BlueLinx Holdings Inc.'s (NYSE:BXC) Shares Lagging The Market But So Is The Business

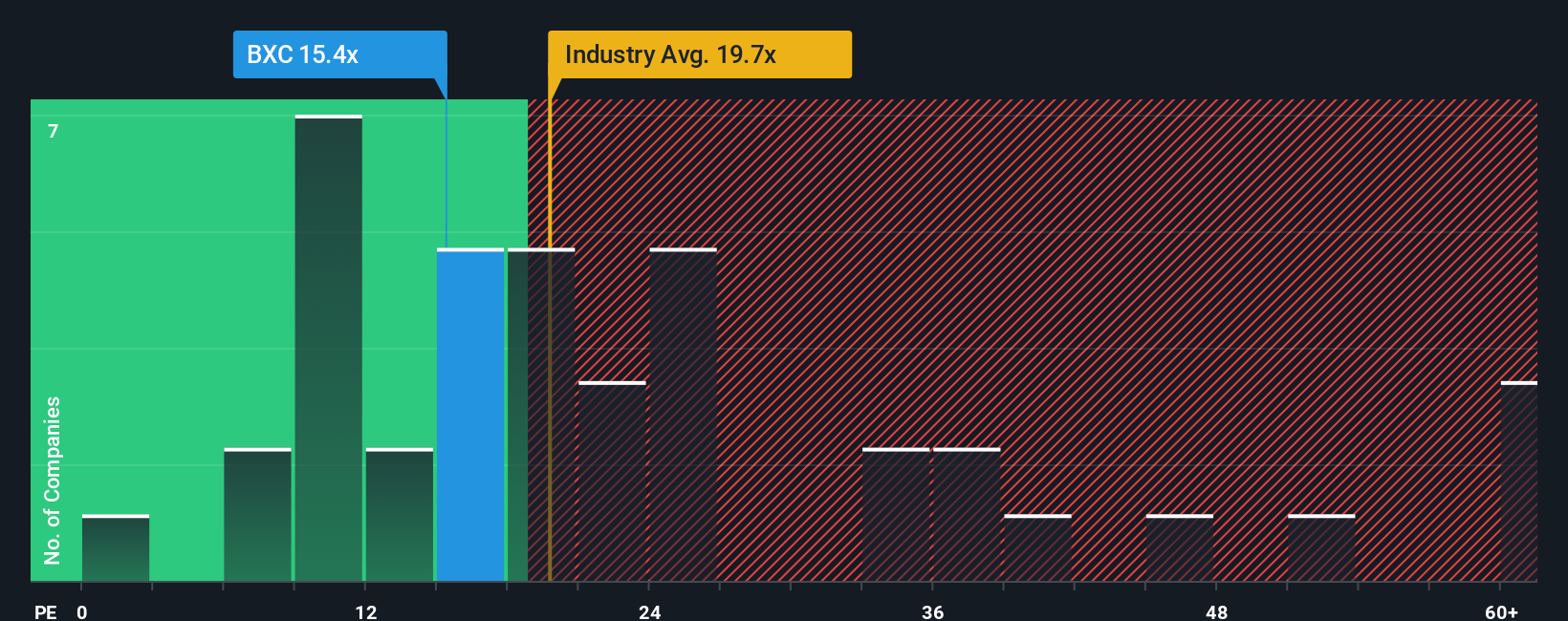

With a price-to-earnings (or "P/E") ratio of 15.4x BlueLinx Holdings Inc. (NYSE:BXC) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 33x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

BlueLinx Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for BlueLinx Holdings

Does Growth Match The Low P/E?

In order to justify its P/E ratio, BlueLinx Holdings would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. As a result, earnings from three years ago have also fallen 87% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 39% as estimated by the four analysts watching the company. With the market predicted to deliver 13% growth , that's a disappointing outcome.

With this information, we are not surprised that BlueLinx Holdings is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that BlueLinx Holdings maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for BlueLinx Holdings that you need to be mindful of.

If you're unsure about the strength of BlueLinx Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal