Carnival Corporation & (NYSE:CCL) Reports Strong Q2 Earnings With US$565 Million Net Income

Carnival Corporation & (NYSE:CCL) recently reported a significant earnings improvement, with sales and net income rising sharply year-over-year for the second quarter and first half of 2025. The company's share price increased by 24% over the last quarter, partly reflecting the positive financial results. Additionally, the launch of a new $4.5 billion revolving credit facility underscores strong banking relationships and confidence in Carnival's improved business performance. While the broader market climbed 1.9% in the last week and gained 12% over the past year, Carnival's initiatives in debt management and product offerings added weight to its upward trajectory.

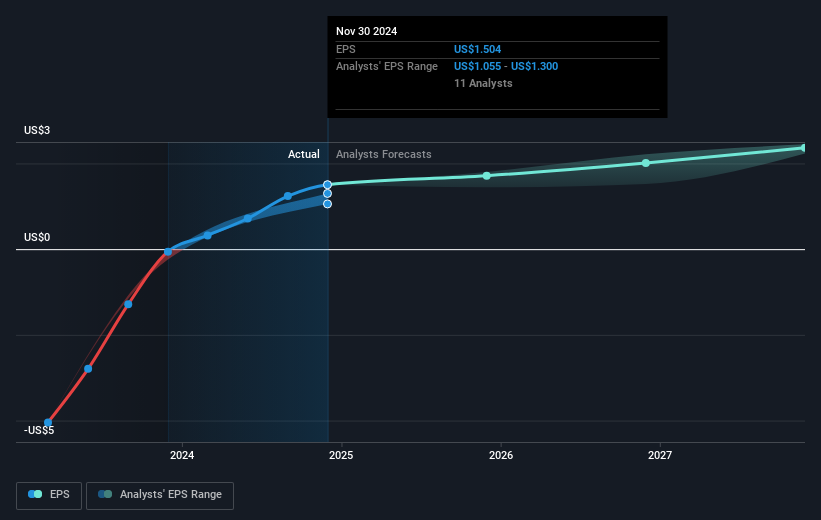

The recent financial strides by Carnival Corporation, with its share price soaring 24% in the latest quarter, signal a profound transformation that could reshape future narratives around the company. The bolstered earnings and strengthened banking alliances are poised to reinforce investor confidence, augmenting both revenue and earnings forecasts. With a projected revenue of $25.97 billion and earnings of $2.53 billion, the company's initiatives in debt refinancing and destination expansion are expected to solidify its financial footing. However, potential risks like macroeconomic volatility could still impact these outcomes.

Over a longer three-year period, Carnival's total return, including share price and dividends, amounted to a considerable 189.74%. This starkly contrasts the broader market's more modest gains of 12.2% over the past year. Within the hospitality industry, Carnival's performance remains noteworthy, surpassing the industry's 18% return over the same one-year timeframe. Such robust growth highlights the company's evolving market stance and the positive reception to its enhanced product offerings and financial reforms.

Despite recent advances, Carnival's share price of US$19.53 remains below the analyst consensus price target of US$27.65, indicating a potential upside of 29.4%. This gap underscores the market's cautious optimism and the necessity for Carnival to maintain its momentum in executing its growth and cost-reduction strategies efficiently. While the potential for further appreciation is apparent, it remains contingent on future operational successes and external economic conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal