BigBear.ai Holdings, Inc. (NYSE:BBAI) Stock Rockets 44% As Investors Are Less Pessimistic Than Expected

BigBear.ai Holdings, Inc. (NYSE:BBAI) shares have continued their recent momentum with a 44% gain in the last month alone. The last month tops off a massive increase of 276% in the last year.

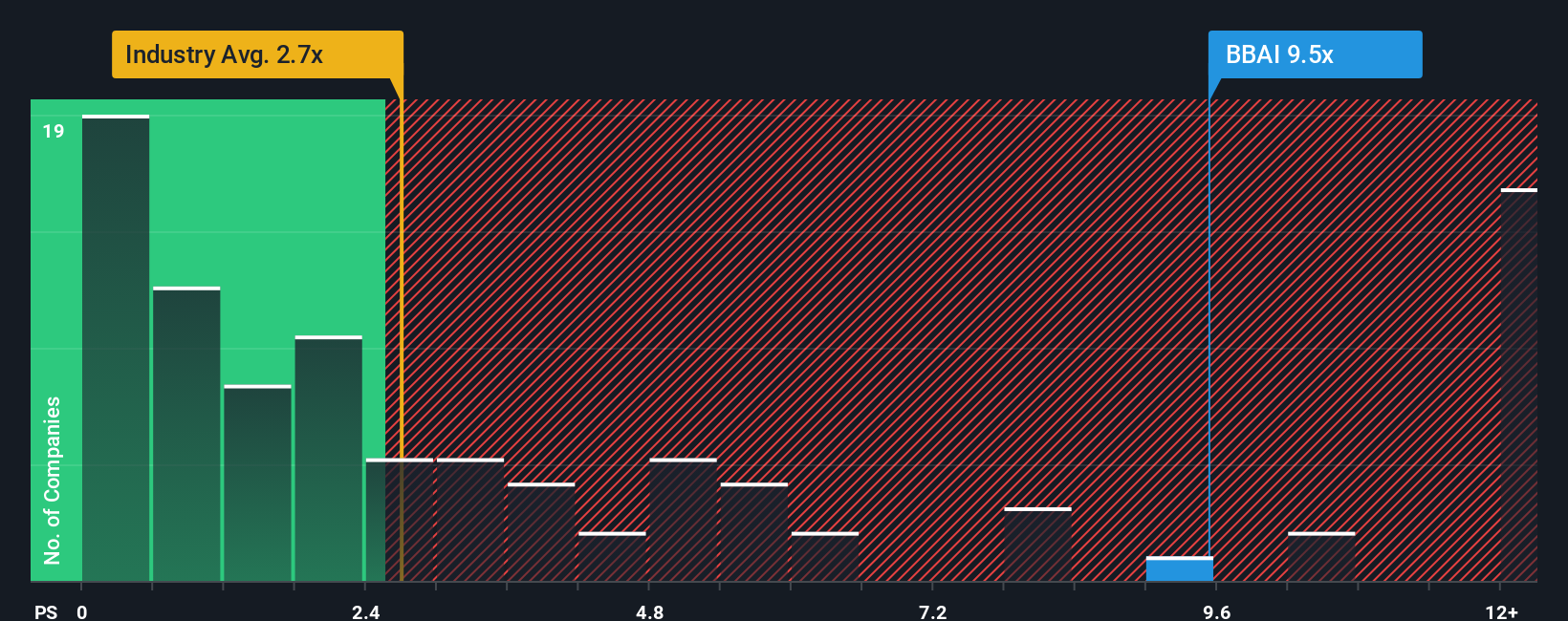

After such a large jump in price, you could be forgiven for thinking BigBear.ai Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.5x, considering almost half the companies in the United States' IT industry have P/S ratios below 2.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for BigBear.ai Holdings

What Does BigBear.ai Holdings' Recent Performance Look Like?

BigBear.ai Holdings could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BigBear.ai Holdings.Is There Enough Revenue Growth Forecasted For BigBear.ai Holdings?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like BigBear.ai Holdings' to be considered reasonable.

Retrospectively, the last year delivered a decent 9.4% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 9.2% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 8.2% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 24%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that BigBear.ai Holdings' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On BigBear.ai Holdings' P/S

BigBear.ai Holdings' P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for BigBear.ai Holdings, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 4 warning signs for BigBear.ai Holdings you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal