Expensify Leads Our Trio Of Penny Stock Picks

Over the last 7 days, the United States market has risen 1.9%, and it's up 12% over the last year, with earnings forecasted to grow by 14% annually. For investors exploring smaller or newer companies, penny stocks—despite their somewhat outdated name—can still offer surprising value when they possess solid financial foundations. In this article, we explore several penny stocks that demonstrate financial strength and potential for long-term growth.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.39 | $502.71M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.929 | $164.51M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.16 | $219.99M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $94.77M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $3.72 | $380.59M | ✅ 3 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Flexible Solutions International (FSI) | $4.37 | $55.27M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8348 | $6.06M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.97 | $88.98M | ✅ 3 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.45 | $459.1M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 446 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Expensify (EXFY)

Simply Wall St Financial Health Rating: ★★★★★★

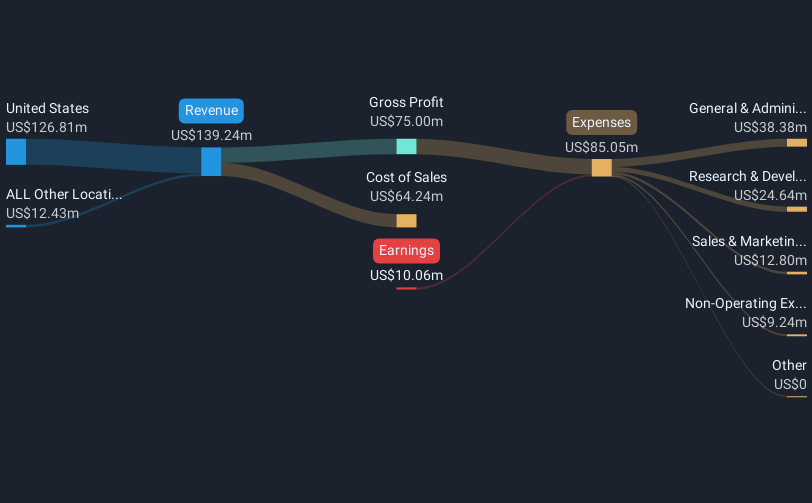

Overview: Expensify, Inc. offers a cloud-based expense management software platform serving both the United States and international markets, with a market cap of $230.08 million.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, totaling $141.78 million.

Market Cap: $230.08M

Expensify, Inc., with a market cap of US$230.08 million, presents a mixed picture for penny stock investors. The company reported first-quarter 2025 sales of US$36.07 million, an increase from the previous year, but remains unprofitable with a net loss of US$3.17 million. Despite this, Expensify maintains a strong cash position and is debt-free, providing stability in its financial runway for over three years even as free cash flow declines slightly each year. Recent strategic moves include new pricing plans aimed at increasing adoption among small to medium-sized businesses and potentially driving future revenue growth.

- Get an in-depth perspective on Expensify's performance by reading our balance sheet health report here.

- Evaluate Expensify's prospects by accessing our earnings growth report.

Grab Holdings (GRAB)

Simply Wall St Financial Health Rating: ★★★★★☆

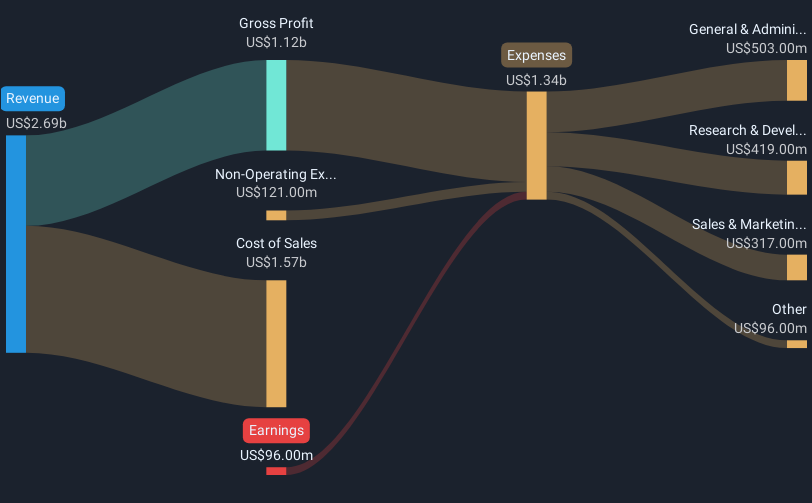

Overview: Grab Holdings Limited operates as a superapp provider across Southeast Asia, offering various services including ride-hailing, food delivery, and digital payments in countries such as Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam; it has a market capitalization of approximately $19.55 billion.

Operations: The company's revenue is primarily derived from three segments: Deliveries generating $1.56 billion, Mobility contributing $1.08 billion, and Financial Services adding $273 million.

Market Cap: $19.55B

Grab Holdings Limited, with a market cap of US$19.55 billion, offers potential for penny stock investors due to its recent profitability and diverse revenue streams across Deliveries, Mobility, and Financial Services. The company reported a first-quarter 2025 net income of US$10 million compared to a loss the previous year. While Grab's debt is well-covered by operating cash flow, its return on equity remains low at -0.5%. Recent developments include discussions about acquiring GoTo Group for US$7 billion and a new fixed-income offering worth US$1.25 billion, which could impact future financial stability and growth prospects.

- Take a closer look at Grab Holdings' potential here in our financial health report.

- Review our growth performance report to gain insights into Grab Holdings' future.

DiDi Global (DIDI.Y)

Simply Wall St Financial Health Rating: ★★★★★☆

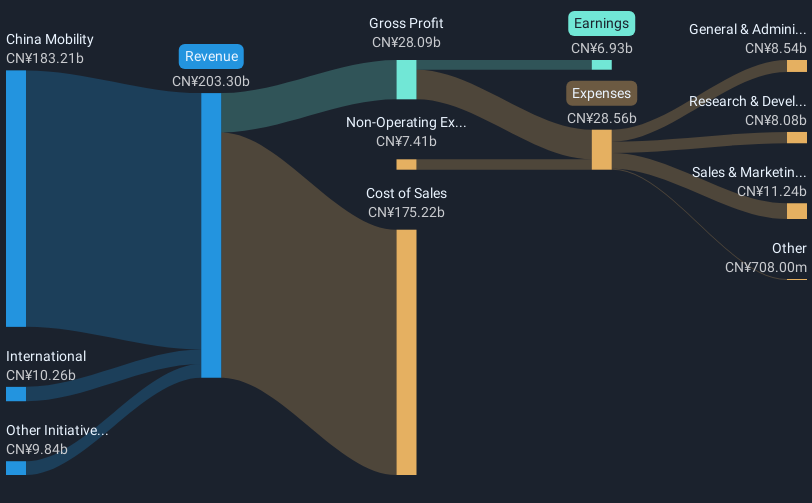

Overview: DiDi Global Inc. operates a mobility technology platform offering diverse services in China, Brazil, Mexico, and other international markets, with a market cap of approximately $22.77 billion.

Operations: The company's revenue is primarily derived from China Mobility at CN¥185.74 billion, followed by International operations at CN¥11.04 billion and Other Initiatives contributing CN¥10.01 billion.

Market Cap: $22.77B

DiDi Global Inc., with a market cap of approximately $22.77 billion, presents an intriguing option for penny stock investors due to its recent transition to profitability and strong financial position. The company benefits from substantial revenue streams primarily in China, complemented by international operations. DiDi's short-term assets significantly exceed both its short- and long-term liabilities, indicating robust liquidity. Recent activities include a substantial share buyback program totaling $956.21 million, reflecting management's confidence in the company's valuation. However, despite these positive indicators, DiDi's return on equity remains low at 1.3%, warranting cautious optimism for potential investors.

- Jump into the full analysis health report here for a deeper understanding of DiDi Global.

- Explore DiDi Global's analyst forecasts in our growth report.

Make It Happen

- Embark on your investment journey to our 446 US Penny Stocks selection here.

- Looking For Alternative Opportunities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal