Uncovering Three Undiscovered Gems In The Australian Stock Market

The Australian stock market has been experiencing turbulence, with the ASX 200 closing down due to geopolitical tensions in the Middle East and rising oil prices benefiting the Energy sector while other sectors like Industrials and Materials faced sell-offs. In this climate of uncertainty, identifying promising small-cap stocks can be challenging but rewarding, as these companies often possess unique growth potential that larger firms may lack.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Catalyst Metals (ASX:CYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Catalyst Metals Limited is engaged in the exploration and evaluation of mineral properties in Australia, with a market capitalization of approximately A$1.43 billion.

Operations: Catalyst Metals generates revenue primarily from its operations in Western Australia (A$315.38 million) and Tasmania (A$93.77 million).

Catalyst Metals, a rising star in the Australian mining sector, has recently turned profitable and is now trading at 57.3% below its estimated fair value. With interest payments well covered by EBIT at 28.3 times, financial stability seems solid despite a slight increase in the debt-to-equity ratio from 0% to 1% over five years. The Trident Gold Project shows promise with probable ore reserves of 1.3 million tonnes at 4.4 g/t for 188,000 ounces of gold, and recent drilling results indicate high-grade mineralization that could extend mine life beyond five years while reducing upfront capital costs to A$15 million through positive cash flows from an open pit operation.

- Navigate through the intricacies of Catalyst Metals with our comprehensive health report here.

Evaluate Catalyst Metals' historical performance by accessing our past performance report.

Emeco Holdings (ASX:EHL)

Simply Wall St Value Rating: ★★★★★☆

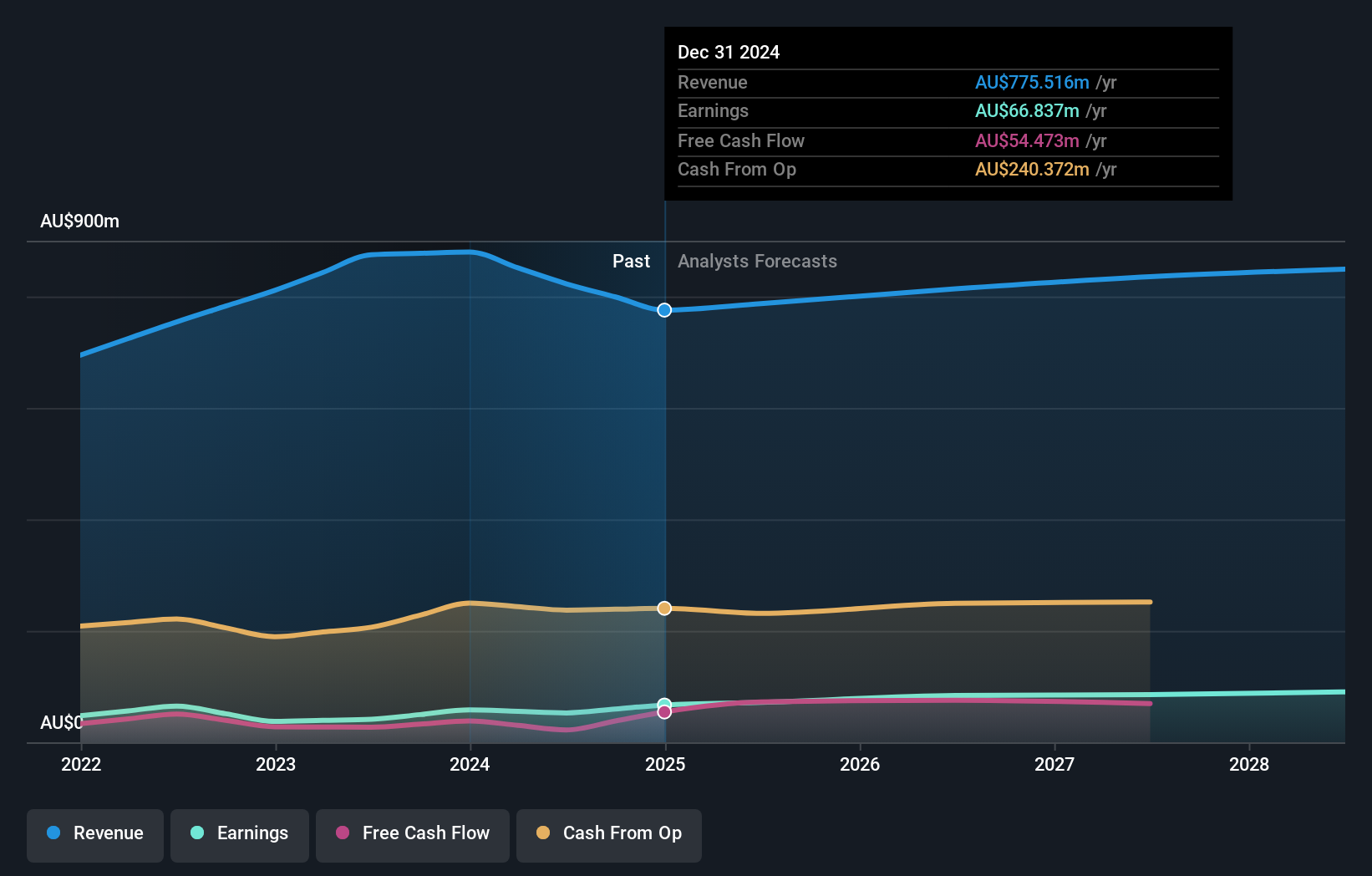

Overview: Emeco Holdings Limited specializes in providing surface and underground mining equipment rental, as well as complementary equipment and mining services in Australia, with a market capitalization of A$411.59 million.

Operations: The primary revenue streams for Emeco Holdings come from its rental segment, generating A$579.43 million, and workshops contributing A$292.97 million.

Emeco, a provider of mining equipment rental services in Australia, shows promise with its strategic focus on capital management and business simplification. Over the past five years, its debt-to-equity ratio has impressively decreased from 197% to 42%, reflecting improved financial health. The company is trading at a significant discount of 53% below estimated fair value, suggesting potential upside. Despite these positives, challenges such as weather impacts and project dependencies remain. With earnings projected to grow by 7% annually and profit margins expected to rise from 8.6% to 10%, Emeco's future appears cautiously optimistic amidst industry uncertainties.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Value Rating: ★★★★★☆

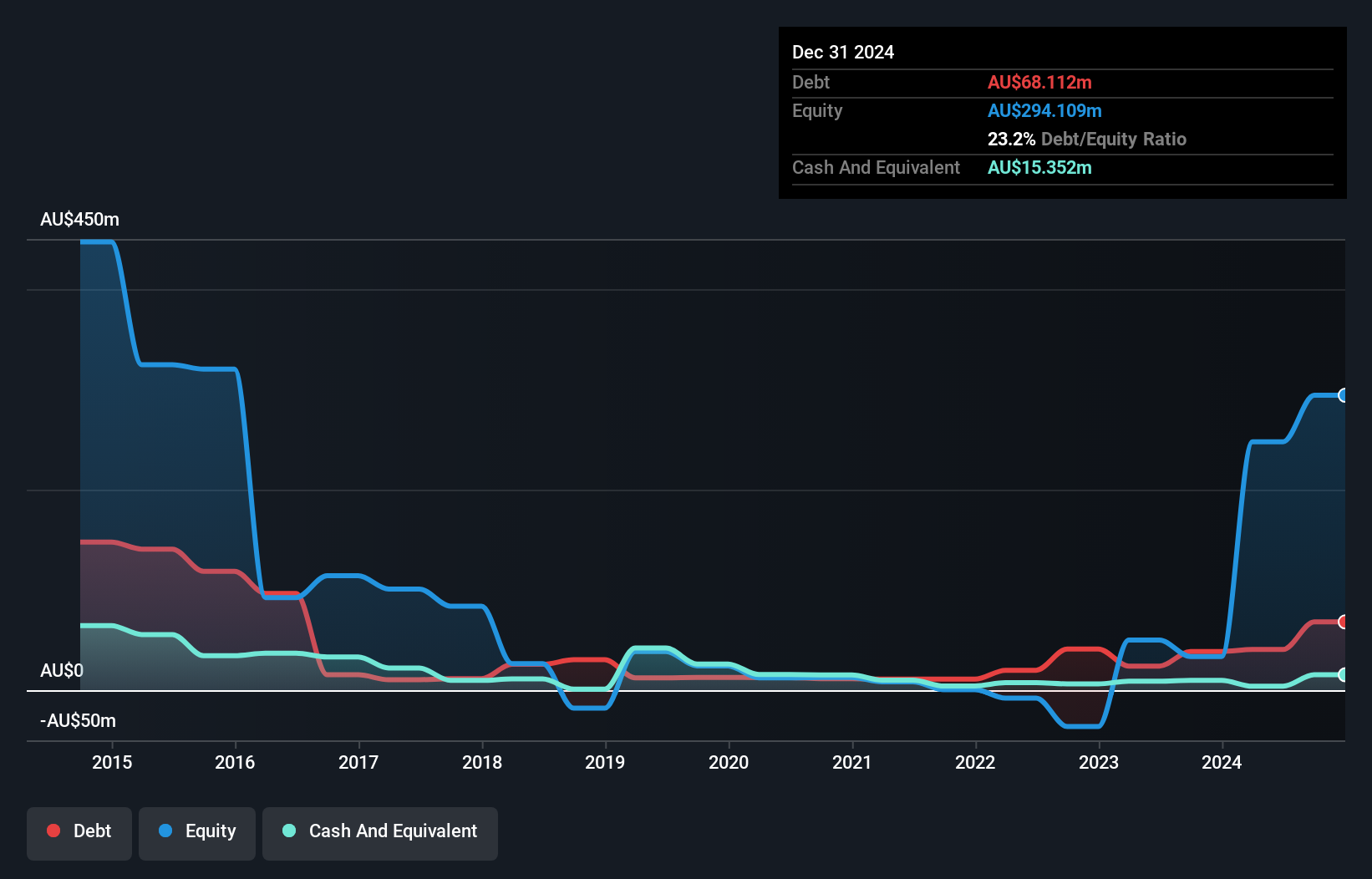

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of gold and silver mineral properties with a market capitalization of A$568.22 million.

Operations: Kingsgate Consolidated generates revenue primarily from its Chatree segment, amounting to A$210.69 million.

Kingsgate Consolidated, a player in the metals and mining sector, has shown impressive earnings growth of 1203% over the past year, outpacing industry averages. Trading at 92.3% below its estimated fair value suggests it offers good relative value compared to peers. The company has successfully reduced its debt to equity ratio from 52.5% to a satisfactory 23.2%, with interest payments well covered by EBIT at 17.2x coverage, indicating robust financial health. Additionally, Kingsgate announced a share repurchase program aimed at enhancing shareholder value as part of their capital management strategy set to expire in May 2026.

- Take a closer look at Kingsgate Consolidated's potential here in our health report.

Explore historical data to track Kingsgate Consolidated's performance over time in our Past section.

Summing It All Up

- Unlock more gems! Our ASX Undiscovered Gems With Strong Fundamentals screener has unearthed 41 more companies for you to explore.Click here to unveil our expertly curated list of 44 ASX Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal