ASX Penny Stocks Spotlight: Arafura Rare Earths And Two More To Consider

The Australian market has been experiencing a mixed performance, with the ASX200 trading flat and sectors like Health Care and Financials showing strength, while IT, Real Estate, and Industrials faced sell-offs. In such a fluctuating landscape, investors often seek opportunities in smaller or newer companies that might offer unexpected value. Penny stocks—despite their somewhat outdated name—represent this niche, where solid financial foundations can lead to significant returns. This article explores three penny stocks that exemplify financial resilience and potential for growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.40 | A$113.22M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$118.24M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.79 | A$430.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.76 | A$465.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.60 | A$848.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$352.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.655 | A$811.08M | ✅ 5 ⚠️ 3 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.705 | A$223.65M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.47 | A$164.65M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.755 | A$141.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 470 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Arafura Rare Earths (ASX:ARU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arafura Rare Earths Limited is involved in the exploration and development of mineral properties in Australia, with a market cap of A$431.26 million.

Operations: Currently, there are no reported revenue segments for Arafura Rare Earths Limited.

Market Cap: A$431.26M

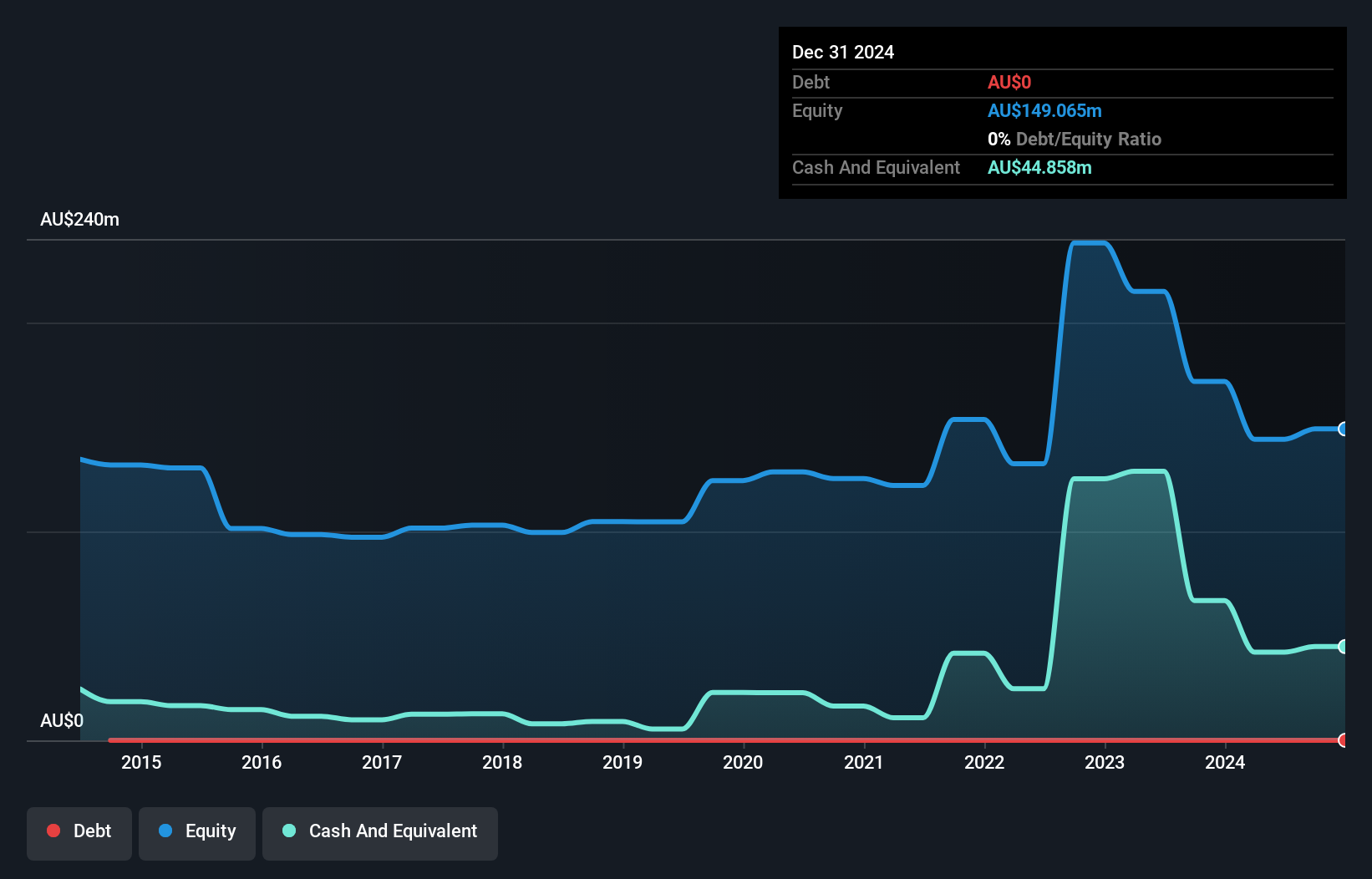

Arafura Rare Earths, with a market cap of A$431.26 million, remains pre-revenue and unprofitable, facing challenges such as an inexperienced board and management team. Despite this, the company maintains a debt-free status and has sufficient short-term assets (A$45.5M) to cover liabilities. Recent capital raised through private placements extends its cash runway beyond 10 months, although it still lacks profitability forecasts for the next three years. The appointment of experienced secretaries aims to strengthen governance amidst stable weekly volatility in stock performance over the past year (9%).

- Dive into the specifics of Arafura Rare Earths here with our thorough balance sheet health report.

- Gain insights into Arafura Rare Earths' future direction by reviewing our growth report.

Conrad Asia Energy (ASX:CRD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Conrad Asia Energy Ltd., along with its subsidiaries, is involved in oil and gas exploration and development, with a market cap of A$125.04 million.

Operations: Conrad Asia Energy Ltd. has not reported any specific revenue segments.

Market Cap: A$125.04M

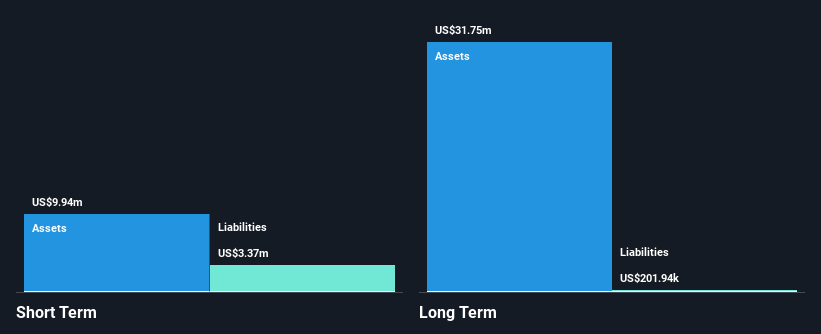

Conrad Asia Energy Ltd., with a market cap of A$125.04 million, is pre-revenue and currently unprofitable, having reported a net loss of US$7.61 million for 2024. Despite this, it remains debt-free and its short-term assets (US$4.5M) comfortably exceed both short- and long-term liabilities. The company recently raised A$9 million through follow-on equity offerings to bolster its cash runway beyond the initial three months forecasted based on free cash flow estimates. However, an auditor expressed doubt about its ability to continue as a going concern, highlighting significant risks associated with investing in this stock category.

- Get an in-depth perspective on Conrad Asia Energy's performance by reading our balance sheet health report here.

- Gain insights into Conrad Asia Energy's outlook and expected performance with our report on the company's earnings estimates.

Immutep (ASX:IMM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Immutep Limited is a late-stage biotechnology company focused on developing novel LAG-3 related immunotherapies for cancer and autoimmune diseases in Australia, with a market cap of A$357.80 million.

Operations: The company generates revenue from its immunotherapy segment, amounting to A$4.88 million.

Market Cap: A$357.8M

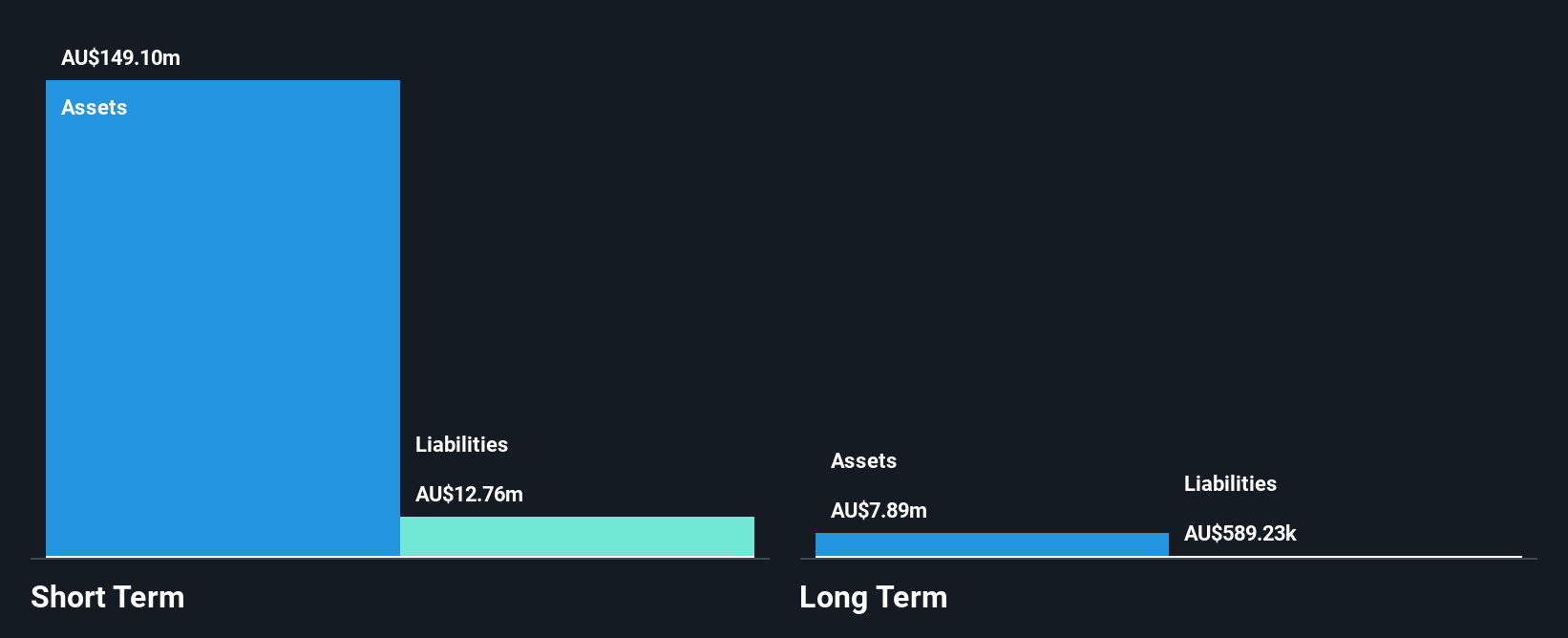

Immutep Limited, with a market cap of A$357.80 million, is a pre-revenue biotechnology firm focusing on LAG-3 related immunotherapies. Recent announcements highlight promising data from its Phase I and II trials for IMP761 and eftilagimod alfa (efti), targeting autoimmune diseases and various cancers, respectively. The company has sufficient cash runway for over three years despite being unprofitable, supported by strong short-term assets exceeding liabilities. Immutep's management team is experienced, and the company has reduced its debt significantly over five years while maintaining stable shareholder equity without dilution in the past year.

- Click here to discover the nuances of Immutep with our detailed analytical financial health report.

- Learn about Immutep's future growth trajectory here.

Summing It All Up

- Jump into our full catalog of 470 ASX Penny Stocks here.

- Contemplating Other Strategies? These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal