BlackRock (NYSE:BLK) Launches iShares Texas Equity ETF Capitalising On Texas Economic Momentum

BlackRock (NYSE:BLK) recently launched the iShares Texas Equity ETF, a new investment product tapping into Texas’s robust economy. This announcement underscores the company's commitment to exploring growth opportunities in diverse economic environments. Over the last month, BlackRock's stock price increased by 4%, outpacing the broader market's 2% climb over the recent week. While the ETF launch highlighted growth potential, market momentum likely contributed significantly to this price movement. Additionally, BlackRock's engagement in discussions for potential acquisitions, such as its involvement with Circle Internet Group, may have added weight to the positive sentiment around its future prospects.

BlackRock has 1 weakness we think you should know about.

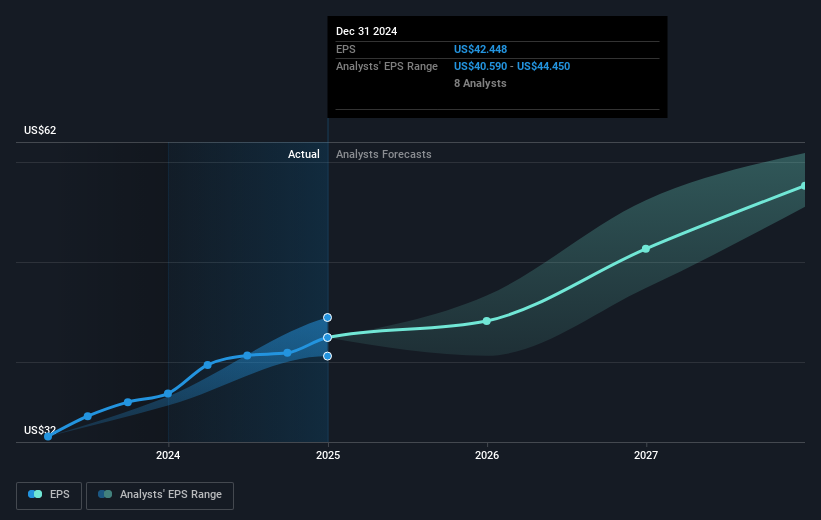

The introduction of BlackRock's iShares Texas Equity ETF highlights the firm's focus on diversified growth in vibrant economic settings. This move could influence the company's revenue and earnings forecasts, especially given the strong demand for innovative ETFs. In context, BlackRock's total shareholder return over the past five years reached 108.46%, suggesting robust long-term performance. While this growth is impressive, BlackRock's 1-year return underperformed the US Capital Markets industry, which achieved a 30.9% return, highlighting some short-term challenges relative to peers.

The share price climb of 4% during the past month against a backdrop of discussions regarding potential acquisitions and ETF launches aligns closely with BlackRock's broader expansion strategies. Despite recent positive price movements, the current share price remains approximately 10.6% below the consensus analyst price target of US$1,023.32, suggesting further potential upside as the company continues to focus on growth in private markets, ETFs, and international ventures. The recent developments could bolster revenue growth and alter earnings projections, given BlackRock's aims to enhance efficiency through technology and broaden its asset base. However, execution will be crucial amidst potential risks from geopolitical tensions and inflationary pressures.

Learn about BlackRock's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal