3 Undiscovered European Gems Backed By Solid Fundamentals

Amidst escalating geopolitical tensions and renewed uncertainties about U.S. trade policy, European markets have faced a downturn, with the pan-European STOXX Europe 600 Index declining by 1.57%. Despite these challenges, opportunities remain for investors seeking stocks backed by strong fundamentals—those that demonstrate resilience through solid financial health and consistent performance even in volatile market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Campine (ENXTBR:CAMB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Campine NV operates in the circular metals and specialty chemicals sectors both in Belgium and internationally, with a market cap of €322.50 million.

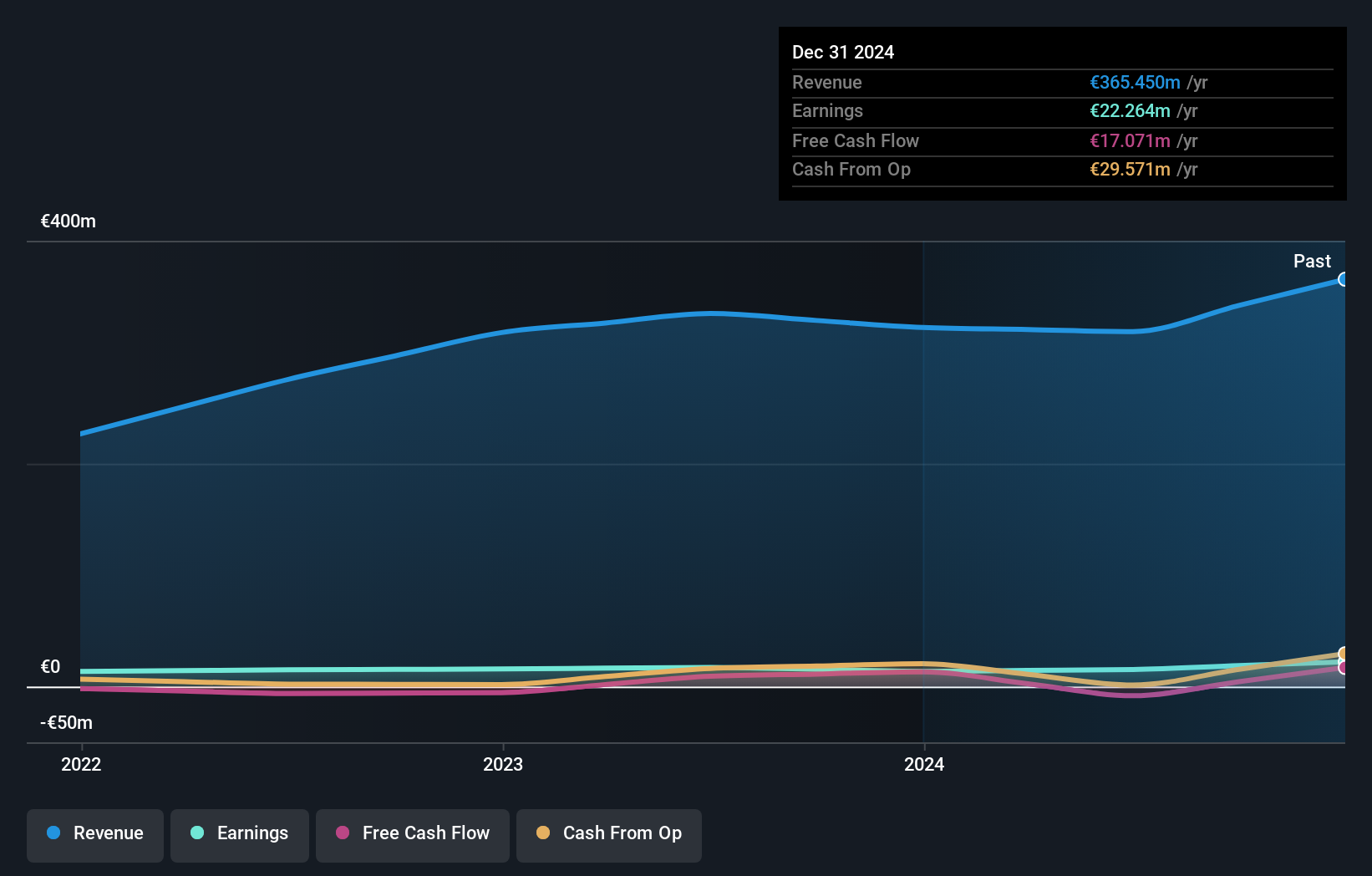

Operations: Campine NV generates revenue primarily from its Circular Metals segment, contributing €211.18 million, and its Specialty Chemicals segment, adding €186.93 million.

Campine, a nimble player in the metals and mining sector, has demonstrated impressive earnings growth of 63.1% over the past year, outpacing the industry's modest 3.2%. The company's debt management is commendable with a net debt to equity ratio of 17.2%, which remains satisfactory despite an increase from 12% five years ago. Trading at a significant discount of 66.7% below its estimated fair value, Campine appears undervalued by market standards. Recent announcements include an annual dividend hike to €3.15 per share, highlighting shareholder returns amidst robust financial health marked by well-covered interest payments at 16 times EBIT coverage.

- Navigate through the intricacies of Campine with our comprehensive health report here.

Understand Campine's track record by examining our Past report.

Oeneo (ENXTPA:SBT)

Simply Wall St Value Rating: ★★★★★★

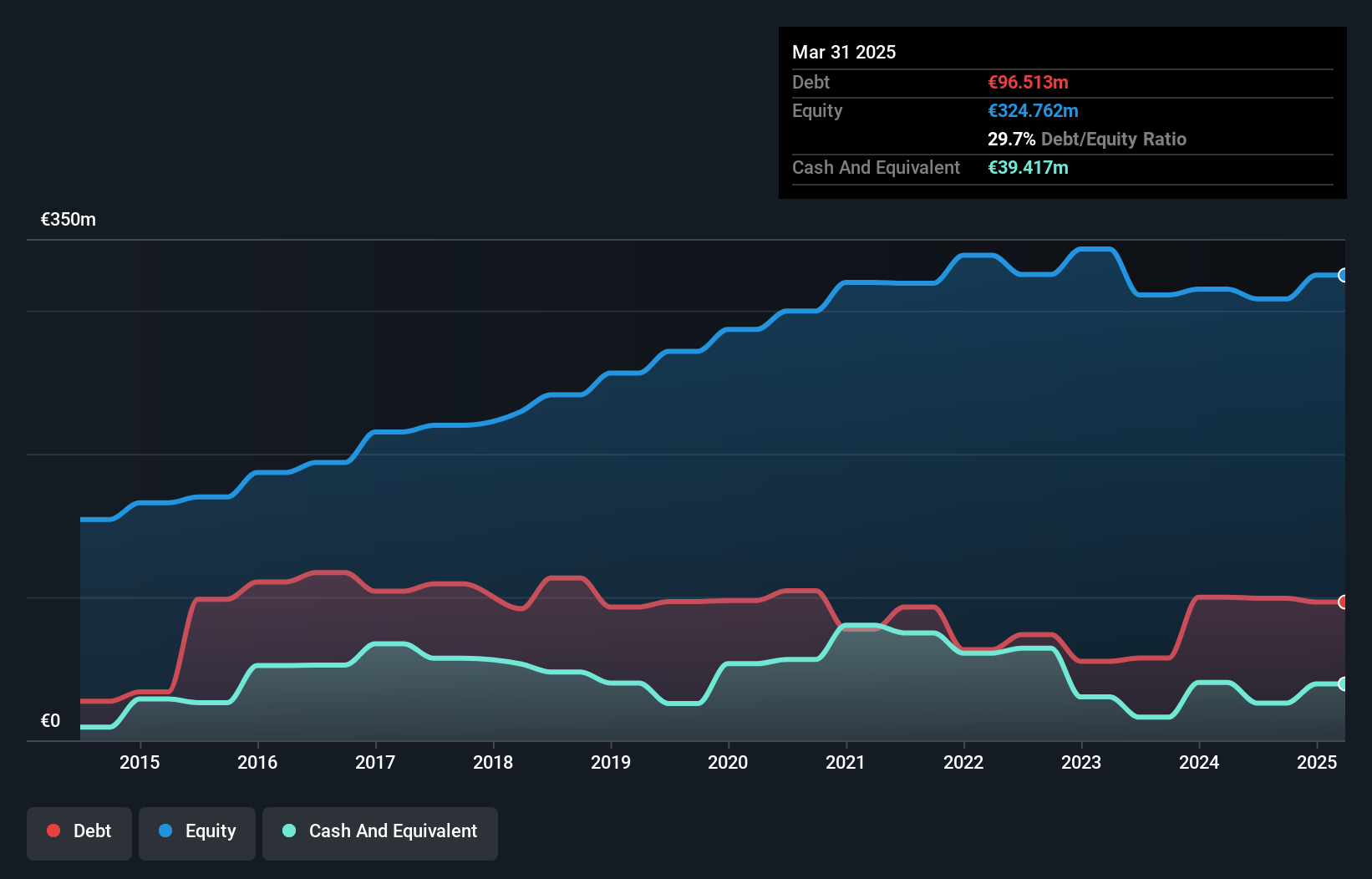

Overview: Oeneo SA is a global player in the wine industry, with a market capitalization of €626.51 million.

Operations: Oeneo SA generates revenue primarily from two segments: Closures (€222.50 million) and Winemaking (€82.60 million).

Oeneo, a notable player in the wine and spirits packaging industry, has demonstrated resilience with its earnings growth of 3.2% over the past year, outpacing the broader packaging sector's -21.8%. The company reported net income of €29.77 million for the fiscal year ending March 31, 2025, slightly up from €28.85 million previously. Its net debt to equity ratio stands at a satisfactory 17.6%, indicating prudent financial management over time as it reduced from 34% to 29.7% in five years. Trading at about one-third below its estimated fair value suggests potential upside for investors eyeing undervalued opportunities in Europe.

- Click to explore a detailed breakdown of our findings in Oeneo's health report.

Gain insights into Oeneo's historical performance by reviewing our past performance report.

Rainbow Tours (WSE:RBW)

Simply Wall St Value Rating: ★★★★★★

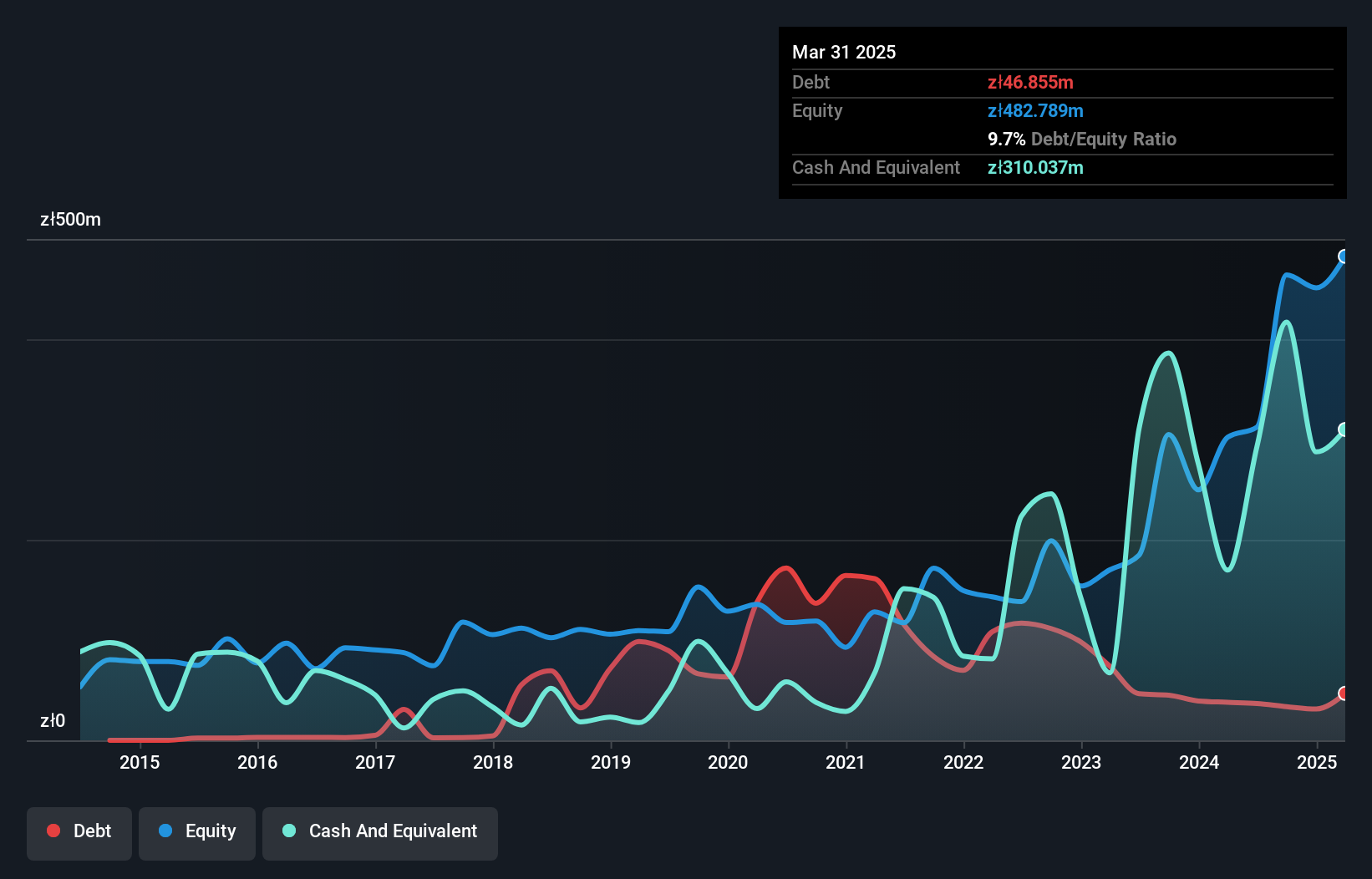

Overview: Rainbow Tours S.A. is a tour operator serving Poland and several international markets, including the Czech Republic, Greece, Spain, Turkey, Slovakia, and Lithuania; it has a market cap of PLN1.94 billion.

Operations: Rainbow Tours generates revenue primarily from its tour operator activities in Poland, which account for PLN4.14 billion, and to a lesser extent from foreign operations contributing PLN161.84 million.

Rainbow Tours, a vibrant player in the European travel sector, has demonstrated robust financial health with its earnings surging by 57.5% over the past year, outpacing the hospitality industry's 9.8%. The company trades at a significant discount of 36.4% below its estimated fair value, suggesting potential upside for investors. Impressively, Rainbow Tours has reduced its debt-to-equity ratio from 101.6% to just 9.7% over five years while maintaining high-quality earnings and positive free cash flow. Recent quarterly sales reached PLN 869 million compared to PLN 722 million last year, with net income rising from PLN 39 million to PLN 60 million.

- Unlock comprehensive insights into our analysis of Rainbow Tours stock in this health report.

Explore historical data to track Rainbow Tours' performance over time in our Past section.

Next Steps

- Investigate our full lineup of 335 European Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal