US stock outlook | Futures on the three major stock indexes have mixed ups and downs, and the Fed's interest rate decision hits hard

1. Before the US stock market on June 18 (Wednesday), futures for the three major US stock indexes had mixed ups and downs. As of press release, Dow futures were down 0.02%, S&P 500 futures were up 0.05%, and NASDAQ futures were up 0.15%.

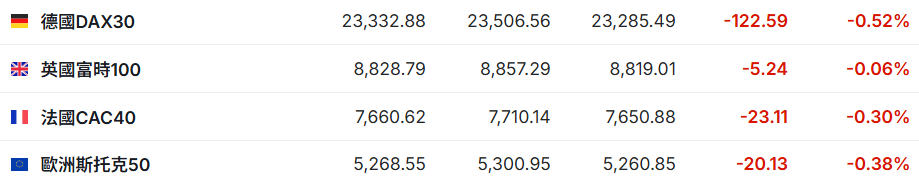

2. As of press release, the German DAX index fell 0.52%, the UK FTSE 100 index fell 0.06%, the French CAC40 index fell 0.30%, and the European Stoxx 50 index fell 0.38%.

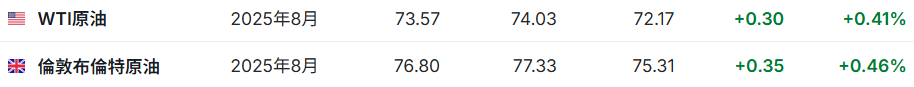

3. As of press release, WTI crude oil rose 0.41% to $73.57 per barrel. Brent crude rose 0.46% to $76.80 per barrel.

Market news

The interest rate decision is expected to “stand still” tonight, and Federal Reserve officials are waiting for the economic “fog” to dissipate. Federal Reserve officials generally expect to keep interest rates unchanged for the fourth consecutive meeting at the interest rate resolution to be held on Wednesday EST, and reiterated the need to have a clearer understanding of the impact of a series of government policy adjustments on the economy before adjusting borrowing costs. Policymakers have previously warned that President Donald Trump's tariffs could drive up inflation and unemployment, but so far, steady job growth and cooling inflation have allowed Federal Reserve officials to keep interest rates unchanged this year. Given the uncertain economic outlook, investors and economists will keep a close eye on policymakers' updated economic and interest rate forecasts. Officials may continue to include two interest rate cuts this year as shown in most forecasts, but some economists say the “bitmap” may only show one rate cut.

The market is betting that the Federal Reserve will cut interest rates at least once this year, and US bond yields will fall. The market still expects the Federal Reserve to cut interest rates at least once in 2025, so the price of US Treasury bonds has risen accordingly. Previously, retail sales data for May had mixed results, while the auctions of inflation-protected bonds were doing well. Due to concerns about the escalation of the Middle East conflict, risk aversion increased, and US debt rose further. US Treasury yields fell by 2 to nearly 7 basis points for each term. The 2-year US Treasury interest rate (most significantly affected by changes in the Federal Reserve's policy) fell 2 basis points to 3.95%; while the 10-year US Treasury yield fell 6 basis points to 4.39%. As Federal Reserve officials are holding a two-day meeting in Washington, traders are still betting that interest rates will be cut by about 25 basis points this year — the first rate cut in October has been completely digested by the market.

Is the “shadow chairman” effect surfacing? Traders are betting heavily that the Federal Reserve will cut interest rates quickly after Powell leaves office. US interest rate traders are betting that the Federal Reserve will quickly shift to a more dovish monetary policy after current Federal Reserve Chairman Powell's term ends in May 2026. The central assumption of this bet is that after US President Trump appoints Powell's successor, the new chairman of the Federal Reserve will start cutting interest rates at the first monetary policy meeting after taking office (expected to be June 2026). Futures trading volume associated with this bet set a record on Monday and continued to expand on Tuesday. Although Trump has been urging Powell to cut interest rates over the past few months, Federal Reserve officials have said many times that they are still waiting to see the impact of tariffs on the economy and inflation. The market generally expects that the Federal Reserve will keep interest rates unchanged at Wednesday's meeting and may lower expectations of interest rate cuts this year to cope with the upward pressure on prices caused by tariffs.

The US Senate passed the stablecoin bill, and Trump and the crypto industry won a landmark victory. The US Senate passed the stablecoin bill with 68 votes in favor and 30 against on Tuesday local time, setting regulatory rules for cryptocurrencies linked to the US dollar. This is a landmark victory for the rising crypto industry and US President Donald Trump. The bill will be submitted to the House of Representatives for consideration. The market value of Trump-related stablecoins has reached $2 billion. The House of Representatives has been advancing its own legislation, including a more comprehensive measure to regulate the broader crypto market. Members of the House of Representatives must now decide whether to accept the Senate bill or negotiate a compromise.

Individual stock news

The JPM.US (JPM.US) blockchain layout will pilot the deposit token JPMD on the Coinbase (COIN.US) public chain. J.P. Morgan Chase will launch a pilot project called JPMD, which represents dollar deposits at the world's largest bank. As financial institutions accelerate their deployment in the digital asset sector, this move marks an important breakthrough for traditional financial giants in blockchain applications. Naveen Mallela, global co-head of Kinexys by JPMorgan's blockchain division, revealed that a transaction is expected to be completed within a few days: JPMorgan will transfer a fixed amount of JPMD from the bank's digital wallet to Coinbase Global, the largest cryptocurrency exchange in the US.

Disney (DIS.US) teamed up with Amazon (AMZN.US) to improve streaming ad targeting capabilities. Disney and Amazon have reached a new partnership aimed at improving the targeting capabilities of streaming TV ads. According to the report, cooperation between Disney's real-time advertising trading platform and Amazon's demand-side platform (DSP) logistics department will enable more advertisers to obtain content inventory from Disney's major platforms. This partnership will open up more opportunities for brands using Amazon DSP to reach consumers watching Hulu, Disney+, and ESPN content. According to the report, Disney+'s content inventory will be open to Amazon DSP's international customers, including France, Germany, Italy, Portugal, Spain, Switzerland, Turkey and the United Kingdom. The integration is expected to launch in the third quarter of this year.

Amazon's (AMZN.US) AWS customization strategy has paid off, pointing to Nvidia (NVDA.US), the dominant AI chip leader. Amazon's cloud computing service platform AWS will announce an update to its Graviton4 chip. The chip's network bandwidth reaches 600 gigabits per second, which the company says is the highest bandwidth in public clouds. AWS engineer Ali Saidi compared this speed to a machine reading 100 music CDs per second. Graviton4 is a central processing unit (CPU) and is one of many chip products launched by Amazon's Annapurna Labs in Austin, Texas. This chip is a major victory for the company's customization strategy, enabling it to compete with traditional semiconductor vendors such as Intel (INTC.US) and AMD (AMD.US). But the real battle is challenging Nvidia (NVDA.US) in the field of artificial intelligence infrastructure.

Microsoft (MSFT.US) teamed up with AMD (AMD.US) to create a multi-device ecosystem, and the next generation of Xbox consoles will be included in the cooperative landscape. Microsoft announced on Tuesday that it has reached a multi-year cooperation agreement with Ultrafine Semiconductor. The two sides will carry out in-depth technical collaboration on the tech giant's next-generation Xbox console and other devices. Microsoft said in a statement that this cooperation will cover “joint research and development of silicon chips combined across devices,” and the next generation of Xbox consoles is clearly on the list. Xbox President Sarah Bond (Sarah Bond) also emphasized that the next-generation Xbox platform will focus on multi-device linkage and will no longer be limited to the gaming ecosystem of its own stores.

Amazon (AMZN.US) CEO warns: Generative AI will reduce the size of the company's workforce. Amazon CEO Andy Jassi said in a memo to employees on Tuesday that with the promotion of generative artificial intelligence and intelligent agent technology, Amazon's overall workforce size will shrink in the next few years. Artificial intelligence is reshaping the global workforce by automating repetitive routine tasks, and industry leaders expect this will drive industries to cut or transform specific jobs. Despite the uncertainty, most experts believe that AI will not cause large-scale unemployment, but rather trigger a reconfiguration of the workforce structure. Jasi said, “As we deploy more generative AI and intelligent agents, the way we work will change. Some existing jobs will require less manpower, while more people will be needed for other types of work.”

Key economic data and event forecasts

20:30 Beijing time: The initial monthly construction permit rate in the US in May (%), the number of US jobless claims for the week ending June 14 (10,000), and the annualized monthly rate of new housing starts in the US in May (%).

22:30 Beijing time: Changes in US EIA crude oil inventories for the week ending June 13 (10,000 barrels).

The next day at 02:00 a.m. Beijing time: The upper limit of the US federal funds rate target for June (%).

The next day at 04:00 a.m. Beijing time: Net foreign purchases of long-term securities in the US in April (100 million US dollars).

The next day at 02:30 a.m. Beijing time: Federal Reserve Chairman Powell held a monetary policy press conference.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal