Top UK Penny Stocks To Watch In June 2025

The UK market has been facing challenges, with the FTSE 100 and FTSE 250 indices recently experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery. Amid these broader market movements, investors often look for opportunities in less conventional areas like penny stocks. Although the term 'penny stock' might seem outdated, these smaller or newer companies can offer unique investment potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.20 | £297.66M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.08 | £458.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.22 | £340.92M | ✅ 5 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.84 | £1.14B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.44 | £47.61M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.47 | £430.93M | ✅ 2 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.11 | £320.37M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.085 | £173.09M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.80 | £11.01M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.21 | £68.76M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 299 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Springfield Properties (AIM:SPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Springfield Properties Plc, with a market cap of £123.21 million, operates in the United Kingdom's house building industry through its subsidiaries.

Operations: The company generates revenue of £250.48 million from its housing building activity in the UK.

Market Cap: £123.21M

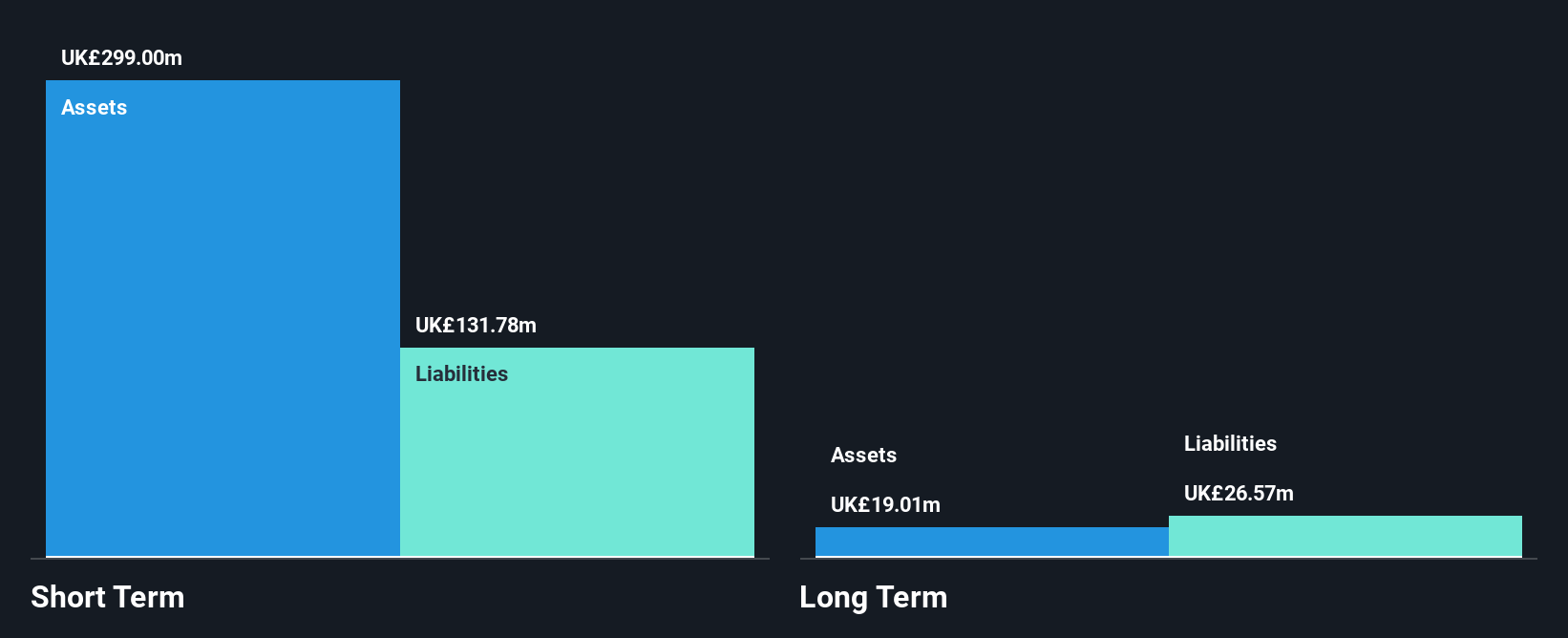

Springfield Properties, with a market cap of £123.21 million, operates in the UK house building sector and generated £250.48 million in revenue. The company has not diluted shareholders recently and maintains a satisfactory net debt to equity ratio of 39.4%. Its short-term assets comfortably cover both short and long-term liabilities, although interest coverage is minimal at 3x EBIT. Despite low return on equity at 5.7%, earnings grew by 9.9% last year, surpassing industry averages, though future earnings are forecast to decline by an average of 5.5% annually over the next three years.

- Get an in-depth perspective on Springfield Properties' performance by reading our balance sheet health report here.

- Gain insights into Springfield Properties' future direction by reviewing our growth report.

Liontrust Asset Management (LSE:LIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liontrust Asset Management Plc is a publicly owned investment manager with a market cap of £238.40 million.

Operations: The company generates revenue primarily from its Investment Management segment, amounting to £169.79 million.

Market Cap: £238.4M

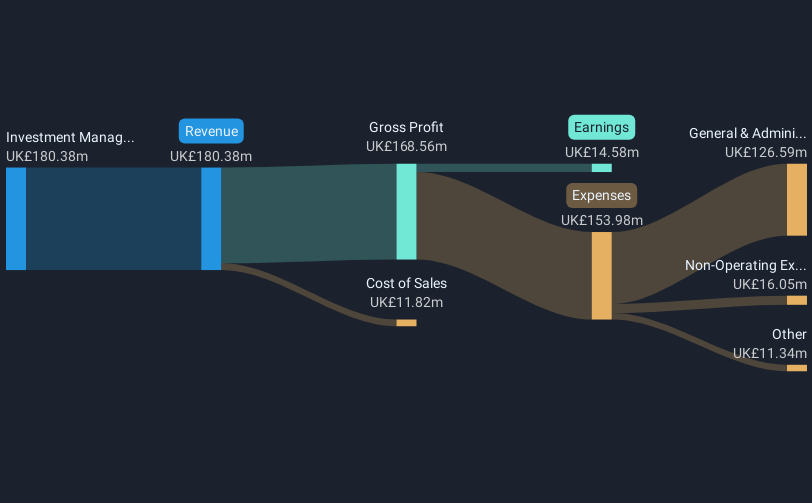

Liontrust Asset Management, with a market cap of £238.40 million, has shown a turnaround by becoming profitable this year with net income reaching £16.7 million, compared to a loss previously. Despite the improvement in earnings per share to GBP 0.262, the company faces challenges such as significant insider selling and an unsustainable dividend yield of 18.95%. The company's short-term assets exceed its liabilities, and it remains debt-free for five years. However, past earnings growth has been negative at 11.4% annually over five years despite recent profitability improvements driven by large one-off losses impacting results.

- Dive into the specifics of Liontrust Asset Management here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Liontrust Asset Management's future.

ME Group International (LSE:MEGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ME Group International plc operates, sells, and services a variety of instant-service equipment in the United Kingdom, with a market cap of £861.90 million.

Operations: The company generates £307.89 million in revenue from its Personal Services - Others segment.

Market Cap: £861.9M

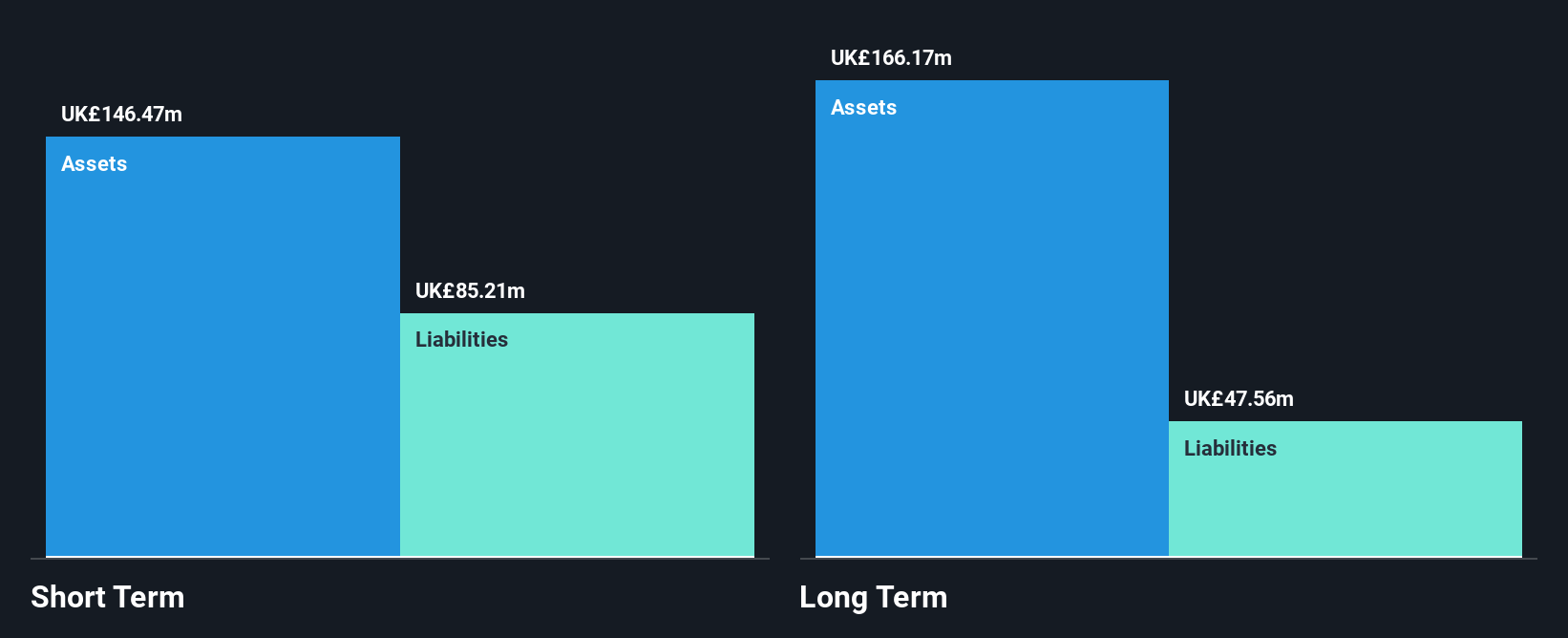

ME Group International, with a market cap of £861.90 million, has demonstrated financial stability by reducing its debt to equity ratio from 44.8% to 26.7% over five years and maintaining more cash than total debt. The company's short-term assets exceed both its short and long-term liabilities, indicating strong liquidity. Despite a dividend yield that is not well covered by free cash flows, MEGP's earnings have grown significantly at 28.1% annually over the past five years but slowed to 6.8% last year. Recent strategic considerations may impact future shareholder value as the company explores potential acquisition offers without any firm proposals yet announced.

- Jump into the full analysis health report here for a deeper understanding of ME Group International.

- Evaluate ME Group International's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 299 UK Penny Stocks by clicking here.

- Searching for a Fresh Perspective? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal