The Strait of Hormuz is booming, and European gas prices have risen for six consecutive days

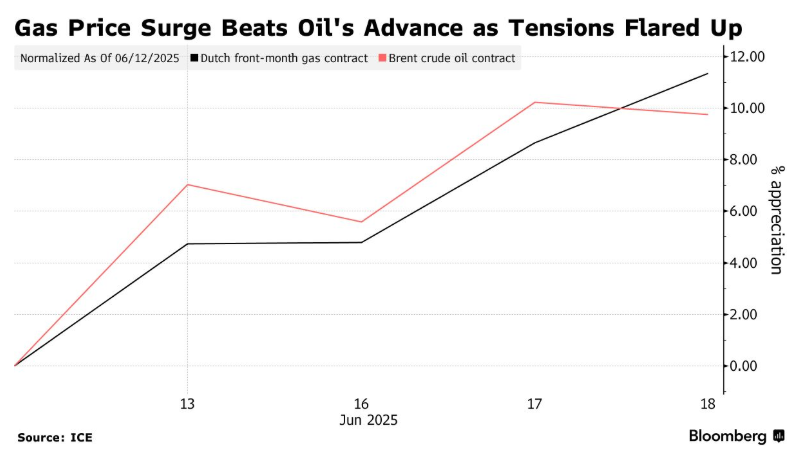

The Zhitong Finance App learned that the European gas price benchmark, TTF natural gas futures prices in the Netherlands, rose sharply for six consecutive days, setting the longest continuous rise record in nearly four weeks. The conflict between Israel and Iran is intensifying, and is likely to bring America into the quagmire of war and spread to the entire Middle East, triggering market concerns about the complete blockage of shipping traffic in the Strait of Hormuz, one of the world's most critical energy trade channels.

As the military conflict between Israel and Iran intensifies, and is likely to bring the US into the quagmire of war and spread to the entire Middle East, and even the Strait of Hormuz faces a potential blockade crisis, European gas prices continued to rise on Wednesday. TTF natural gas futures prices rose 2.8% on Wednesday, surpassing the 40 euro per megawatt hour mark, hitting this level for the first time since the beginning of April.

The Strait of Hormuz is a very important energy trade route. About one-fifth of the world's liquefied natural gas (LNG) trade passes through this strait, and any degree of trade interruption may cause LNG prices to rise disproportionately. Since the balance between supply and demand in the global gas market is fundamentally more tight than the oil market, it is expected that European gas prices will continue to rise relatively stronger than Brent crude oil for some time to come. Europe has almost stopped gas transportation through Russian pipelines since the Russian-Ukrainian conflict in 2022. It is extremely dependent on LNG from the Middle East and North America, and the Strait of Hormuz is an important waterway for liquefied natural gas transportation in the Middle East.

Some market observers worry that Iran may choose to block the passage of oil tankers or LNG carriers that need to sail through the Strait of Hormuz in the short term. As the situation escalates, Qatar, the world's largest LNG exporter, requested liquefied natural gas carriers to wait outside the strait for LNG to be loaded until Qatar is ready for loading. About one-fifth of the world's LNG trade needs to pass through this narrow bottleneck channel.

“Waterway transportation is still being closely monitored, as any trade flow obstruction could cause LNG prices to rise disproportionately — especially for countries that are highly dependent on the region's LNG supply,” Lu Ming Bang, senior analyst at Rystad Energy, wrote in the report. “Keeping the Strait of Hormuz open and avoiding supply disruptions is in the best interests of all Middle Eastern countries, including Iran.”

According to Bloomberg ship tracking data, up to now, the southbound LNG carrier carrying cargo has successfully passed through the Strait of Hormuz, while three northbound tankers are waiting anxiously outside the strait, and another one may join the waiting queue on Wednesday. Since last Friday, waterway trade risks have also boosted the price of Brent crude oil, the international crude oil price benchmark.

Analysts Maggie Xueting Lin and Anthony Yuen from Wall Street Citigroup said that compared to Brent crude oil prices, the rise in European gas prices “should be relatively stronger.” “The main reason is that the fundamentals of supply and demand in the global gas market are tighter than oil, and after a sudden sharp escalation of geopolitical tension, the initial increase in oil prices is usually much stronger than gas prices, although the two face almost the same risk of transportation disruptions.”

Florence Schmit, a strategist at Rabobank based in the London market, said: “The next two days should determine whether energy and gas prices will continue to rise strongly, or whether the market will calm down again (at least temporarily).” She added that the potential threat of Iran attacking US military bases, or the reduction in LNG carrier traffic in the Strait of Hormuz, poses a serious upward risk to global gas supply.

European gas price benchmark - The Dutch TTF gas futures price for recent months was reported at 39.69 euros per megawatt hour at 9:04 a.m. Amsterdam time, an increase of more than 1%.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal