Sumec And 2 Other Undiscovered Gems In Asia With Strong Potential

As global markets navigate a landscape of mixed economic signals and geopolitical tensions, small-cap stocks have shown resilience, with smaller-cap indexes outperforming larger counterparts in recent weeks. In this context, identifying promising opportunities requires a keen eye for companies that demonstrate robust fundamentals and adaptability amidst fluctuating conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Advancetek EnterpriseLtd | 43.92% | 38.91% | 59.75% | ★★★★★★ |

| Subaru Enterprise | NA | 2.03% | 4.77% | ★★★★★★ |

| Pro-Hawk | 10.92% | -8.48% | -3.47% | ★★★★★★ |

| BBK Test Systems | NA | 10.95% | 9.12% | ★★★★★★ |

| Shenyang Yuanda Intellectual Industry GroupLtd | NA | 10.83% | 32.79% | ★★★★★★ |

| Shenzhen Keanda Electronic Technology | 3.18% | -5.89% | -13.61% | ★★★★★☆ |

| Firich Enterprises | 32.65% | -1.31% | 35.54% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 27.20% | 20.30% | -23.01% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Sumec (SHSE:600710)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumec Corporation Limited operates in the supply and industrial chain business in China, with a market capitalization of CN¥13.11 billion.

Operations: The company generates revenue through its supply and industrial chain operations in China.

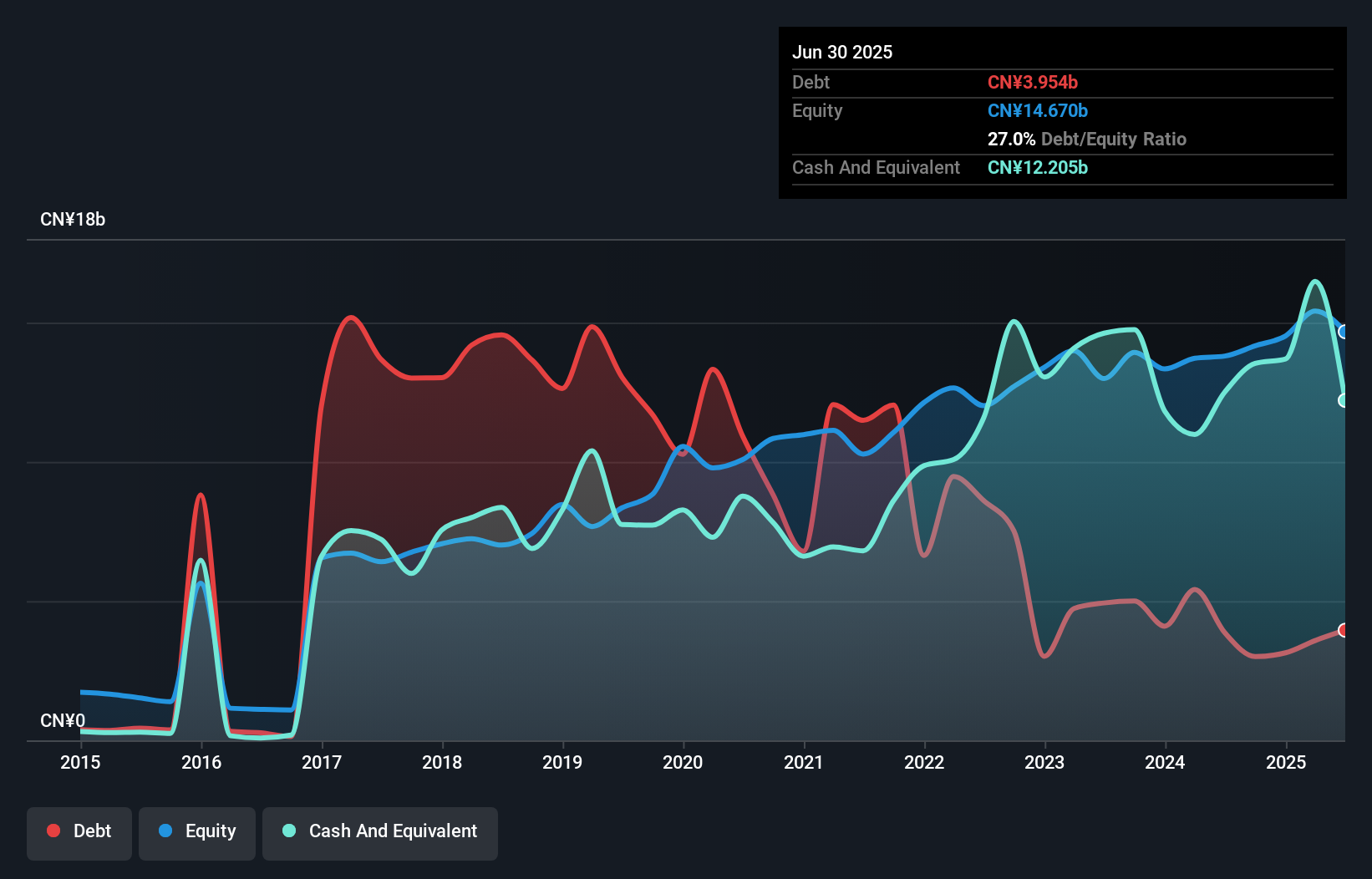

Sumec, a promising player in the Asian market, has demonstrated strong financial health with its debt to equity ratio improving from 136.2% to 23.2% over five years. The company's earnings growth of 12.6% outpaces the Trade Distributors industry average of -21.8%, indicating robust performance. Trading at 91.8% below estimated fair value, it offers significant potential for investors seeking undervalued opportunities. Recent results show net income rising to CNY 293 million from CNY 267 million year-on-year, and basic earnings per share increasing to CNY 0.22 from CNY 0.20, reflecting consistent profitability and growth prospects ahead.

- Navigate through the intricacies of Sumec with our comprehensive health report here.

Gain insights into Sumec's historical performance by reviewing our past performance report.

Shanghai Shunho New Materials TechnologyLtd (SZSE:002565)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Shunho New Materials Technology Co., Ltd. operates in the new materials industry, focusing on innovative material solutions, with a market cap of CN¥6.50 billion.

Operations: Shunho New Materials generates its revenue primarily from the sale of innovative materials. The company has reported a gross profit margin of 27.5% in recent periods, indicating its ability to manage production costs relative to sales effectively.

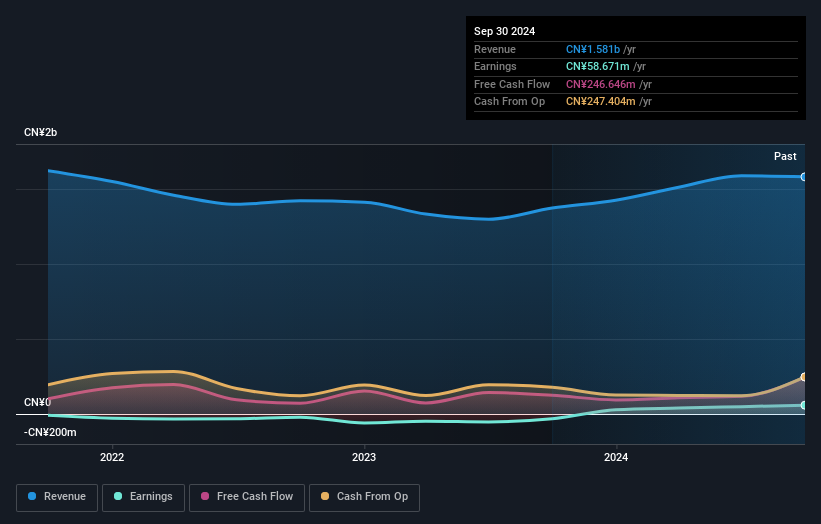

Shanghai Shunho New Materials Technology, a relatively small player in its sector, has been trading at 52.5% below its estimated fair value, suggesting potential undervaluation. The company recently reported a net income of CNY 13 million for Q1 2025, down from CNY 20 million the previous year, with basic earnings per share dropping to CNY 0.0126 from CNY 0.0185. Despite this dip in earnings growth of -1.4%, Shunho's debt-to-equity ratio improved significantly over five years from 15% to just under 7%. Additionally, the firm completed a buyback of approximately 2.7% of shares for CNY100 million by May this year and announced dividends amounting to CNY0.40 per ten shares for fiscal year-end distribution.

Dynapack International Technology (TPEX:3211)

Simply Wall St Value Rating: ★★★★★★

Overview: Dynapack International Technology Corporation specializes in the production and distribution of lithium-ion battery packs across Taiwan, the United States, and other global markets with a market cap of NT$31.66 billion.

Operations: Dynapack's primary revenue stream is derived from the production and sales of hammer battery packs, contributing NT$12.85 billion. The company's financial performance reflects a focus on this segment, which plays a significant role in its overall market presence.

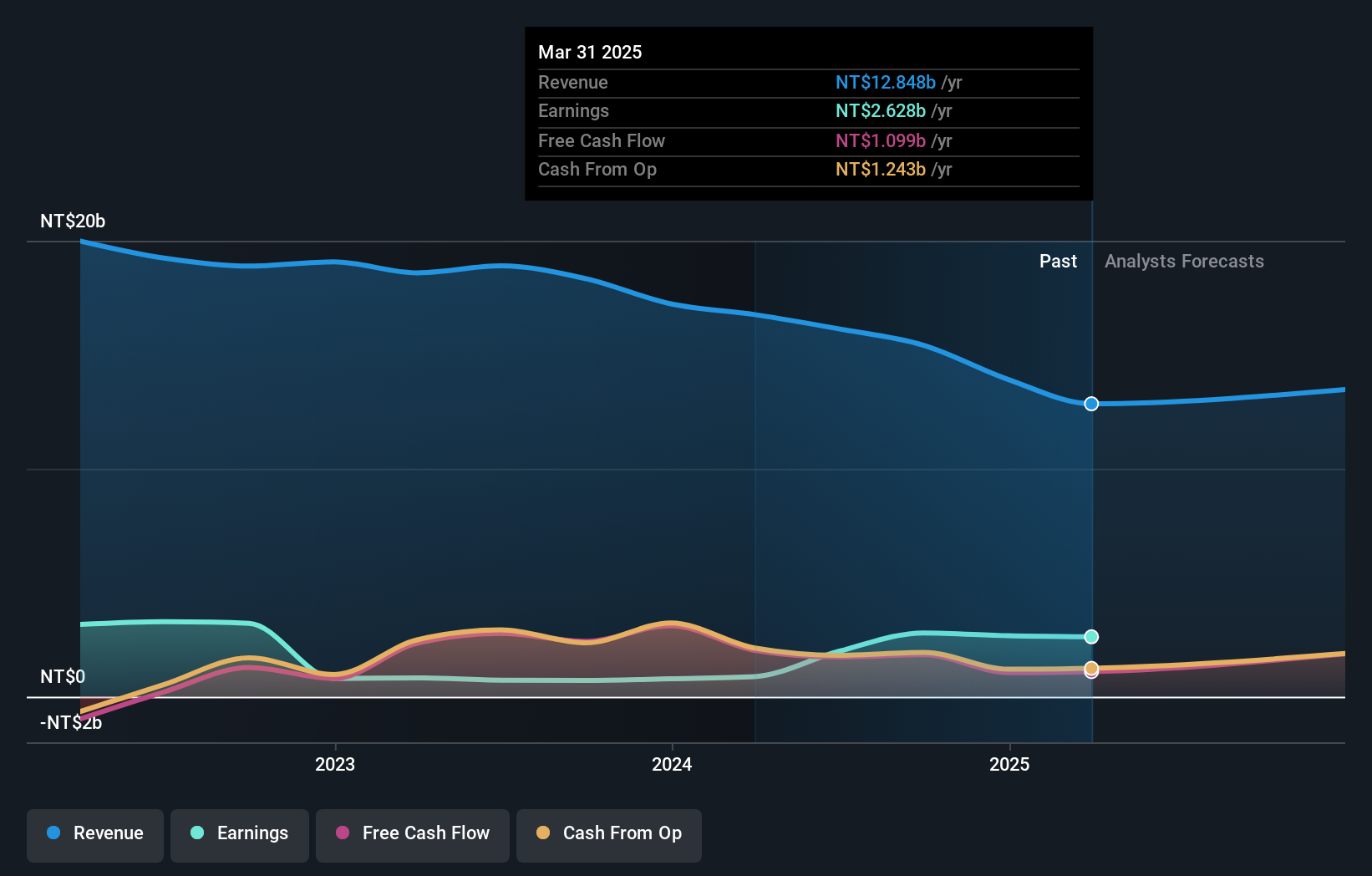

Dynapack International Technology, a small cap player in the electronics sector, has shown impressive earnings growth of 197.9% over the past year, outpacing the industry’s 14.2%. The company boasts a favorable price-to-earnings ratio of 12x compared to Taiwan's market average of 18.1x, suggesting potential value for investors. Despite recent volatility in its share price, Dynapack maintains financial robustness with more cash than total debt and a reduced debt-to-equity ratio from 71.4% to 13.9% over five years. Recent events include dividend affirmations totaling US$52 million and amendments to its Articles of Incorporation this June.

Seize The Opportunity

- Access the full spectrum of 2639 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal