IPO Interpretation | IFBH Limited: How long can the coconut water IPO asset-light myth supported by Chinese consumers last?

In recent years, against the backdrop of people paying more attention to health management, coconut water, which is low in calories, rich in electrolytes, and has a sweet taste, has been promoted to the front of the stage and has become a new top class. With the “natural electrolytes” health label, if coconut water stepped on the cusp, ushered in excellent development opportunities.

In just 2 months, IFBH Limited, the parent company of iF Coconut Water, has obtained a Hong Kong Stock Exchange pass and will soon be listed on the main board of the Hong Kong Stock Exchange, with CITIC Securities as the sole sponsor.

Coconut water supports 240 million dollars in revenue

As a ready-to-drink drink and ready-to-eat food company rooted in Thailand, if's history can be traced back to 2013-2013, when the if brand was born, and General Beverage has always operated the IF brand, then launched the Innococo brand in 2022. In December 2022, General Beverage underwent a business restructuring to split its international business (in particular the IF and InnoCoco brands) from General Beverage's other two business lines to streamline operations and centrally manage the IF and InnoCoco brands in markets other than Thailand.

According to Insight Consulting's report, in terms of retail sales in 2024, if is the second-largest company in the global coconut water drink market — in 2017, if brand entered the mainland China market and topped the list for five consecutive years since 2020. The market share (if+ InnoCoco) in 2024 (if+ InnoCoco) is about 34%, surpassing the second-largest competitor by more than seven times; previously, if entered the Hong Kong market in 2015, and has been at the top of the list for nine consecutive years since 2016, with a market share in 2024 (if+) (Innococo) is about 60%, surpassing the second-largest competitor by more than seven times.

Currently, the product portfolio under the IF and InnoCoco brands covers three product categories: natural coconut water drinks, other beverages, and plant-based snacks. Among them, if focuses on providing natural and healthy Thai drinks and food, and designs product concepts for various consumer tastes; Innococo strives to provide healthy alternatives to traditional sports functional drinks. In 2024, if will provide 32 products.

In 2023 and 2024 (hereinafter referred to as the reporting period), the company achieved revenue of US$87.442 million (approximately RMB 638 million) and US$158 million (approximately RMB 1.153 billion), and net profit of US$16.754 million (approximately RMB 122 million) and US$333.16 million (approximately RMB 243 million), respectively. Among them, revenue and net profit growth rates in 2024 were 80.3% and 98.8%, respectively. In 2023 and 2024, coconut water contributed 93.8% and 95.6% of IFBH's revenue, and is its main revenue product.

Among IFBH's global markets, the Chinese market is the primary growth engine, contributing the most revenue. According to the prospectus, IFBH's revenue in the mainland China market reached US$146 million (approximately RMB 1,066 million) in 2024, accounting for 92.4% of revenue. In the same period, IFBH's revenue in the Hong Kong market in China increased 46% year over year to US$7.2 million, accounting for 4.6%.

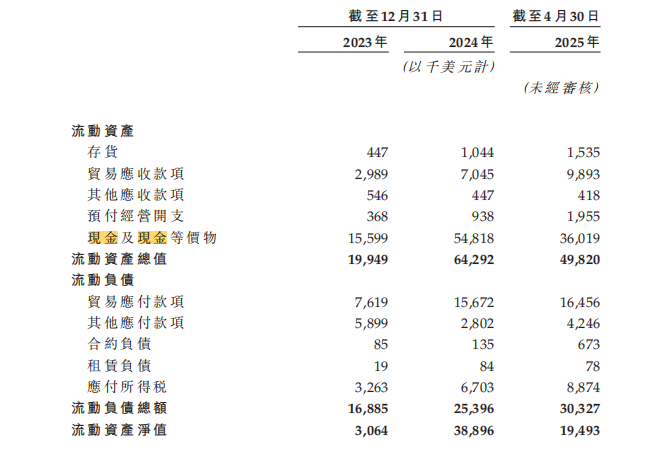

The rapid increase in revenue and profit also led to an increase in cash flow. According to the prospectus data, as of 2024, the company's net cash flow from operating activities reached US$41.753 million, an increase of 55% over the previous year; cash and cash equivalents at the end of the period were US$54.818 million, an increase of 251.42% over the previous year.

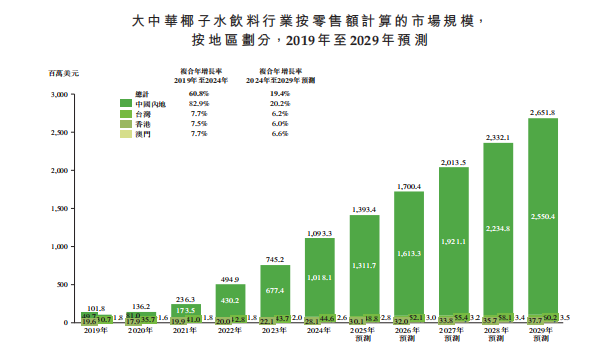

In fact, in recent years, China has become one of the fastest-growing regions in the global coconut water market. According to Insight Consulting data quoted in the prospectus, between 2019 and 2024, the compound annual growth rate of China's coconut water market reached 60.8%, far exceeding that of other regions. In 2024, retail sales in the Chinese market have surpassed the $1 billion mark. It is expected to surpass North America and become the world's largest consumer market for coconut water by 2027.

However, it should be noted that IFBH also has obvious development limitations of a single product structure and excessive dependence on the Chinese market.

Asset-light operating model “two sides in one”

The core of the asset-light model adopted by IFBH is the “three outsourcing” strategy. The company outsources all production processes of the product to professional foundries. Among them, foundries such as General Beverage in Thailand have become the main production base for if coconut water. In terms of logistics transportation, IFBH chose to cooperate with third-party logistics suppliers to achieve rapid product delivery through its professional logistics network and efficient distribution capabilities. In terms of sales channels, IFBH has established a complete distributor system to entrust product sales and distribution to third party distributors.

This asset-light model brings significant cost advantages and operational flexibility to IFBH. On the one hand, through outsourced production and logistics, IFBH avoids the financial pressure and operational risks brought about by large-scale fixed asset investments, and is able to concentrate limited resources on brand building and market expansion. On the other hand, close collaboration with third party partners enables IFBH to make full use of its professional advantages and resources to achieve efficient operation.

According to the data, IFBH's gross margin increased steadily from 34.7% in 2023 to 36.7% in 2024. This achievement is undoubtedly quite impressive in the competitive beverage industry.

Although the asset-light OEM model brought rapid development opportunities in the early stages of brand establishment, this model also has potential risks as the market environment changes.

IFBH foundries are mainly concentrated in Thailand, and the largest foundry is General Beverage under the founder's name. This highly centralized layout makes IFBH vulnerable to geopolitical risks. Once Thailand's political situation changes or trade policy is adjusted, its production and supply may be seriously affected.

For coconut water products that require extreme freshness, the quality of the ingredients determines the taste and quality. IFBH does not directly participate in production, and has weak control over raw material procurement and production processes in foundries, causing uncertainty in product quality management. Industry sources revealed that the freshness of coconut water ingredients has a great impact on taste, and transportation time control under the OEM model is the key to quality management.

According to IFBH's prospectus, in 2023 and 2024, IFBH's purchases from the five major suppliers accounted for 92.3% and 96.9% of the total procurement amount for the same period, respectively, and the top five customers contributed 97% of revenue. This high dependence on a small number of suppliers and customers makes IFBH's supply chain extremely unstable.

Food and drink circuit “There are many deep-water fish, and gambling agreements are imminent

The reason why IFBH has been able to rapidly rise in the coconut water drink industry in China is mainly due to the fact that the track is a fertile ground that “needs to be cleared urgently”.

According to the Insight Consulting Report, from 2019 to 2024, the global coconut water beverage industry grew significantly. The market size rose from US$2,517 billion to US$4.989 billion, with a compound annual growth rate of 14.7%. The industry is expected to grow at a CAGR of 11.1% over the next five years, reaching US$8.457 billion in 2029.

Among them, from 2019 to 2024, the coconut water beverage industry expanded significantly in the Greater China market, growing from US$102 million to US$1,093 million, with a compound annual growth rate of 60.8%. Among them, the size of the mainland China market increased from US$49.7 million in 2019 to US$1,018 billion in 2024, with a compound annual growth rate of 82.9%, and is expected to reach US$2.55 billion in 2029.

According to the above report, the predicted growth of the coconut water beverage market in mainland China is mainly driven by factors such as increasing consumer health awareness, improving distribution channels, and expanding consumer groups.

On the one hand, the company is also facing obvious increased market competition and price war pressure. In recent years, a large number of brands have poured into the Coconut Water Circuit, including domestic and foreign players such as Vita Coco, Coco Full Score, etc., and product homogenization is serious. According to data from the Tmall platform, although iFBH's price is lower than Vita Coco (if unit price is about 5.2 yuan/350 ml), retailers such as Hema sell 1-liter products for only 9.9 yuan, and the price war reduces profit margins.

On the other hand, IFBH also has the risk of supply chain dependency and raw material price fluctuations. According to information, IFBH's coconut water raw materials are entirely dependent on Thai suppliers, and in recent years, high temperatures and droughts in Southeast Asia have led to a reduction in coconut production, and the price of coconut green will increase by more than 70% in 2024. Despite plans to introduce multinational suppliers to reduce risk, there are still hidden risks to supply chain stability in the short term.

More importantly, IFBH's gambling agreement is imminent.

Prior to the IPO, Pongsakorn Pongsak directly and indirectly held approximately 77.64% of iF's total issued shares, including direct equity of approximately 6.53%; and 71.11% indirect interest held indirectly through General Beverage, the company it controls.

Notably, IFBH, General Beverage and Pongsakorn Pongsak signed a share subscription agreement with Aquaviva Co., Ltd. on March 15, 2024. Under the agreement, Aquaviva Co., Ltd. agreed to subscribe for 125,000 new shares (equivalent to 11.11% of IFBH's total issued and paid up share capital after the issuance of the relevant shares was completed), with a total subscription price of US$17.5 million.

According to the agreement, if the company fails to complete its IPO by December 31, 2026, investors have the right to request Pongsakorn Pongsak to purchase all of its shares at an exercise price equal to an internal rate of return equivalent to the investor receiving a net return of 12% per year on the investor's investment in its shares. Put options expire after the IPO and can no longer be exercised.

In other words, if the company fails to successfully go public before December 31, 2026, it will face share repurchase obligations and be required to pay more than 23 million US dollars. Pressured by a gambling agreement with a specific time frame, IF's IPO is imminent, but the good news is that after passing the hearing, its IPO journey was only one last step away.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal