Top European Dividend Stocks To Consider In June 2025

As European markets navigate the complexities of global tensions and economic shifts, indices such as the STOXX Europe 600 have experienced declines amid ongoing geopolitical concerns. In this climate, dividend stocks can offer a measure of stability and potential income, making them an attractive consideration for investors looking to balance risk in uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.56% | ★★★★★★ |

| Teleperformance (ENXTPA:TEP) | 5.52% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.46% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Mapfre (BME:MAP) | 4.86% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 5.07% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.71% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.87% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.58% | ★★★★★★ |

Click here to see the full list of 240 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Compañía Española de Viviendas en Alquiler (BME:CEV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compañía Española de Viviendas en Alquiler S.A., along with its subsidiaries, focuses on leasing real estate properties in Spain and has a market cap of €167.90 million.

Operations: Compañía Española de Viviendas en Alquiler generates its revenue primarily through property rental (€20.88 million) and real estate developments and projects (€16.73 million).

Dividend Yield: 3%

Compañía Española de Viviendas en Alquiler offers a stable dividend history with payments increasing over the past decade. The current yield of 3.03% is below the Spanish market's top quartile, but dividends are well-covered by cash flow, evidenced by a low cash payout ratio of 46%. Despite strong earnings growth last year, future earnings are forecasted to decline. The stock trades at a favorable P/E ratio of 7.1x compared to the broader market.

- Delve into the full analysis dividend report here for a deeper understanding of Compañía Española de Viviendas en Alquiler.

- Insights from our recent valuation report point to the potential overvaluation of Compañía Española de Viviendas en Alquiler shares in the market.

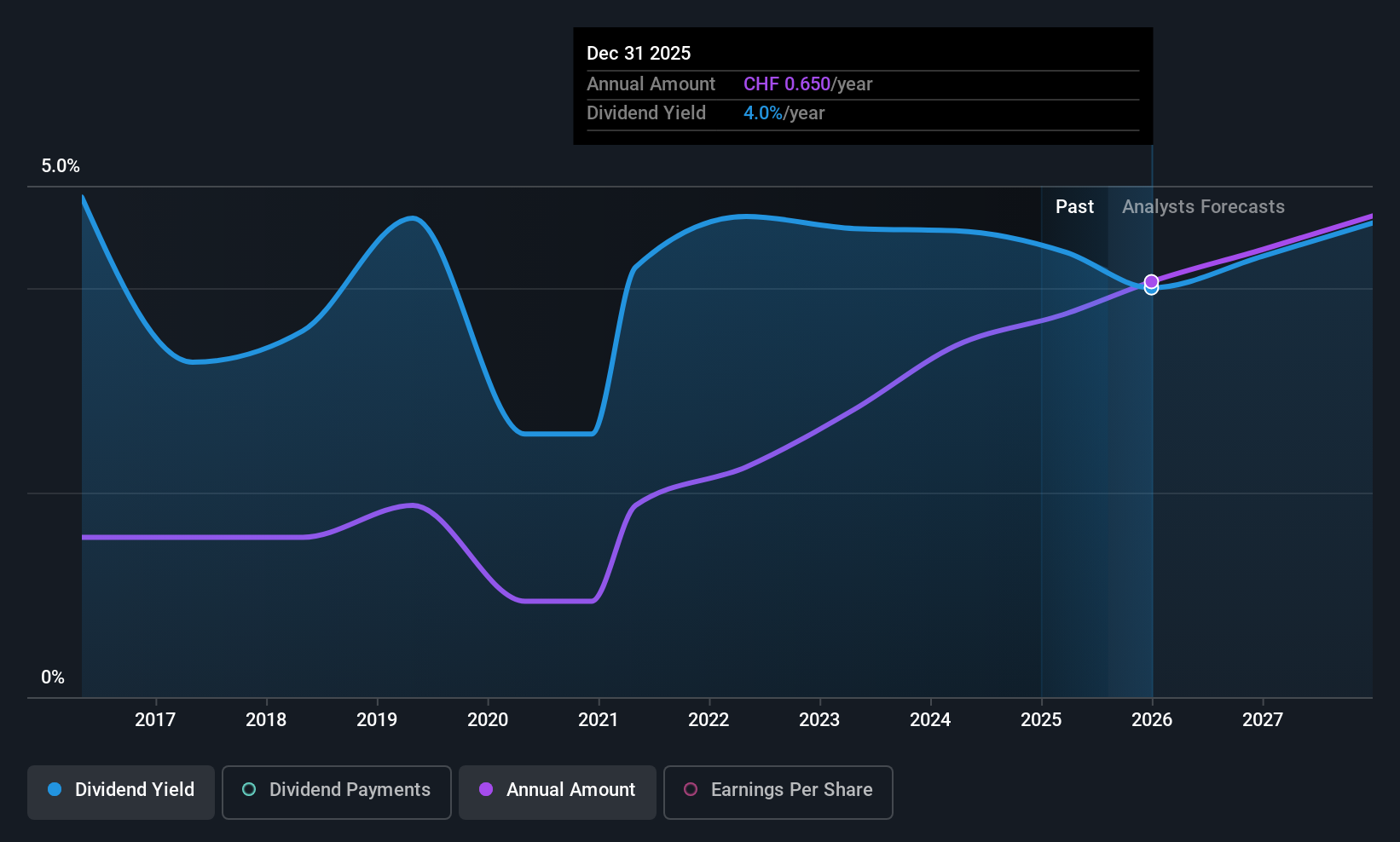

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EFG International AG, with a market cap of CHF4.28 billion, operates through its subsidiaries to offer private banking, wealth management, and asset management services.

Operations: EFG International AG generates revenue through several segments, including Corporate (CHF53.60 million), Global Markets & Treasury (CHF94.70 million), Investment and Wealth Solutions (CHF124.90 million), and its Private Banking and Wealth Management divisions across the Americas (CHF128.80 million), Asia Pacific (CHF195.50 million), United Kingdom (CHF192.30 million), Switzerland & Italy (CHF452.20 million), and Continental Europe & Middle East (CHF254.80 million).

Dividend Yield: 4.2%

EFG International's dividend yield of 4.2% ranks in the top 25% of Swiss dividend payers, although its history is marked by volatility. The payout ratio stands at a manageable 59.9%, with future coverage expected to improve slightly. Recent executive changes, including Soha Nashaat's appointment as executive chair, aim to bolster strategic objectives. Despite an unstable dividend track record, EFGN trades at a good value relative to peers and maintains low bad loan allowances (7%).

- Take a closer look at EFG International's potential here in our dividend report.

- Our valuation report here indicates EFG International may be undervalued.

Bastei Lübbe (XTRA:BST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bastei Lübbe AG is a media company that publishes books, audio books, e-books, and other digital products in the genres of fiction and popular science across Germany, Austria, Luxembourg, and Switzerland with a market cap of €130.42 million.

Operations: Bastei Lübbe AG generates revenue through its segments, including Novel Booklets at €7.11 million and Books (including E-Books) at €109.81 million.

Dividend Yield: 3%

Bastei Lübbe's dividend yield of 3.04% falls short of the top quartile in Germany, with a history of volatility over the past decade. Despite this, dividends are covered by earnings (payout ratio: 43.2%) and cash flows (cash payout ratio: 80.2%). The stock trades significantly below its estimated fair value and is expected to rise by analysts. Although not consistently reliable, dividends have shown growth over ten years, presenting a mixed opportunity for investors seeking income stability.

- Navigate through the intricacies of Bastei Lübbe with our comprehensive dividend report here.

- Our expertly prepared valuation report Bastei Lübbe implies its share price may be lower than expected.

Key Takeaways

- Investigate our full lineup of 240 Top European Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal