Top European Dividend Stocks For June 2025

Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have experienced a downturn, with the pan-European STOXX Europe 600 Index ending 1.57% lower recently. As investors navigate these turbulent conditions, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.58% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.99% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.35% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.45% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 5.03% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 3.90% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.23% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.56% | ★★★★★★ |

Click here to see the full list of 239 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

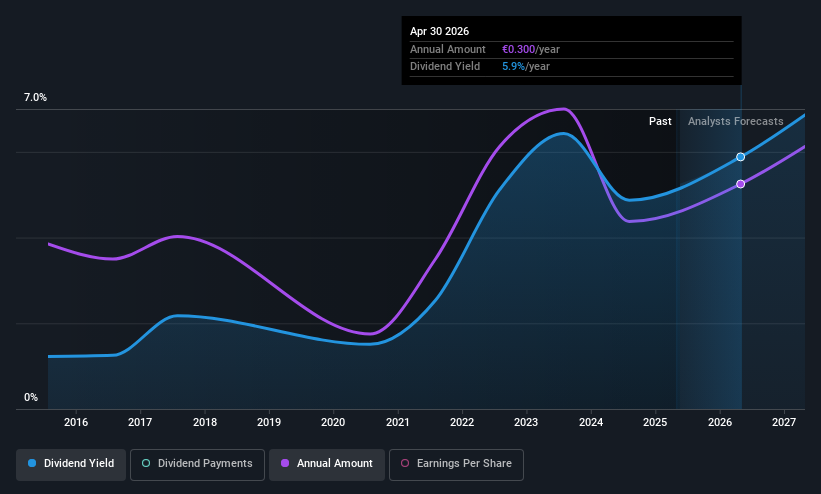

Fugro (ENXTAM:FUR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fugro N.V., with a market cap of €1.31 billion, offers geo-data services to the infrastructure, energy, and water industries across Europe, Africa, the Americas, Asia Pacific, the Middle East, and India.

Operations: Fugro N.V. generates revenue from several regions: €515.72 million from the Americas, €488.97 million from Asia Pacific, €1.11 billion from Europe-Africa, and €225.45 million from the Middle East & India.

Dividend Yield: 6.3%

Fugro's dividend, with a payout ratio of 32%, is well covered by earnings and cash flows, reflected in its cash payout ratio of 57.8%. Although the dividend yield of 6.33% places it among the top payers in the Dutch market, its stability and growth remain uncertain as dividends were recently initiated. The stock trades at a significant discount to estimated fair value and shows high volatility, while analysts anticipate a price increase.

- Dive into the specifics of Fugro here with our thorough dividend report.

- The valuation report we've compiled suggests that Fugro's current price could be quite moderate.

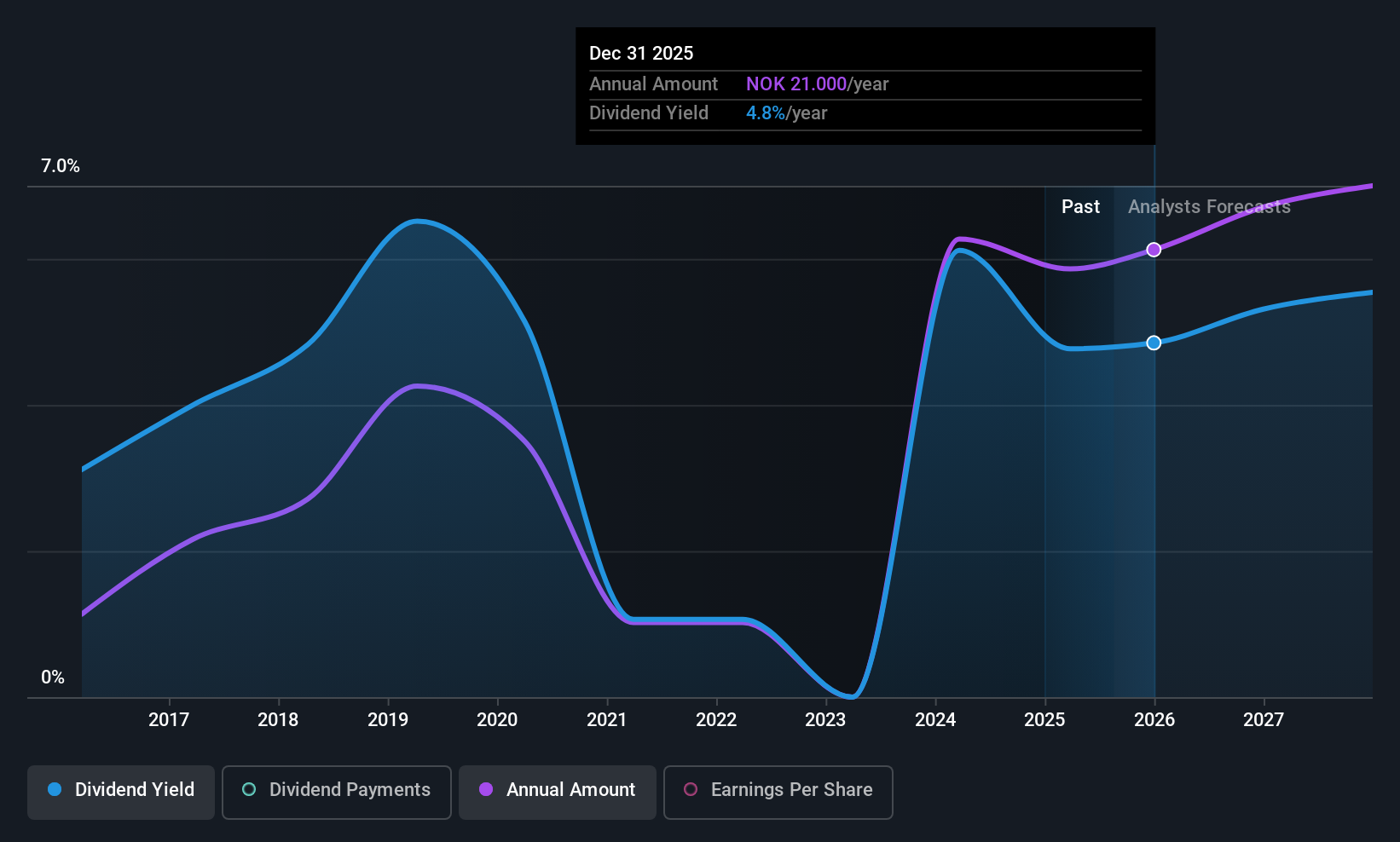

SpareBank 1 Østfold Akershus (OB:SOAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SpareBank 1 Østfold Akershus is a Norwegian savings bank offering a range of banking products and services, with a market cap of NOK5.24 billion.

Operations: SpareBank 1 Østfold Akershus generates its revenue through a diverse array of banking products and services tailored to the Norwegian market.

Dividend Yield: 4.8%

SpareBank 1 Østfold Akershus, trading at a significant discount to its estimated fair value, offers a dividend yield of 4.76%, below the top quartile in Norway. Despite earnings growth of 19.3% last year and a manageable payout ratio of 43.2%, its dividend history is volatile and unreliable over the past decade. Recent earnings showed declines in both net interest income (NOK 195 million) and net income (NOK 114 million) compared to the previous year.

- Take a closer look at SpareBank 1 Østfold Akershus' potential here in our dividend report.

- Our expertly prepared valuation report SpareBank 1 Østfold Akershus implies its share price may be lower than expected.

Zumtobel Group (WBAG:ZAG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zumtobel Group AG is a global player in the lighting industry with a market capitalization of €208.22 million.

Operations: Zumtobel Group AG generates its revenue through two primary segments: Lighting, contributing €877.94 million, and Components, adding €303.43 million.

Dividend Yield: 5.1%

Zumtobel Group's dividend yield of 5.11% ranks it among the top 25% in Austria, although its dividend history has been volatile over the past decade. Despite a lower net profit margin this year (1.5%), dividends are well-covered by earnings (payout ratio: 65.7%) and cash flows (cash payout ratio: 27.4%). The company is trading at a favorable valuation with a price-to-earnings ratio of 12.8x, below the Austrian market average of 13.4x.

- Unlock comprehensive insights into our analysis of Zumtobel Group stock in this dividend report.

- The analysis detailed in our Zumtobel Group valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 236 more companies for you to explore.Click here to unveil our expertly curated list of 239 Top European Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal