. Despite being unprofitable and not expected to achieve profitability in the next three years, BARK has shown financial improvements; its short-term assets exceed both short-term and long-term liabilities significantly. Recent earnings revealed a slight decline in sales to US$484.18 million for the year ended March 31, 2025, while losses have narrowed compared to the previous year. The company anticipates lower first-quarter revenue due to reduced marketing efforts amid uncertain macro conditions.

- Click here and access our complete financial health analysis report to understand the dynamics of BARK.

- Learn about BARK's future growth trajectory here.

Seritage Growth Properties (SRG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Seritage Growth Properties is a company focused on the ownership, development, redevelopment, management, sale and leasing of diversified retail and mixed-use properties across the United States with a market cap of approximately $165.59 million.

Operations: The company's revenue segment primarily involves real estate properties, which generated -$3.41 million.

Market Cap: $165.59M

Seritage Growth Properties, with a market cap of US$165.59 million, is navigating the complexities of penny stocks in the real estate sector. Despite ongoing unprofitability and declining earnings over five years, its short-term assets of US$123.1 million exceed short-term liabilities significantly but fall short against long-term liabilities of US$240 million. The company has reduced its debt substantially from 157.9% to 62.8% over five years and recently made a voluntary prepayment on its term loan facility, reducing annual interest expenses by approximately US$99.4 million since December 2021 while pursuing a strategic Plan of Sale reducing its portfolio to 15 assets from approximately 160 since March 2022.

- Click to explore a detailed breakdown of our findings in Seritage Growth Properties' financial health report.

- Review our historical performance report to gain insights into Seritage Growth Properties' track record.

Summing It All Up

- Investigate our full lineup of 449 US Penny Stocks right here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal