Duolingo (NasdaqGS:DUOL) Sees 27% Stock Price Rise Over Last Quarter

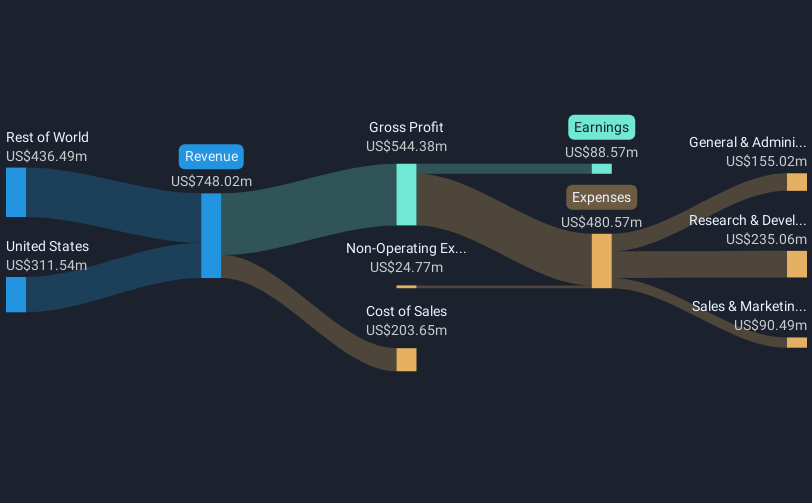

Duolingo (NasdaqGS:DUOL) has recently announced first-quarter earnings results, showcasing a notable increase in both sales and net income compared to the previous year. This, along with the launch of 148 new language courses, represents a significant positive development for the company. During the last quarter, Duolingo's stock saw a price increase of 27%, a substantial rise compared to the market's modest growth. The company's strategic expansion into new linguistic offerings likely aligned well with investor expectations, particularly given the broader market's continued appetite for growth stocks. This blend of strong earnings and innovative product development positions Duolingo favorably among its peers.

Every company has risks, and we've spotted 1 weakness for Duolingo you should know about.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

The recent announcement of Duolingo's strong first-quarter earnings and launch of numerous new language courses aligns well with its ongoing strategy of diversifying offerings and enhancing user engagement through diverse content. This initiative, coupled with its application of generative AI, is likely driving both user growth and operational efficiency. However, the news could affect revenue and earnings forecasts positively, by potentially accelerating subscriber growth and increasing profitability, though revenue growth might not be immediate from new courses alone.

Over the past three years, Duolingo's total shareholder return, including dividends, was 370.81%, underscoring significant investor interest and strong market performance. This long-term growth outpaces the market's average one-year return of 12.2% and the Consumer Services industry's 24% return over the same period. This exceptional performance set a high hurdle for continued momentum.

Currently, Duolingo's share price is slightly below the consensus analyst price target of US$508.56, emphasizing a perceived fair valuation by analysts relative to its current US$490.55 share price. The positive market reaction to recent developments suggests optimism, yet the analyst consensus expects a modest reduction in share price to US$447.86, reflecting some caution around future growth assumptions. Investors might need to weigh these projections against the company's growth strategies and market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal