Exploring Undiscovered Gems In Canada With Strong Potential

As the Canadian market navigates a landscape marked by steady interest rates and geopolitical uncertainties, small-cap stocks are drawing attention for their potential resilience and growth opportunities. In this environment, identifying stocks with strong fundamentals and adaptability can be key to uncovering hidden gems that may thrive despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 11.60% | 32.30% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

| Lithium Chile | NA | nan | 53.15% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Alphamin Resources (TSXV:AFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Alphamin Resources Corp. is involved in the production and sale of tin concentrate, with a market capitalization of approximately CA$1.06 billion.

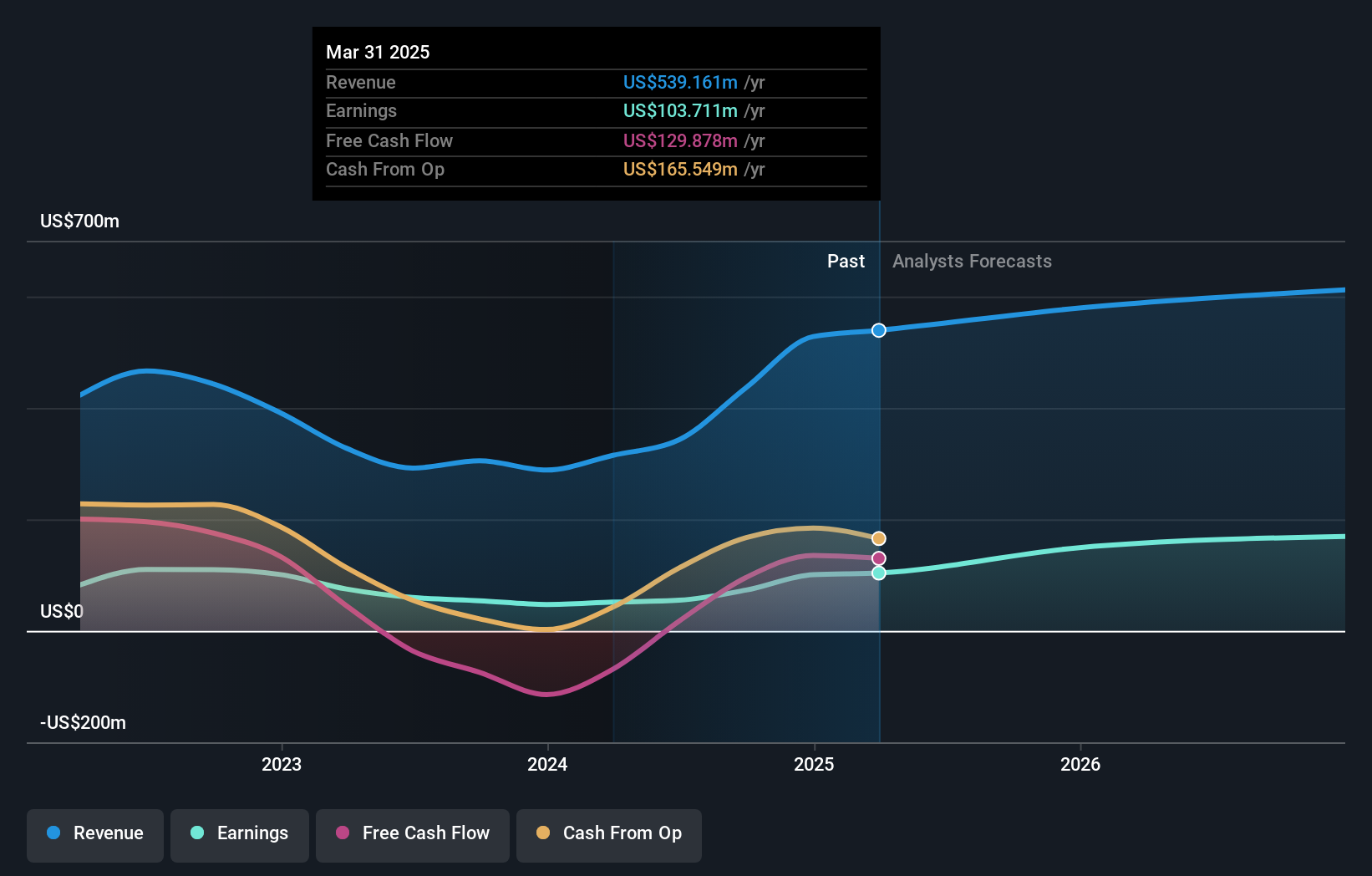

Operations: Alphamin Resources generates revenue primarily from the production and sale of tin concentrate, with reported revenues of $539.16 million.

Alphamin Resources, a nimble player in the mining sector, has seen earnings grow by 101% over the past year, outpacing the industry average of 37%. Despite recent operational hiccups due to security issues in DRC, their Bisie tin mine is back online with production resuming at full throttle. The company boasts a solid financial footing with cash exceeding total debt and interest payments well covered by EBIT at 44.5 times. Trading at 38% below its estimated fair value and having reduced its debt-to-equity ratio from 55% to 16% over five years, Alphamin presents an intriguing investment opportunity amidst ongoing challenges.

- Navigate through the intricacies of Alphamin Resources with our comprehensive health report here.

Assess Alphamin Resources' past performance with our detailed historical performance reports.

Elemental Altus Royalties (TSXV:ELE)

Simply Wall St Value Rating: ★★★★★★

Overview: Elemental Altus Royalties Corp. focuses on acquiring and generating precious metal royalties, with a market capitalization of CA$442.37 million.

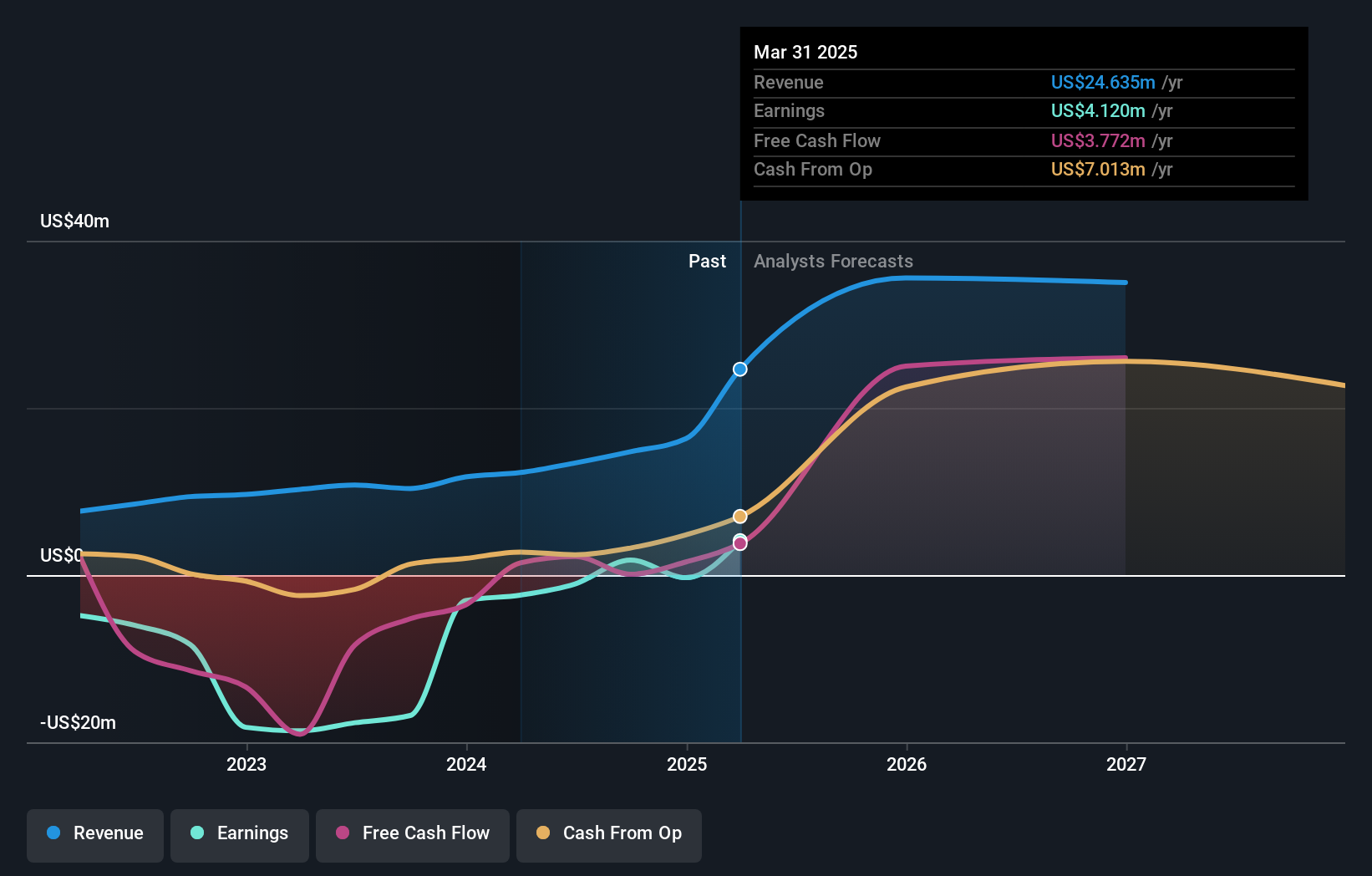

Operations: Elemental Altus Royalties generates revenue primarily through the acquisition of royalties, streams, and similar production-based interests, amounting to $24.64 million.

Elemental Altus Royalties, a small cap player in the royalty sector, has shown notable financial improvements. The company recently reported revenue of US$11.64 million for Q1 2025, significantly up from US$3.33 million the previous year, with net income reaching US$3.45 million compared to a net loss of US$1.01 million before. Additionally, Elemental's production results reveal an impressive 102% increase in Attributable Gold Equivalent Ounces to 4,606 ounces over the same period last year. With no debt and high-quality earnings now characterizing its profile, this firm is trading at a substantial discount of 45% below estimated fair value.

Valeura Energy (TSX:VLE)

Simply Wall St Value Rating: ★★★★★★

Overview: Valeura Energy Inc. operates in the exploration, development, and production of petroleum and natural gas in Thailand and Turkey, with a market capitalization of CA$782.20 million.

Operations: Valeura Energy generates revenue primarily from its oil and gas exploration and production segment, amounting to $682.54 million.

Valeura Energy, a Canadian oil and gas player, has recently completed an eight-well drilling campaign in the Gulf of Thailand, exceeding expectations with double the pre-drill estimates for total oil pay. The company reported net income of US$14 million for Q1 2025, down from US$19 million a year ago. Earnings per share stood at US$0.13 compared to last year's US$0.18. Valeura's debt-free status and significant earnings growth of 699% over the past year highlight its operational strength despite forecasted declines in earnings by an average of 70% annually over the next three years.

Next Steps

- Investigate our full lineup of 44 TSX Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal