Shenzhen Bingchuan NetworkLtd And 2 Other Undiscovered Gems In Global Markets

In recent weeks, global markets have experienced mixed performance amid geopolitical tensions and economic uncertainties, with smaller-cap indexes showing resilience compared to their larger counterparts. As central banks hold steady on interest rates and economic indicators reveal varied outcomes, investors may find opportunities in lesser-known stocks that possess strong fundamentals and growth potential. Shenzhen Bingchuan Network Ltd is one such example of an undiscovered gem in the global market landscape, offering intriguing prospects for those seeking to explore beyond the mainstream.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sinopower Semiconductor | NA | 1.45% | -4.33% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Forth Smart Service | 51.94% | -6.63% | -7.91% | ★★★★☆☆ |

| Mr Max Holdings | 48.68% | 1.03% | 0.97% | ★★★★☆☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

| Fengyinhe Holdings | 0.60% | 39.37% | 65.41% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shenzhen Bingchuan NetworkLtd (SZSE:300533)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Bingchuan Network Co., Ltd. operates as an online gaming company in China with a market capitalization of approximately CN¥6.35 billion.

Operations: Shenzhen Bingchuan Network Co., Ltd. generates revenue primarily from its online game segment, totaling approximately CN¥2.86 billion. The company's financial structure includes a segment adjustment of CN¥26.44 million, impacting overall revenue figures.

Shenzhen Bingchuan Network, a nimble player in the entertainment sector, recently reported a significant turnaround with CNY 188.81 million in net income for Q1 2025 compared to a CNY 445.5 million loss the previous year. The company's price-to-earnings ratio of 19.7x suggests it offers good value against the broader CN market at 37.9x, despite its earnings declining by an average of 28% annually over five years. With no debt burden and high-quality earnings, this stock seems poised for potential growth as it navigates its volatile share price and strives to stabilize revenue streams further.

- Get an in-depth perspective on Shenzhen Bingchuan NetworkLtd's performance by reading our health report here.

Gain insights into Shenzhen Bingchuan NetworkLtd's past trends and performance with our Past report.

Shenzhen FRD Science & Technology (SZSE:300602)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen FRD Science & Technology Co., Ltd. operates in the electronic components manufacturing industry and has a market cap of CN¥11.11 billion.

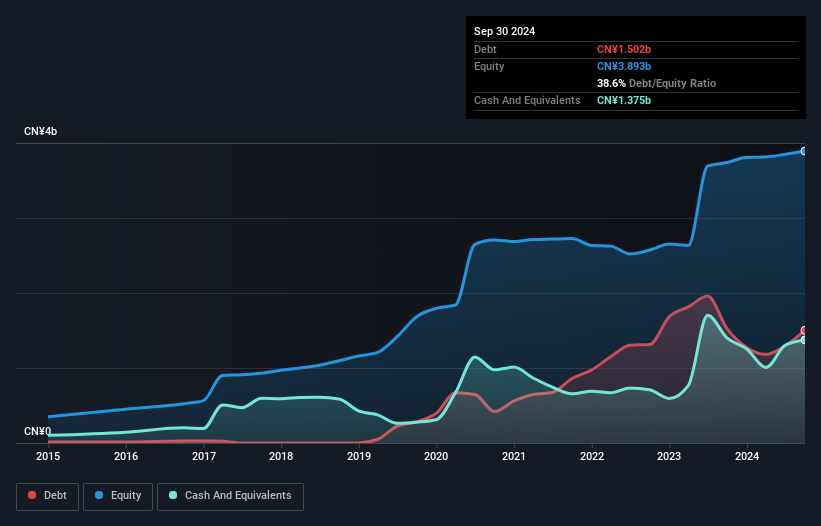

Operations: The company generates revenue of CN¥5.18 billion from its electronic components manufacturing segment.

Shenzhen FRD Science & Technology, a smaller player in the tech industry, has shown impressive growth with earnings increasing by 35.2% over the past year, outpacing the electrical industry's -1.2%. Their net debt to equity ratio stands at a satisfactory 13.3%, indicating sound financial health. The company's EBIT covers interest payments 14.9 times over, showcasing robust earnings quality and financial stability. Recent events include a dividend increase to CNY 0.38 per ten shares and an extraordinary shareholders meeting discussing stock incentives, reflecting proactive shareholder engagement and potential for future value creation.

Chenbro Micom (TWSE:8210)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chenbro Micom Co., Ltd. is involved in the research, design, manufacture, processing, and trading of computer peripherals and systems globally, with a market cap of NT$56.86 billion.

Operations: Chenbro's primary revenue stream is from computer peripherals, generating NT$15.90 billion. The company's financial performance can be analyzed through its gross profit margin, which reflects the efficiency of production and sales processes.

Chenbro Micom, a nimble player in the tech industry, recently showcased its prowess at COMPUTEX 2025 with AI server enclosures and cloud solutions. The company’s earnings for Q1 2025 revealed a solid performance with sales reaching TWD 4.15 billion, up from TWD 2.77 billion the previous year, and net income rising to TWD 666.8 million from TWD 364.92 million. Earnings per share also saw an increase to TWD 5.53 from TWD 3.03 last year, reflecting robust growth potential as Chenbro continues its strategic focus on R&D and global partnerships in AI and cloud markets.

- Dive into the specifics of Chenbro Micom here with our thorough health report.

Assess Chenbro Micom's past performance with our detailed historical performance reports.

Key Takeaways

- Reveal the 3178 hidden gems among our Global Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal